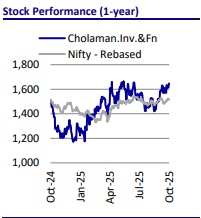

Buy Cholamandalam Inv & Fin Ltd for the Target Rs. 1,920 by Motilal Oswal Financial Services Ltd

Cyclical soft patch; long-term engines intact

Recalibrating to enhance quality and build a more resilient franchise with structural strength

* Cholamandalam Investment and Finance (CIFC) is currently navigating a cyclical soft patch, reflected in moderation in business volumes and AUM growth. This phase has also coincided with the strategic winding down of the CSEL business, which was developed through digital partnerships. To offset this, the company is actively building new growth engines, such as consumer durables and gold loans—both segments with significant potential to scale over the medium term.

* In terms of asset quality, the company has witnessed some seasonal weakness, further accentuated by early and prolonged monsoons. In FY26- YTD, credit costs have remained elevated for the company, driven by multiple factors, including: 1) higher delinquencies in newer business segments, 2) the early onset of monsoon that disrupted fleet utilization, particularly in mining and rural transport markets, and 3) widespread floods in certain parts of the country, which affected operations and collections. We believe that credit costs are likely to remain elevated in 2Q as well, driven by extended (and early) monsoons and localized flood-related disruptions.

* We expect asset quality pressures in the vehicle finance segment to persist in the near term, with the second half of this fiscal year likely to see a recovery as seasonal trends turn favorable, fleet utilization improves, festive demand picks up, and the agricultural cycle strengthens.

* Amid a challenging macroeconomic environment and initial issues in segments such as consumer durables and gold loans, the company remains strategically focused on safeguarding asset quality and redirecting growth toward segments that offer superior risk-adjusted returns—a philosophy set to drive CIFC’s next phase of expansion. NIM tailwinds are expected to continue and further expand in 2HFY26, supported by a decline in the CoF driven by the transmission of MCLR rate cuts from banks.

* CIFC’s entry into gold loans marks a diversification into a high-yield, highfrequency retail lending business. The company opened ~73 dedicated gold loan branches in 1QFY26 and plans to expand to over 100 in the near future. Given the secured and short-tenor nature of this product, the company plans to scale this business in a calibrated manner through FY26, initially strengthening its presence in urban markets before expanding deeper into rural and semi-urban markets.

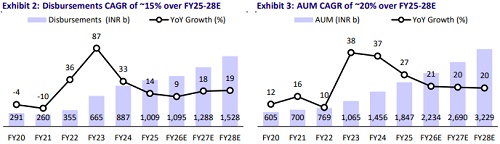

* CIFC continues to demonstrate resilience through its diversified business model, prudent risk management, and focus on sustainable growth, even as it navigates a dynamic operating environment. The company is actively working to improve asset quality amid a weak macro environment. Although currently experiencing a soft cyclical patch, CIFC remains a robust franchise, with an expected CAGR of ~20% in AUM and ~25% in PAT over FY25-28, alongside projected RoA/RoE of 2.7%/20% in FY28. Reiterate our BUY rating with a TP of INR1,920 (4x Sep’27E BVPS).

Moderation in AUM growth; vehicle volumes will be a key monitorable

* CIFC’s AUM growth stood at 23% as of 1QFY26 and is expected to moderate to ~21% by 1HFY26, reflecting deferred vehicle sales (driven by the announcement of GST rate cut in mid-Aug’25) and relatively lower disbursements in certain new business verticals. Disbursement momentum is anticipated to revive in 2H, supported by festive-season demand, improving rural cash flows, some spillover in vehicle sales from 2Q to 3Q/4Q, and a pick-up in its newer gold loan business.

* Going forward, CIFC will focus on expanding its consumer durable (CD), gold loan, and in-house digital lending businesses, with the company expecting a noticeable improvement in AUM and disbursement growth from these segments by 4QFY26.

* For VFs, the cut in vehicle prices has led to loan amounts being ~5-6% lower (assuming LTVs remain constant). Consequently, auto sales volumes need to increase by ~10-11% to achieve any noticeable improvement in disbursement growth. Vehicle volumes did pick up after 22nd Sep’25, driven by pent-up demand and the GST rate cut coinciding with Navratri. However, the key monitorable remains whether this momentum in vehicle sales will sustain over the medium term or taper off within the next 3-4 months. We model AUM growth of 21%/20% in FY26/FY27E.

