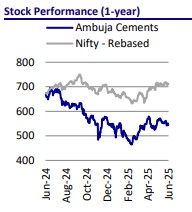

Buy Ambuja Cements Ltd for the Target Rs. 630 by Motilal Oswal Financial Services Ltd

Acquisition-led growth; efficiency push yet to materialize

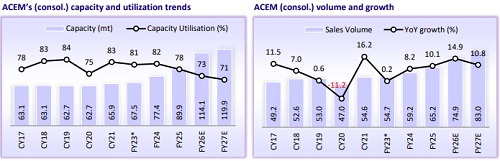

The key highlights of ACEM’s FY25 annual report: 1) the company’s consolidated cement capacity has risen to 100.3mtpa currently from 76.9mtpa in FY24-end, primarily led by inorganic growth. However, most of the company’s organic grinding unit expansions are witnessing delays of around 6-12 months from the scheduled timeline; 2) various cost-saving measures, including group synergy initiatives, are currently underway but have yet to yield meaningful results; 3) it reported a sharp increase in related-party transactions, aimed at improving process efficiency and leveraging group synergies; and 4) projecting cement demand growth of ~7-8% YoY in FY26, led by strong demand from infrastructure, housing and commercial sectors.

Aggressive on M&A; organic growth yet to catch up

* The company’s consolidated cement capacity has increased from 76.9mtpa as of Mar’24 to 100.3mtpa, including the acquisition of Orient Cement, brownfield expansion at Farakka, West Bengal, and a small capacity addition through debottlenecking in Apr’25.

* Under the new management, ACEM has been focusing on capacity expansion through strategic acquisitions, including Sanghi Industries (6.0mtpa), Penna Cement (10.0mtpa), and Orient Cement (8.5mtpa). In contrast, the progress on organic expansions has been slower, with construction going on at 12 sites and commissioning expected in FY26E. The board has also approved 21mtpa of additional grinding capacity, slated for FY27-28, as part of its plan to increase the capacity to 140mtpa.

* ACEM’s consolidated sales volumes grew ~10% YoY to 65.2mt, aided by incremental growth from inorganic expansions. However, standalone cement production increased ~3% YoY. The company’s cement capacity utilization (consolidated) stood at ~78% in FY25 vs. ~82% in FY24.

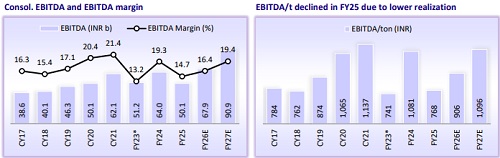

Cost reduction drive underway; yet to deliver results

* ACEM has undertaken a series of cost-reduction initiatives to improve efficiency and profitability. These include long-term sourcing agreements for key raw materials like fly-ash, with nearly 40% of fly-ash now secured through such arrangements. It has increased the use of fly-ash sourced from group companies across its manufacturing plants to optimize the cost. It has significantly increased its limestone reserves to ~9.0b tons, ensuring a stable supply of a key raw material.

* A significant push is being made toward green energy, with investments of INR100b planned in WHRS, solar, and wind projects. Green power capacity has increased notably in FY25, and the company aims to raise the green power share to ~60% by FY28, which could reduce power costs by INR90/t. Efforts are also underway to improve energy efficiency and increase the use of alternative fuels, with ambitious targets for lowering both thermal and electrical energy consumption by FY30.

* Logistics efficiency is another key area of focus, with a significant shift toward sea transport, optimized depot networks, and investments in specialized rakes for bulk cement transport. It operates 14 sea vessels and plans to expand its marine fleet and terminal infrastructure to further reduce freight costs. In FY25, the company’s total opex/t (consolidated) inched down ~1% YoY (INR60/t) to INR4,460/t, mainly due to a reduction in power & fuel costs and freight costs. ACEM is targeting to reduce opex/t to INR3,650/t by FY28.

Related-party transactions rise on leveraging group synergies

* ACEM strategically established MSA with its subsidiaries to realize economies of scale, improve operational and logistics cost efficiency, optimize fuel and resource usage and sourcing, integrate its supply chain, reinforce competitive edge, and expand market reach. These agreements are in place with ACC, Sanghi Industries (SIL), Asian Fine Cement, Penna Cement, Orient Cement and Adani Cement Industries.

* ACEM is leveraging synergies of the group to substantially increase transactions with group companies. The value of goods/services purchased from other related parties stood at INR49.2b in FY25 vs. INR14.7b in FY24 (average INR9.2b over CY18-FY23). After a sharp increase in the purchase of goods/services from other related parties, the amount outstanding from other related parties also surged to INR9.4b from INR1.8b in FY24 (average INR1.4b over CY18-FY23).

* In FY23, ACEM made an advance payment of INR9.25b to Mundra Petrochem (MPL) for exclusive long-term raw material/fuel supply rights for its Mundra cement plant, initially expected to be commissioned in FY26. Currently, the advances stand at the same level and the cement plant is now expected to be commissioned by FY27-28, based on the progress of polyvinyl chlorine unit of MPL.

View and valuation

* ACEM has reiterated its capacity target of 140mtpa and EBITDA/t target of INR1,500 by FY28. Until now, capacity growth was largely driven by the inorganic route. However, the expansion will be largely organic in FY26, with multiple projects progressing across various locations. The company is also expected to prioritize the integration of acquired assets. Profitability improvement will be driven by ongoing cost-saving measures and a rising share of premium products.

* We estimate a CAGR of ~17%/35%/33% in consolidated revenue/EBITDA/PAT over FY25-27, albeit on a low base. We estimate EBITDA/t to increase to INR906/INR1096 in FY26/FY27 from INR768 in FY25. ACEM (consol.) trades at 21x/16x FY26/FY27E EV/EBITDA and USD147/USD140 EV/t. We maintain our BUY rating with a TP of INR630 (valuing the stock at 18x FY27E EV/EBITDA).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412