Buy Coromandel International Ltd for the Target Rs. 2,800 by Motilal Oswal Financial Services Ltd

Favorable agri outlook to support growth momentum

Operating performance in line

* Coromandel International (CRIN) continued to deliver healthy operating performance in 2QFY26 (EBIT up 15% YoY), supported by continued traction in crop protection (EBIT up 34% YoY) and nutrients and allied (EBIT up 16% YoY).

* A favorable agricultural scenario, supported by above-normal monsoon and high reservoir levels, is expected to sustain the growth trajectory. Moreover, the rising demand for crop protection products, easing global agrochemical channel inventories, the integration of NACL Industries (a company primarily engaged in the agrochemical sector and specializing in crop protection products like insecticides, fungicides, and herbicides), capacity expansion, introduction of new molecules in the crop protection segment, and the rising consumption of NPK are expected to reinforce growth going forward.

* We have modeled the acquisition of NACL Industries completed during the quarter and raised our revenue estimates by 5%/7%/8% and earnings estimates by 4% for FY26/FY27/FY28, respectively. We value the company at ~28x FY27E EPS to arrive at a TP of INR2,800. Reiterate BUY

Healthy performance across segments drives profitability

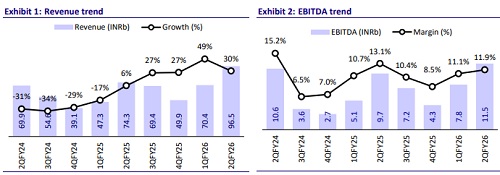

* CRIN reported revenue of INR96.5b (est. INR85.8b) in 2QFY26, up 30% YoY. Total manufacturing fertilizer volumes (NPK+DAP) declined marginally by 1% YoY to ~1.1mmt, and total phosphate fertilizer manufacturing volumes (including SSP) declined 2% YoY to 1.29mmt. Overall phosphatic volumes (NPK + DAP) increased 7% to 1.4mmt.

* Nutrient & other allied business revenue rose 28% YoY to INR86.6b, while crop protection business revenue grew 42% YoY to INR10.7b. Standalone Crop protection (i.e. ex NACL) business grew 10% to INR8.3b.

* EBITDA grew 18% YoY to INR11.5b (est. in-line). According to our calculations, manufacturing EBITDA/mt (including SSP) stood at INR6,340 (up 17% YoY), while EBITDA/mt for phosphate fertilizers (DAP and NPK) stood at INR7,398 (up 17% YoY).

* EBIT margin for the nutrient & other allied business contracted 130bp YoY to 11.4%, while EBIT margin for the crop protection business contracted ~80bp YoY to 13.6% (Due to the consolidation of NACL). However, standalone EBIT margins expanded 500bp YoY to 19.5%.

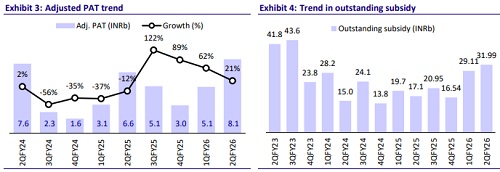

* Adjusted PAT stood at IN8.1b (est. in line), up 21% YoY.

* CRIN’s 1HFY26 revenue/EBITDA/Adj. PAT grew 37%/30%/34% to INR167b/INR19.3b/INR13.1b. Total manufactured fertilizer volume (NPK + DAP) grew 4% YoY to ~2mmt, and total phosphate fertilizer manufacturing volumes (including SSP) grew 4% YoY to 2.38mmt.

Highlights from the management commentary

* Outlook: Healthy performance is expected to continue in 2HFY26, driven by a favorable rabi season outlook, the announcement of NBS rates, above-normal reservoir levels, and the anticipated normalization of weather conditions following the unseasonal rainfall.

* Subsidy: During the quarter, CRIN received INR33.4b/INR46.4b in subsidy claims for 2Q/1HFY26, compared to INR38.5b in 1QFY25. As of Sep’25, outstanding subsidies stood at ~INR32b compared to INR17.1b as of Sep’24.

* Crop protection: The export business, driven by strong momentum in Mancozeb, grew 6-7% during the quarter with a significant improvement in profitability, making it a key contributor to the overall performance of crop protection. The company continues to enhance its export portfolio through capacity expansion and the development of new molecules.

Valuation and view

* We believe the company is well-positioned to sustain its growth momentum in FY26, supported by favorable market dynamics, increasing shift toward NPK fertilizers for balanced nutrition, and strong growth in crop protection led by synergy benefits of the NACL consolidation.

* CRIN’s medium-term outlook remains strong, backed by: 1) expansion into new geographies, 2) development of new molecules across fertilizers and crop protection segments, 3) backward integration for the fertilizer business, 4) acquisition of NACL, and 5) the scale-up of BMCC.

* We have modeled the acquisition of NACL Industries completed during the quarter and raised our revenue estimates by 5%/7%/8% and earnings estimates by 4% for FY26/FY27/FY28, respectively. We value the company at ~28x FY27E EPS to arrive at a TP of INR2,800. Reiterate BUY

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)