Buy Dr. Agarwals Health Care Ltd For Target Rs. 510 by Motilal Oswal Financial Services Ltd

Transforming sight!

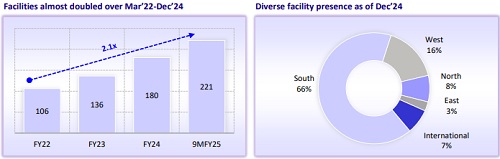

* With three generations of the promoter family involved in comprehensive eye care services, Dr. Agarwals Health Care (DAHL) has built one of the largest eye care franchises (221 facilities as of Dec’24) in India. DAHL offers a comprehensive range of services, including surgeries (65% of revenue), consultation (14% of revenue), and products such as opticals (13% of revenue)/pharmaceuticals (8% of revenue).

* DAHL is strengthening its reach by deepening market penetration and expanding through a hub-and-spoke model, currently operating 28 hubs and 193 spokes. With a focus on established locations, it has the potential to add 40-50 centers annually.

* The latent demand for eye care (industry CAGR likely to be 12-14% over FY24-28), coupled with DAHL’s efforts to treat more patients at existing centers as well as add new centers, is expected to drive industry outperformance over the next five years.

* DAHL has delivered a robust revenue/EBITDA CAGR of 38%/41% over FY22-24 aided by organic as well as inorganic growth levers. We expect a 21%/23% revenue/ EBITDA CAGR, reaching INR24.9b/INR6.9b over FY25-27, fueled by a 19% CAGR in surgical volumes, a 20% CAGR in pharmacy revenues, and stable operating profitability.

* We value DAHL on an SoTP basis (premised on 24x 12M forward EV/EBITDA for the surgery/consultancy businesses, 14x EV/EBITDA for the optical business, 12x EV/EBITDA for the pharmacy business, and adjusted for a non-promoter stake in Dr Agarwals Eye Hospital (AEHL) and Dr. Thind) to arrive at our TP of INR510. Initiate coverage with a BUY rating

Single specialty niche play

* Unlike conventional super-specialty hospitals that offer a wide range of services, DAHL has carved out a niche for itself with a strong focus on ophthalmology.

* Eye care is notably less capital-intensive and has a shorter gestation period for setting up clinics and tertiary centers, making it an attractive business model.

* As a vital sensory organ, the eye plays a critical role in human function, making its treatment indispensable, even within an asset-light business model.

* In this fragmented industry, DAHL stands as the largest eye-care chain, with a revenue of INR16b and EBITDA of INR4.3b over 12M ending Dec’24, demonstrating strong potential to sustain its growth momentum.

Hub-and-spoke model/extensive services enable treatment for a broader patient pool

* To address the full range of patients’ eye care needs, from diagnosis to treatment, and efficient capital allocation, DAHL has adopted a hub-and-spoke model to establish a presence in 14 states, four union territories and nine countries in Africa.

* DAHL has 193 spokes, consisting of 61 primary facilities and 132 secondary facilities. The primary facilities provide initial diagnosis/consultancy services, while the secondary facilities offer select services, including cataract surgeries.

* It has 28 hubs (tertiary centers) equipped with super-specialty surgical capabilities, including retinal, corneal, and refractive surgeries. The company remains committed to adding hubs and spokes across both metro and nonmetro cities, thereby increasing patient accessibility while optimizing the efficiency of critical resources across its network.

Demand tailwinds and strong business scope for organized chains bode well for DAHL

* The eye care industry is expected to post a 12-14% CAGR over FY24-28, reaching INR550-650b.

* Among single-specialty healthcare services, eye care is expected to be the fastest-growing category, alongside oncology.

* This growth is driven by the increasing prevalence of eye disorders, fueled by changing lifestyles, increased screen time, an aging population, and the rise in diseases such as diabetes.

* The higher penetration of insurance is likely to drive higher patient volume.

* The rise of organized corporate eye care chains has enhanced service quality by providing consistent and reliable treatments.

* With organized eye care chains comprising only 13-15% of the industry, there is considerable potential for these chains (including DAHL) to outpace the industry, leveraging economies of scale and offering enhanced services to patients.

Ingredients in place to fortify growth prospects

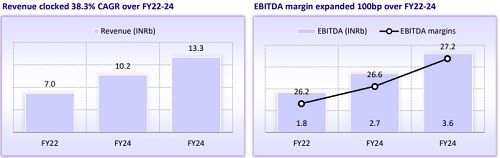

* DAHL’s efforts to expand the patient base through: a) increased treatments at existing facilities, b) upgrading of facilities, and c) the addition of new facilities have resulted in a revenue CAGR of 38% over FY22-24, reaching INR13.3b.

* It has delivered a 9MFY25 revenue growth of 27% YoY, reaching INR12.5b. The overall performance during FY22-24 was driven by a 38% CAGR in surgery volume, a 35% CAGR in pharma product sales, and a 26% CAGR in optical sales.

* While the gross margin has remained stable, the EBITDA margin expanded 100bp over FY22-24 despite higher opex related to new facilities and higher marketing spending. EBITDA reached INR3.6b in FY24, clocking a 41% CAGR over FY22-24. DAHL delivered a PAT CAGR of 48% over FY22-24 to reach INR831m.

* Notably, its EBITDA grew 27.5% YoY to INR3.3b in 9MFY25. However, PAT grew at a slower rate of 7% YoY for 9M due to higher finance costs and depreciation.

* ROE weakened to 8% in FY24 vs. 17.7% in FY22 due to funds raised in earlier years.

* While return ratios are expected to improve gradually, the allocation of capex for greenfield projects/facility upgrades is expected to drive a 21%/23% CAGR in revenue/EBITDA, reaching INR24.9b/INR6.9b.

Valuation and view: Initiate coverage with a BUY rating

* The hospital sector in the listed space is currently trading at an average of 22x 12M forward EV/EBITDA. The positive factors supporting DAHL’s valuation include: a) its asset-light business model, b) the significant market share shift from unorganized to organized players, c) the strong ophthalmology expertise of DAHL's management, d) efforts to expand its presence across regions (south, west, north, and east), and e) superior growth and profitability compared to its peers in the organized space. However, these positives are partially offset by: a) moderate return ratios in the medium term and b) the existence of a separately listed subsidiary. Based on these factors, we assign a 24x 12M forward EV/EBITDA multiple to the surgery/consultancy business, a 12x multiple to the pharmacy business, and a 14x multiple to the opticals business and adjust for a nonpromoter stake in AEHL/Dr. Thind to arrive at our TP of INR510.

* The bull case scenario assumption of 28% CAGR in surgeries can drive an EBITDA CAGR of 30.4% over FY25-27, reaching INR7.5b. Valuing optimal execution at a higher multiple (assigning 25x 12M forward EV/EBITDA to the surgery/ consultancy business, 13x EV/EBITDA to the pharmacy business, and 15x EV/EBITDA to the opticals business, and adjusting for a non-promoter stake in AEHL/Dr. Thind) would lead to a TP of INR560, implying a 34% potential upside.

* The bear case scenario assumption of a lower 17.8% CAGR in surgeries may lead to an 11.5% EBITDA CAGR over FY25-27. Accordingly, assigning a lower multiple (23x 12M forward EV/EBITDA to the surgery/consultancy business, 11x EV/EBITDA to the pharmacy business, and 13x EV/EBITDA to the opticals business, and adjusting for a non-promoter stake in AEHL/Dr. Thind) would lead to a TP of INR370, implying an 11% potential downside.

* Considering an upside of 22% in the base case scenario, we initiate coverage on the stock with a BUY rating.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)