Buy Karur Vysya Bank Ltd For Target Rs. 270 By Yes Securities Ltd

Reasonably steady outcome given backdrop

Our view – Asset quality stellar, growth reasonable while margin declines

Asset Quality – Gross slippages decline materially on sequential basis, indicative of sound underlying asset quality: Gross NPA additions amounted to Rs. 1.39bn for 3QFY25, translating to an annualized slippage ratio of 0.7% for the quarter, down - 23bps QoQ. Gross slippage ratio had amounted to Rs. 1.81bn in 2QFY25. Recoveries from technically written off accounts amounted to Rs 1.75bn for the quarter. Provisions were Rs 1.47bn, down by -18.0% QoQ and -1.5% YoY, translating to calculated annualised credit cost of 73bps. This low credit figure contains entirely prudential provisions worth Rs 0.17bn made on restructured assets and the usual prudential provision Rs 0.25bn being made every quarter.

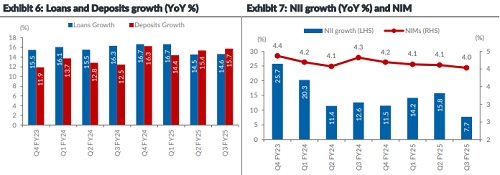

Net Interest Margin – NIM declined on sequential basis as cost of deposits continued to rise: NIM was at 4.03%, down -8bps QoQ and -29bps YoY. Cost of deposits has risen 10 bps QoQ and management stated may rise 10 bps further in 4Q. The guidance for NIM in 4Q was cautious at 3.85%.

Balance sheet growth – Loan growth outcome and outlook remained broadly stable: The advances for the bank stood at Rs. 823 bn, up by 3.4% QoQ and 14.6% YoY. The deposits were at Rs. 992 bn, up by 3.5% QoQ and 15.7% YoY. The RAM book has grown 20% YoY, driven by mortgages and jewel loans. Corporate loans have de-grown 2% QoQ since the bank is cautious on low-yield loans and on certain sectors. Agri loans, which are mainly jewel loans, have grown 5% QoQ since the bank is already compliant with the RBI advisory on gold loans. Management stated that both loan book and deposits would grow at 14% plus for the financial year.

We maintain ‘Buy’ rating on KVB with an unchanged price target of Rs 270: We value KVB at 1.6x FY26E P/BV for an FY25E/26E/FY27E RoE profile of 15.6%/16.3%/16.8%. (See our recent Initiating Coverage Report).

(See Comprehensive con call takeaways on page 2 for significant incremental colour.)

Other Highlights (See “Our View” above for elaboration and insight)

* Opex control: Total cost to income ratio was at 47.3% up/down by 55/-299bps QoQ/YoY and the Cost to assets was at 2.6% down by -3/-16bps QoQ/YoY.

* Fee income: Core fee income to average assets was at 0.8%, down -2bps/-8bps QoQ/YoY.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632