Buy ICICI Lombard General Insurance Ltd For Target Rs. 2,222 By JM Financial Services

Strong result with an in line Combined Ratio

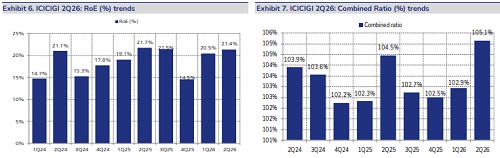

ICICI Lombard (ICICIGI) reported strong results with a PAT of INR 8.2bn, +9% JMFe, +18% YoY, +10% QoQ. Combined Ratio was in line with JMFe at 105.1% (a 40bps YoY deterioration), beat came with strong investment income – with a INR 9.3bn decline in unrealized gains on book. Claims performance improved sequentially in the key fire, motor and health segments, while substantially deteriorating in crop. We expect premium growth to pick up (from 3.5%) with green shoots in fire and motor and sustained strength in retail health. With the strong results, we raise our EPS estimates by 4%/2%/1% for FY26/FY27/FY28e. We maintain BUY with a reduced target price of INR 2,222 (against INR 2,250 earlier), valuing the insurer at 32x FY27e EPS of INR 69 (against 34x FY27e EPS of INR 67 earlier).

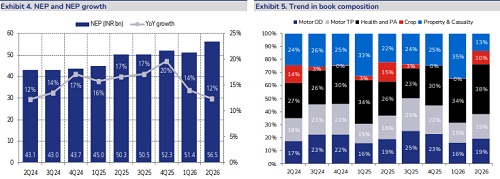

* While growth will optically look better from 3Q, we search for a pick-up to teens: Against reported GDPI contraction of 2% YoY, like-to-like growth was reported at 3.5%, while NEP growth was in line at 12.5%. Industry growth in FY26 has been led by public insurers and ICICIGI has ceded market share to protect profitability. Growth in retail health and fire remained solid at 25% and 50%, respectively, while motor grew by just 1%. In motor segment, GST 2.0 and expectation of tariff hikes in Third Party can result in a pick-up in premium growth for the company. We expect NEP growth for FY26e to remain at 12% levels, before recovering to 15% over FY27-FY28e.

* COR in line, investment performance keeps surprising positively: Combined Ratio was in line at 105.1% (against 104.9% JMFe), with Claims Ratio at 72.1% and EOM to NWP at 33.0%. Claims performance improved sequentially in the key fire, motor and health segments, while substantially deteriorating in crop to 114%, against 96% YoY. For FY26e, we raise our Claims Ratio for crop business, resulting in a pickup in COR to 102.5% (up 25bps from earlier estimates). With competition from public insurers, we also raise FY27/FY28e COR to 102.2%/102.0% against 102.0%/101.8% earlier. Investment performance was strong, with yields of ~8.7%, however, it came with a INR 9.3bn decline in unrealized gains on book to INR 16.4bn, still a healthy number at 2.9% of investment book, even though down from INR 25.7bn in Jun’25.

* Valuations and view – growth to drive rerating hereon: At CMP, the stock trades at 31/27x FY26/FY27e EPS. Like-to-like GDPI growth of 3.5% (reported -2%) conceals the 12%+ net earned premiums growth, as the company has seen a decline in crop business and strong growth in retail health (and fire). However, for sustained earnings growth, we need GDPI growth to pick up. Fire has started firing, retail health remains strong and we wait for motor segment to pick up. With the strong RoE profile, we expect the stock to deliver strong returns with growth. We maintain BUY with a reduced target price of INR 2,222 (against INR 2,250 earlier), valuing the insurer at 32x FY27e EPS of INR 69 (against 34x FY27e EPS of INR 67 earlier).

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361