Buy Tech Mahindra Ltd For Target Rs. 1,950 by Motilal Oswal Financial Services Ltd

The march of redemption continues

Both growth and margin aspirations on track despite macro uncertainty.

* Tech Mahindra (TECHM) reported 4QFY25 revenue of USD1.5b, down 1.5% QoQ in constant currency (CC) vs. our estimate of 0.8% cc decline. BFSI/Communications grew 2.4%/1.0% QoQ, while Healthcare/Hi-tech and Media declined 5.6%/8.2% QoQ. EBIT margin was up 40bp QoQ at 10.5%, beating our estimate of 10.3%. PAT stood at INR11.6b (up 18.7% QoQ/20.3% YoY), above our estimate of INR10b. For FY25, revenue/EBIT/PAT grew 4.0%/48.5%/20.3% YoY in INR terms. In 1QFY26, we expect revenue/EBIT/PAT to grow by 3.0%/30.0%/37.2% YoY. Net new deal TCV was USD798m, up 7.1% QoQ/59.6% YoY. We reiterate BUY on TECHM with a TP of INR1,950 (implying 35% upside), based on 25x FY27E EPS.

Our view: Margin roadmap intact

* TECHM’s revenue outlook shows strength in BFSI, where early recovery signals are visible and client progress continues. Communications remained neutral, with signs of seasonal stability returning, particularly in Europe and Asia Pacific. Manufacturing and Hi-Tech remained under pressure. Automotive continued to be soft and discretionary spends in Hi-Tech were cut during the quarter.

* Targets maintained: Despite these vertical-specific headwinds, management reiterated its aspiration to outgrow peers in terms of revenue by FY27.

* Deal TCV growth best in class: TECHM posted a 42% YoY increase in deal TCV in FY25, the strongest among large and mid-tier peers. While this partly reflects a low base, we believe a structural shift is underway in the firm’s large-deal strategy—driven by a dedicated deal team, proactive propositioning, and industrialized win processes under the ‘Turbocharge’ and ‘Large Deal’ programs. Notably, the firm closed two deals with TCV of over USD100m, including one focused on churn reduction with a leading Americasbased telco and another in the device certification and 5G labs space. Management believes a TCV range of USD600-800m is a sustainable baseline going forward.

* Margin expansion plan on track: TECHM’s FY27 margin aspiration of 15% now appears achievable, supported by structural initiatives under Project Fortius— focused on pyramid optimization, pricing improvement, automation, and utilization of T&M resources. Cost levers include an improved offshore mix, subcontractor rationalization, and SG&A efficiency. These gains are expected to offset investments in GenAI, talent upskilling, and wage hikes.

* FY27 margin improvement contingent on growth: While its FY26 margin expansion plan can carry on without a major pick-up in industry growth, reaching 15% in FY27 depends on growth returning to the industry. That said, management has clearly shown a plan that works, and our base case now assumes it will be fulfilled.

* Other highlights from the analyst meet: TECHM is doubling down on healthcare and BFSI, particularly in areas like asset and wealth management, core banking, and payments. It continues to scale up high-margin service lines such as engineering, enterprise apps (Oracle, Salesforce), and GenAI offerings, including multi-agent systems and Industry 4.0. The company is also pushing its GCC strategy and modernizing BPS delivery, with a sharp shift from voice to digital. Management stressed the role of “diamond-shaped” cost structures and strong talent planning in supporting execution and profitability.

Valuation and change in estimates

* We keep our estimates largely unchanged, reflecting steady directional progress. We estimate FY25/FY26/FY27 EBIT margins at 9.7%/12.2%/14.5%, which will result in a 27% CAGR in INR PAT over FY25-27. We value TECHM at 25x FY27E EPS with a TP of INR1,950 (35% upside). We reiterate our Buy rating on the stock.

Miss on revenues, beat on margins; healthy deal TCV growth

* Revenue stood at USD1.5b, down 1.5% CC (down 1.2% in USD terms) and below our estimates of 0.8% QoQ CC decline. For FY25, revenue stood at USD6.2b.

* IT service/BPO declined 0.3%/5.8% QoQ.

* BFSI/Communications grew 2.4%/1% QoQ. Healthcare/Hi-Tech and Media declined 5.6%/8.2% QoQ. Retail and Manufacturing were flat.

* EBIT margin was up 40bp QoQ at 10.5%, beating our estimate of 10.3%. FY25 margins stood at 9.7%, up 360bp YoY.

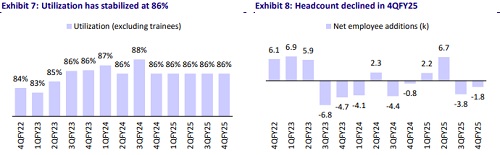

* Net employee count declined by 1,757 or 1.2% QoQ. Utilization (excl. trainees) was up 70bp at 86.3%. LTM attrition was up by 60bp at 11.8%.

* NN deal TCV was USD798m, up 7.1% QoQ/59.6% YoY.

* PAT stood at INR11.6b (up 18.7% QoQ/20.3% YoY), above our estimate of INR10b. FY25 PAT stood at INR42.5b.

* FCF conversion to PAT stood at 111% vs. 172% in 3Q.

Key highlights from the management commentary

* The global economic landscape remains volatile. FY25 was a foundational year focused on laying the groundwork for future growth, while FY26 is expected to be a year of acceleration.

* Consolidation and cost-takeout programs are expected to play a key role in this environment, alongside growing importance of GCC deals.

* The auto and hi-tech segments have seen softness for the past three months.

* Some BPO ramp-ups in the USA were deferred during the quarter.

* The sequential revenue decline was largely attributed to deferral of a renewal deal in the BPO segment.

* Increased deal sizes contributed to YoY growth, particularly in larger accounts.

* Margin gain in FY25 was aided by a 100bp benefit from the reduction of the non-core portfolio. A 20-30bp tailwind is expected in FY26 from the same.

* Communication & Media: It declined due to industry-wide headwinds. Telcos are prioritizing cost optimization over discretionary spending.

Valuation and view

We remain positive about the restructuring at TECHM under the new leadership and believe this quarter was another step in the right direction. But we expect the impact from these steps to be visible gradually. We believe its bottom-up transformation appears relatively independent of discretionary spending. With the potential for telecom recovery and improved operational efficiency, we see room for sustained margin improvement going forward. We value TECHM at 25x FY27E EPS with a TP of INR1,950 (35% upside). We reiterate our Buy rating on the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412