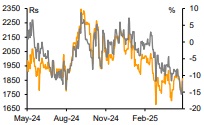

Buy Shriram Pistons & Rings Ltd For Target Rs. 2,850 By Emkay Global Financial Services Ltd

uploads/news/Shriram Pistons & Rings Ltd.jpg

Shriram Pistons (SPRL) posted a healthy Q4FY25 performance, with ~16%/9% YoY consolidated/standalone revenue growth, accompanied by 120bps/100bps QoQ consolidated/standalone EBITDA margin expansion to 21.3%/22.2%. Adjusted for the recent TGPEL acquisition, consolidated revenue growth stood at 12% with ~40bps QoQ EBITDA margin expansion. SPRL highlighted the strong order visibility, and targets sustained growth momentum against the backdrop of a subdued demand environment on the back of diversified presence across powertrains and growing capabilities across applications owing to recent acquisitions. We raise FY26E/27E EPS by 2%/4.5% (implying 13% FY25-27E EPS CAGR), on sustained growth momentum and ramp-up in subsidiaries with over 20% return ratios. Valuations at 14x FY27E PER remain attractive. We retain BUY with unchanged TP of Rs2,850 at 20x FY27E PER.

Healthy quarter with in-line margin performance

Revenues grew 16% YoY to Rs9.8bn (~5% beat on estimates), aided by consolidation of TGPEL (we estimate consolidated revenues ex-TGPEL to have grown ~12% YoY). EBITDA grew 19% YoY to ~Rs2.1bn (~10% beat on estimates), with EBITDA margin expanding by ~120bps QoQ to 21.3%, driven by lower employee cost and other expenses (though gross margins contracted by ~260bps QoQ; we estimate consolidated margins ex-TGPEL at ~20.5%). Standalone EBITDA margin rose by ~100bps QoQ to 22.2%; subsidiary margins accelerated to 15.2% in Q4 vs 9.8% in Q3. Consolidated PAT grew ~22.5% YoY to Rs1.4bn.

Earnings Call KTAs

SPRL has guided to sustained outperformance vs the underlying industry, against the backdrop of a relatively subdued domestic and global demand momentum. In Q4FY25, SPRL revenue growth stood at 15% vs 3% growth in underlying industry volumes (2Ws/PVs grew 9%/5%, while CVs de-grew 1%). 2) SPRL believes that all powertrains would continue to co-exist amid enhanced focus on cleaner/alternative fuel technologies like hydrogen, biofuel, etc; SPRL would benefit from this owing to its diversified presence and offerings across powertrain technologies. Collectively, Takahata and EMFi generate less than 15% of their combined revenue from ICE-related products. 3) SPRL has doubled the revenue of its subsidiary EMFi in FY25 (vs ~Rs130mn in FY24) despite regulatory delays; EMFI has onboarded multiple customers with its new plant, to operationalize by Jun-25; several customer programs are already undergoing validation/approval. 4) The recent acquisition of Karna Intertech, a key GDC (gravity die casting) products supplier to SPRL, is a strategic step toward backward integration; Karna’s skillset and machinery to enable seamless manufacturing, minimize supply chain disruptions, and strengthen SPRL’s tooling capabilities. 5) TGPEL and Karna have significantly expanded SPRL’s injection molding product portfolio, positioning the company favorably to offer a wider range of products across applications. 6) SPRL is actively exploring synergistic M&A opportunities (both domestic and international) focused on its existing business domains.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354