Buy Sirca Paints Ltd for the Target Rs.625 by Choice Broking Ltd

Well-positioned to capitalise on structural growth opportunity

We believe, Sirca Paints Limited (SIRCA), with its exclusive collaboration with Europe’s wood coating stalwart SIRCA S.P.A, is well-positioned to capitalise on the long runway for growth of premium Wood Coatings market in India. As of FY25, this market is pegged at INR 100Bn and would grow at a CAGR of 10%+ over the next 5-10 years in our view.

We forecast FY25-28E Revenue/EBITDA/PAT CAGR of 27/28/30% for SIRCA. It trades at attractive multiples of ~18x/26x FY28E EV/EBITDA/P/E. Given the growth runway, we believe these metrics are reasonable, on an absolute as well as relative basis.

The 3 key pillars of our constructive Investment Thesis on SIRCA are: I) Structural growth story of premium wood coatings in India: We believe, following are the main drivers of growth of the premium coating products and high-quality finishes:

a) Overall growth (FY25-30E CAGR of ~9%) of Paints industry which, in turn, is broadly driven by India’s GDP growth, given construction, housing, real estate are significant drivers of India’s economic growth.

b) Domestic furniture manufacturing industry growth and rapid capacity expansion (30+% over next 3 years) by MDF/HDHMR players.

II) Melamine replacement would accelerate PU demand: We believe there is a structural shift in India’s Wood Coatings market, from formaldehyde based Melamine (INR 30-35Bn market size as of FY25) which is carcinogenic to PU based products which are considered much safer. Transition to PU is also backed by increasing adoption of MDF in the furniture industry as Melamine struggles with adhesion on engineered materials. Additionally, once architect driven, PU coatings, are increasingly becoming mainstream retail products. While we expect overall Wood Coatings demand to increase at a 10% CAGR over FY25-30E, we expect PU based segment to grow at a faster rate of 25% due to these dynamics. SIRCA by virtue of its strong presence in high quality PU based wood coatings, would be a key beneficiary of this shift away from Melamine.

III) Strategic acquisitions would expand product portfolio breadth and deepen market reach: SIRCA’s recent strategic acquisitions (Welcome, Wembley) expand its product portfolio breadth and customer base. Welcome and Wembley acquisitions broad base SIRCA’s presence in the wood coatings value chain into thinners, sanding sealers, enamels etc.

Valuation: We use a DCF-based approach to value SIRCA. Our base case scenario TP is INR 625/sh and upside scenario (20–25% probability event) fair value is INR 800/sh. Whereas, our downside scenario (15–20% probability event) fair value is INR 360/sh. (Bull Bear Case).

Risks to our BUY rating: Possible significant slowdown of Indian economy and probable predatory pricing could adversely SIRCA’s business.

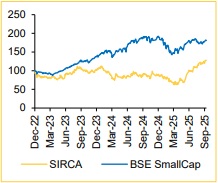

Rebased Price Performance (%)

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)