Buy Hindustan Unilever Ltd For Target Rs. 2,850 by Motilal Oswal Financial Services Ltd

In-line show; embracing growth over margin

* Hindustan Unilever’s (HUVR) 4QFY25 consolidated revenue was up 3% at INR154.5b (in line), with 2% underlying volume growth (est. 1%, 0% in 3QFY25). Rural demand continues to show gradual improvement, while urban demand remains subdued.

* Home Care delivered mid-single-digit volume growth, with revenue up 2%. The company passed on commodity deflation benefits to consumers through calibrated price reductions. However, the segment experienced EBIT margin contraction, with EBIT declining 2% YoY.

* The Beauty & Wellbeing segment witnessed low single-digit volume growth and 6% revenue growth, impacted by the mass skin portfolio. The Hair Care portfolio reported double-digit growth, fueled by volume and company has done several new launches ahead of the summer season. Margin witnessed an expansion, with EBIT up 15% YoY.

* Personal Care posted a low single-digit volume decline, while revenue was up 3%, led by pricing. Oral Care grew in low-single digits, which was also led by pricing. EBIT growth was 5% despite the high RM inflation.

* Food & Refreshment (F&R) revenue declined 1%, with volumes declining in mid-single digits. Tea witnessed low single-digit growth, led by pricing. Coffee reported double-digit growth, while Nutrition Drinks saw a decline. The Ice Cream business grew by double digits, led by volume. EBIT declined 15% YoY.

* EBITDA margin contracted 10bp YoY to 23.1% (est. in line). Management has revised its EBITDA margin guidance for the near term to 22-23%, compared to the earlier guidance of the lower end of 23-24%. The company plans to focus aggressively on volume acceleration, alongside new launches and the reactivation of its value proposition, which is expected to drive better growth in FY26. We reiterate our BUY rating on the stock with a TP of INR2,850 (55x on Mar’27E EPS).

In-line performance; volume growth at 2% YoY

* Net sales grew 3% YoY to INR154.5b (2% in 3QFY25), with underlying volume growth at 2% (est. 1% and flat YoY in 3QFY25). Total revenue was up 3% YoY to INR156.7b (est. INR156.8b). The home care segment revenue grew 2%, beauty and wellbeing grew 6%, and personal care grew 3%, while F&R revenue declined 1% YoY.

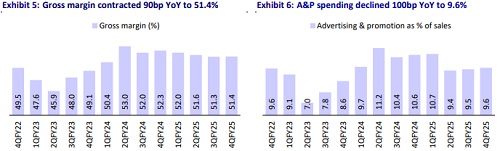

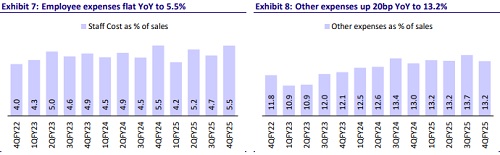

* Gross margins for the quarter contracted 90bp YoY to 51.4% (est. 51.1%), impacted by raw material cost fluctuations. Employee expenses were up 3% YoY, other expenses were up 5% YoY, while ad spends declined 7% YoY. EBITDA margin contracted 10bp YoY to 23.1%. (est. 23.1%).

* EBITDA was up 2% YoY to INR36.2b (est. INR36.2b), PBT was up 5% YoY to INR35.0b (est. INR34.0b), and PAT (bei) grew 3% YoY to INR25.7b (est. INR25.3b).

* Reported PAT was down 4% YoY to INR24.6b, impacted by an exceptional item of INR1,380m related to acquisition and disposal profits and loss, as well as the fair valuation of financial liabilities related to the acquisition.

* In FY25, net sales, EBITDA, and APAT grew 2%, 1%, and 1%.

Management conference call highlights

* The macro outlook is set to improve in the near to medium term, aided by strong agri output, easing food inflation, and potential tax reliefs—supporting both rural and urban consumption. Internally, HUL’s portfolio transformation is gaining momentum, led by core brand relaunches (Lifebuoy, Glow & Lovely) and innovation in Future Core and Market Maker segments.

* HUVR has implemented price hikes to mitigate the impact of raw material price inflation. The company will take low single-digit price hike if commodity prices remain at the current level.

* In FY25, UVG and USG stood at 2% with flat pricing growth, as cost efficiencies and deflation in select raw materials helped offset inflationary pressures. While absolute volume tonnage grew in mid-single digits in FY25, this was partially offset by an adverse product mix.

* E-commerce contributed 7-8% of total sales in FY25, with Quick Commerce accounting for ~2%. Organized trade remained margin accretive due to a higher mix of the Future Core and Market Maker portfolio.

Valuation and view

* We cut our EPS estimates downward by 2% for FY26 and FY27, considering the impact of potential margin contraction following management’s revised EBITDA margin guidance of 22-23% in the near term (vs. the earlier range of 23-24%). We model an EBITDA margin of ~23-23.5% for FY26-FY27, and do not model margin below 23% on yearly basis. Pricing, mix, RM trajectory, and growth are expected to support the operating margin.

* The company focuses on volume-led growth through various initiatives to strengthen its core portfolio, expand TAM, drive premiumization, and transform its Beauty & Wellbeing (B&W) and Foods portfolio. The company is also exploring new growth levers through inorganic opportunities.

* We reiterate our BUY rating with a TP of INR2,850 (55x on Mar’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412