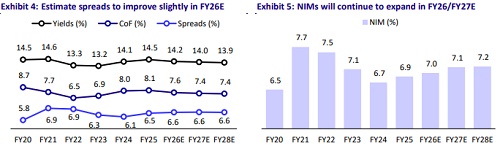

NIM tailwinds to continue; expect expansion of ~10-15bp in FY26

* CIFC will continue to benefit from a declining interest rate environment, with the company guiding for an NIM expansion of 12-15bp in FY26. This improvement is expected to be primarily driven by a reduction in its CoB and the ability to maintain decent yields even in its floating-rate product segments.

* The company’s CoB is projected to decline by ~25-30bp in FY26, with the impact largely expected to be back-ended. Nearly half of CIFC’s bank borrowings are linked to Repo and T-Bill rates, which reprice quickly, while most MCLR-linked borrowings are also expected to show a decline as banks more effectively transmit lower interest rates through their MCLR rates in 2HFY26.

* NIM expansion in FY26 is also expected to be back-ended, with stronger improvement anticipated in 2HFY26. Supported by a gradually improving funding environment and a balanced liability profile, CIFC is well-positioned to deliver margin expansion in the near-to-medium term. We model an NIM expansion of ~10-15bp each in FY26/FY27.

Tight cost control and operational efficiency driving stable opex

* CIFC has maintained strict control over its operating expenses, demonstrating a strong focus on efficiency and cost management. The company continues to leverage digital initiatives and process optimizations to enhance operational efficiency, helping offset inflationary pressures and support sustainable profitability.

* While the cost ratios are expected to remain slightly elevated in the coming quarters, CIFC’s continued emphasis on cost discipline and productivity is likely to keep overall operating ratios well-contained in FY26. CIFC will be adding dedicated gold loan branches this year, while branch additions in other product segments are expected to remain limited.

* CIFC is prioritizing productivity improvements within its existing branch network to drive greater operating leverage. We expect opex/avg. assets to remain stable at ~3% in FY26/FY27.

Near-term pressure on credit costs; gradual relief expected in 2H

* In FY26YTD, the company’s credit cost remained elevated, driven by a combination of cyclical and operational headwinds as highlighted above. These factors, coupled with higher delinquencies in new business segments, early and extended monsoons, and a broader slowdown in industrial activity, have exerted pressure on asset quality.

* Management shared that stress in unsecured MSME lending will be relatively contained for the company, given its limited exposure to this segment. The company has also discontinued newer originations in its fintech-originated CSEL business and tightened underwriting norms in unsecured products to course correct and mitigate incremental slippages. Additionally, it has reduced exposure to supply chain financing, given the lower risk-adjusted returns in this segment. This calibration may moderate near-term growth but is expected to strengthen the company’s risk profile and provide more stability to NIM.

* Given the macro environment (and vehicle financing in particular) in 1HFY26, we expect credit costs in FY26 to remain ~10bp higher YoY at ~1.6%. However, if rural income and industrial activity strengthen through 2HFY26, it could help mitigate further risks to rising credit costs for the fiscal year.

* We believe that near-term asset quality pressures are likely to persist in 2QFY26, driven by prolonged (and early) monsoons and stress in newer businesses. However, a gradual improvement is anticipated from 3QFY26 as fleet utilization improves, infrastructure and construction activities pick up, and agricultural cash flows gain traction.

Valuation and view

* CIFC is gradually evolving into a more robust and resilient NBFC—one that is less cyclical, more diversified, and increasingly anchored in stable, secured retail and SME income streams. The company’s measured approach of curbing exposure to riskier product lines, while simultaneously expanding newer businesses, such as CD and gold loans, underscores its commitment to preserving earnings quality and maintaining balance sheet strength amid a weak macro environment.

* The company is navigating a complex operating environment by reinforcing its core businesses while taking corrective measures in underperforming segments. A key management priority is improving operational efficiency, with efforts directed toward enhancing productivity and optimizing costs, particularly in its vehicle and home loan businesses.

* CIFC trades at 3.8x FY27E P/BV, a premium that we believe is well-deserved and likely to sustain. This reflects the company’s consistent focus on navigating vehicle demand cyclicality while sustaining healthy AUM growth and stable asset quality through a well-diversified product mix. We expect CIFC to deliver a PAT CAGR of ~25% over FY25-28, with RoA/RoE of 2.7%/20% by FY28. We reiterate BUY with a TP of INR 1,920 (based on 4x Sep’27E BVPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412