Buy ICICI Lombard Ltd For Target Rs. 2,200 by Motilal Oswal Financial Services Ltd

Beat on combined ratio; PAT miss due to investment income

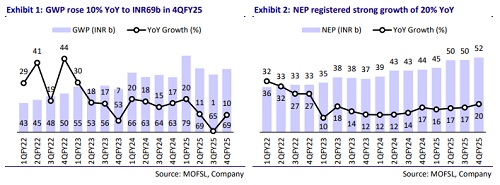

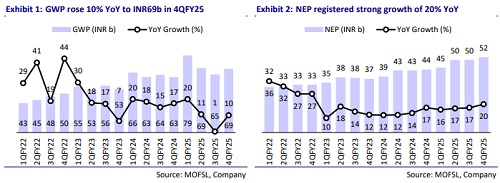

* ICICIGI’s gross written premium was 10% up YoY in 4QFY25 to INR69b (in line), impacted by 1/n regulation implementation for long-term products. NEP grew 20% YoY to INR52.3b (15% beat). For FY25, it grew 17% YoY to INR198b.

* The claims ratio for the quarter stood at 71.6% (280bp above our estimates and 68.6% in 4QFY24). While the commission ratio declined to 18.7% vs our estimates of 19.2% and 19.9% in 4QFY24, the opex ratio came in at 12.1% vs. 13.7% in 4QFY24 and MOFSLe at 15.4%).

* The combined ratio was 90bp lower than our estimates at 102.5% (vs 102.2% in 4QFY24 and 102.7% in 3QFY25).

* PAT declined 2% YoY to INR5.1b (12% miss). For FY25, PAT grew 31% YoY to INR25b.

* The company is targeting double-digit growth in the motor segment through increased focus on older vehicles and robust expansion in the Commercial Vehicle (CV) segment.

* We have broadly retained our FY26/FY27 earnings estimates as higher NEP estimates are offset by lower investment income. Reiterate BUY with a TP of INR2,200 (based on 33x Mar’27E EPS).

Lower expenses and commission ratios lead to beat on combined ratio estimates

* The company’s Gross Direct Premium Income (GDPI) stood at INR268b in FY25 vs INR248b in FY24, up 8.3%, (higher than the industry growth of 6.2%). Excluding the impact of 1/n accounting norm, the company’s GDPI grew 11% in FY25, (higher than the industry growth of 8.6%).

* NEP growth of 20% YoY was driven by 18%/26% YoY growth in the motor segment/healthy (including PA) growth. Meanwhile, the marine segment recorded a flat NEP and the fire segment declined 6% YoY.

* Underwriting losses stood at INR2.1b vs. losses of INR2.3b in 4QFY24 (vs. est. loss of INR3b). Total investment income declined 14% YoY to INR9b vs our estimates of INR11.5b.

* Claims ratio came in at 71.6% vs. 68.6% in 4QFY24 (our est. 68.8%). The loss ratio for the motor OD segment rose to 68.4% from 58.4% in 4QFY24. For the Motor TP segment, it declined to 72% from 73.4% in 4QFY24. The Health segment’s loss ratio was 81.5% vs. 75.4% in 4QFY24.

* Combined ratio stood at 102.5% vs 102.2% in 4QFY24 and MOFSLe at 103.4%. For FY25, it was at 102.8% vs. 103.3% for FY24. Excluding the NATCAT impact of INR0.94b in FY25 and INR1.37b in FY24, the combined ratio stood at 102.4% and 102.5%, respectively.

* In FY25, NEP/PAT stood at INR198b/INR25b, up 20%/down 2% YoY.

* Solvency ratio was 2.69 vs. 2.36 in 3QFY25 and 2.62 in 4QFY24.

Highlights from the management commentary

* In the health segment, the company aims for strong double-digit growth, led by: 1) new customers and 2) inflation-led increase in price and sum assured.

* FY25 was a challenging year for the Commercial Lines segment due to slow capex and weak pricing in fire. However, with recovery in fire pricing and capex activity improving, strong double-digit growth can be expected.

* The regulator is emphasizing strict compliance with EOM regulations. If the industry adopts more rational pricing, ILOM will be well-positioned to capture greater market share.

Valuation and view

* The general insurance industry’s growth rate in FY25 remained slow, due to: 1) weak infrastructure investments, 2) slow credit growth, 3) regulatory impact, and 3) weak trends in motor sales growth.

* However, ICICIGI continues to focus on profitable growth across segments, with motor expected to grow in double digits driven by targeted efforts in older vehicles and commercial vehicles, along with improved portfolio segmentation. The Health segment’s momentum remains strong, particularly in retail, where the company has gained market share and is targeting double-digit growth— supported by new customer acquisition and inflation-linked pricing. Commercial lines saw a weak FY25 due to soft fire pricing and sluggish capex, but early signs of recovery are visible in April fire renewals, setting the stage for a rebound.

* Overall, we expect a growth recovery in FY26 and stable improvement in profitability, with combined ratio improving to 101.5% by FY27. PAT is likely to grow ~14%/16% in FY26 and FY27. We have broadly retained our FY26/FY27 earnings estimates as higher NEP estimates are offset by lower investment income. Reiterate BUY with a TP of INR2,200 (based on 33x Mar’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Tag News

Buy ICICI Lombard Ltd for the Target Rs.2,260 by Motilal Oswal Financial Services Ltd