Neutral BSE Ltd for the Target Rs. 2,250 by Motilal Oswal Financial Services Ltd

Strong volume momentum; regulatory clouds persist

* The regulator is considering measures to increase the tenure of the options segment (Link). One of the measures could be shifting from weekly to monthly expiries for index contracts. If implemented, this could have significant impact on volumes for stock exchanges.

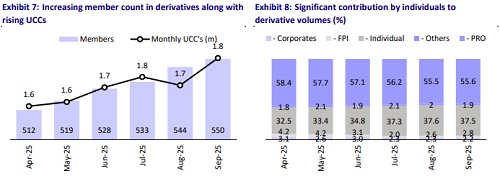

* Earlier, the regulatory mandate allowing only one weekly expiry per exchange (implemented in Nov’24) led to a shift in volumes from Bank Nifty to SENSEX, driving BSE’s premium turnover market share up from 11.4% in Oct’24 to 24.4% in Sep’25. However, a large pool of FPIs is still in the process of setting up their systems following rack allocation, which is expected to further boost volumes.

* The shift of expiry from Tuesday to Thursday (implemented in Sep’25) brought fresh flows, increasing non-expiry day share to the mid-teens and expiry day share to 50- 55%, albeit at the cost of a decline in Friday activity.

* Enhanced broker engagement and the combined order book initiative are driving improvements in execution quality and cash segment flows. BSE’s bulk deals capacity has improved significantly (from 30-40% earlier to ~80-90%), while the infrastructure built for derivatives trading is also being leveraged to support cash activity.

* While recent momentum is encouraging, potential regulatory tightening of F&O products poses a key risk, contributing to a sharp correction in the stock price (trading at 37x FY27E P/E). According to our sensitivity analysis, the removal of weekly expiry could lead to a 35%/ 27% decline in our FY27 derivatives revenue/ PBT (revenue – regulatory fee – clearing cost), resulting in 21% impact on our FY27E EPS. Given the elevated regulatory risks, we reiterate our Neutral rating with a oneyear TP of INR2,250 (based on 40x FY27E EPS).

Gaining market share amid several regulatory changes

* For BSE, many FPIs are yet to start trading in SENSEX. Institutions have rented colocation racks and are currently setting up their trading infrastructure, after which incremental participation is expected to continue in a phased manner.

* BSE’s existing 340 colocation racks are fully occupied, with expansion to 500 racks expected by year-end as institutions await allocation. This growth is expected to enhance liquidity for BSE’s products. Additionally, BSE has introduced charges on colocation trades, which will boost revenue going forward.

* The regulation permitting one weekly expiry product per exchange has caused volumes to shift from BANKNIFTY to SENSEX, leading BSE’s premium turnover market share to rise from 11.4% in Oct’24 to 24.4% in Sep’25, while premium ADTO increased from INR90b in Oct’24 to INR157b in Sep’25.

* Following the shift in expiry from Tuesday to Thursday (effective 1st Sep’25), BSE witnessed increased trading both one day prior to expiry and in longer tenure contracts. This is reflected in the rise of BSE’s non-expiry day market share from single digits to the mid-teens, which was offset by a decline in Friday volume market share.

* BSE also witnessed incremental volumes from traders who maintained their existing strategy for Thursday expiry despite the shift. As a result, BSE’s expiry day market share increased to 50-55% from ~50% prior to the change.

* BSE’s market share in the clearing business has also improved, which is expected to further contribute to consolidated top-line growth going forward.

Future of derivatives segment remains uncertain

* Although various media reports have discussed the regulator’s stance on weekly expiry, no formal regulatory consultation has been initiated.

* Weekly expiry products have witnessed strong adoption across the broader ecosystem of traders and hedgers; therefore, removing these contracts could negatively impact liquidity.

* While changing weekly expiry to fortnightly or monthly could improve margins, there is a risk of volume loss to Bank Nifty if the shift is made to monthly expiry.

* Alternatives to a complete ban on weekly expiry include implementing product suitability criteria or introducing additional guardrails to limit participation.

* BSE’s current focus is on deepening existing offerings before launching new products. The exchange plans to relaunch Bankex, redesigned in line with SEBI’s requirement for indices to be broad-based (minimum 15 stocks).

* Regarding the change in pricing structure, no regulatory approval is required. BSE currently charges ~10% lower transaction fees compared to NSE, providing headroom for potential price increases.

* According to our sensitivity analysis, assuming: 1) a 40% decline in notional turnover due to the removal of weekly expiry, and 2) an improvement in the premium-to-notional to 12bp, the derivatives segment revenue in FY27 is expected to decline 30% YoY, while segment profit (computed as revenue - regulatory fee - clearing cost) is expected to decline 25% YoY. The smaller decline in profit is due to clearing costs being linked to the number of contracts, while regulatory fees are tied to notional turnover. Compared to our current FY27 estimates, the derivatives segment revenue/profit would decline by 35%/27%.

* A smaller decline in notional turnover or improved premium-to-notional turnover could reduce the impact. Additionally, increasing the transaction fee is another lever to offset the effect.

Growing opportunities in the cash segment

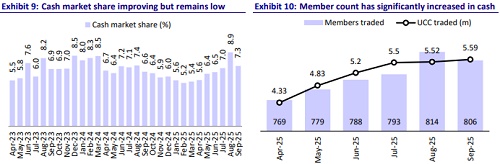

* Stronger relationships with broker clients have driven higher order flows to BSE’s platform, benefiting both the cash and derivatives segments. Several brokers have also begun active market-making on BSE, leading to more competitive order books and improved liquidity.

* The Star MF platform has boosted BSE’s engagement with AMCs, facilitating stronger flows. Additionally, infrastructure established by HFTs for derivatives is being leveraged in the cash market, increasing liquidity and participation across both segments.

* In case of bulk deals, BSE can now provide 80-90% of the book (earlier 30-40%).

* In the top 100 stocks, many vendors now display combined order books by merging the best five bids from NSE and BSE, creating arbitrage opportunities for members. Analysis shows that BSE offered the best bid in ~25-30 of these stocks. As a result, the exchange is educating institutional investors about this feature to enable the best price execution opportunities, contributing to an increase in smart order routing (SOR) from 1.7% in Apr’25 to 2.7% in Sep’25.

Valuation and view

* We expect BSE to sustain its market share gains and maintain robust volume traction, as witnessed in 1HFY26, supported by increasing member participation. Improved trajectory in the cash segment, robust demand for colocation, and strong positioning of the Star MF platform will also contribute to the company’s performance.

* The stock has seen a sharp correction amid regulatory overhang related to potential F&O restrictions. The stock currently trades at 37x FY27E P/E. According to our sensitivity analysis, the removal of weekly expiry could lead to a 35%/ 27% decline in our FY27 derivatives revenue/ PBT (revenue – regulatory fee – clearing cost), resulting in 21% impact on our FY27E EPS. Given the elevated regulatory risks, we reiterate our Neutral rating with a one-year TP of INR2,250 (based on 40x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412