Buy Titan Company Ltd for the Target Rs. 4,500 by Motilal Oswal Financial Services Ltd

Growth outlook improving; slight miss on margins

* Titan Company (TTAN) posted consolidated sales growth of 29% YoY in 2QFY26. Standalone jewelry sales (excl. bullion) rose 19% YoY, driven by the early onset of the festive season, gold exchange campaign, and consumer offers. Studded jewelry grew 16% YoY, and the mix remained flat YoY at 34%. Net jewelry store additions stood at 35 in 2Q, bringing the total count to 1,145. Standalone jewelry LFL growth was 14%, while CaratLane posted a robust 29% YoY growth. Moreover, TTAN witnessed robust festive season sales in October, consistent with the positive feedback shared in our channel checks update (link). Gold prices moderated ~6% during the 10 days after Diwali, supporting incremental footfalls.

* Standalone jewelry EBIT margin (excl. bullion) contracted 60bp YoY to 10.8% (est. 11.6%), impacted by a skewed product mix driven by: a) higher gold coin sales, b) reduced studded margins due to the sharp rise in gold price, and c) investments in exchange offers and campaigns to drive growth. Management reiterated its standalone EBIT margin guidance of 11- 11.5%. CaratLane’s EBIT margin expanded 320bp to 10.2%.

* The domestic watches business reported a 13% YoY revenue growth, led by a strong 17% growth in the analog segment. Analog volumes increased 12% YoY, supported by an 8% rise in average selling prices. In contrast, the smartwatch segment declined 22% YoY, primarily due to lower volumes, though ASPs were higher. Fastrack, Titan, and Helios LFL grew 10%, 11%, and 14% YoY, respectively. Eye care revenue grew 9% YoY, led by an 8% YoY growth in the domestic business.

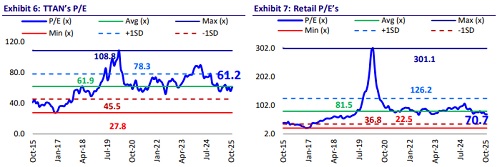

* After a healthy 2Q, a shift of the festive season to an earlier period, and a high base, expectations for 2HFY26 were muted. However, strong jewelry demand over the past 45 days indicates that Titan is effectively capitalizing on the momentum. The earnings growth outlook has certainly improved, despite EBIT margin being under pressure (higher coinage mix). We increase our estimates by 3% and reiterate our BUY rating with a TP of INR4,500 (60x Sep’27 EPS).

Beat in consolidated EBITDA despite standalone EBIT margin pressure

* Growth metrics improving, 2HFY26 better than 1HFY26: TTAN’s consolidated revenue grew 29% YoY to INR187.3b (est. INR163.6b). Consolidated Jewelry sales grew 29% YoY to INR165.2b (est. 142.7b), exbullion sales grew 22% to INR143.3b. Standalone jewelry sales (ex-bullion) grew 19% to INR127.9b (est. INR122.7). Bullion sales grew 122% YoY to INR19.6b. Growth was led by a higher ticket size due to an increase in gold prices. CaratLane’s sales grew 29% YoY. The number of jewelry stores grew 13% YoY to 1,145. Watches/Eyewear/others clocked revenue growth of 13%/9%/63% YoY

* Standalone jewelry EBIT growth at 13%: Gross margin contracted 130bp YoY to 21.4% (est. 23%). EBITDA margin contracted 50bp YoY to 10% (est. 11.2%). Standalone jewelry EBIT margin (excl. bullion) contracted 60bp YoY to 10.8% (est. 11.6%), impacted by elevated promotions and an unfavorable product mix. CaratLane’s EBIT margin expanded 320bp to 10.2%. Watches’ margin expanded 110bp to 16.1% (est. 16.1%). Eye care’s margin declined 540bp YoY to 5.5% (est. 11%).

* Robust 20% earnings growth: EBITDA grew 23% YoY to INR18.8b (INR 18.3b). Ad spends increased 25% YoY, other expenses increased 20% YoY, and employee costs rose 19% YoY. PBT increased 23% YoY to INR15.2b (est. INR15.4b). Adj. PAT rose 20% YoY to INR11.2b (est. INR11.5b).

* In 1HFY26, net sales, EBITADA, and APAT grew 27%, 34%, and 34%, respectively.

Highlights from the management commentary

* October was strong, supported by robust festive season sales. Gold prices moderated by about 6% during the 10 days after Diwali.

* TTAN has launched more offerings in the lower carriages category. The company is also testing 18-karat jewelry, which has received encouraging initial response, though its contribution to the overall sales mix remains minimal.

* For 3QFY26, the company expects overall growth prospects to improve if gold prices stabilize, as this would likely drive higher footfalls and support stabilization in studded jewelry’s gross margins.

* For Tanishq, in FY26, TTAN plans to open 35-40 stores and renovate ~70 stores.

* Standalone EBIT margin (ex-bullion) guidance remains at 11-11.5%, with a stronger focus on absolute growth.

Valuation and view

* We increase our EPS estimates by 3% for FY26/FY27.

* TTAN, with its superior competitive positioning (in sourcing, studded ratio, youth-centric focus, and reinvestment strategy), continues to outperform other branded players. The brand recall and business moat are not easily replicable; therefore, Tanishq’s competitive edge will remain strong in the category.

* The store count reached 3,377 as of Sep’25, and the expansion story remains intact. The non-jewelry business is also scaling up well and will contribute to growth in the medium term.

* We model a CAGR of 18%/20%/23% in revenue/EBITDA/PAT during FY25-28E. TTAN’s valuation is rich, but it offers a long runway for growth with a superior execution track record. Reiterate BUY with a TP of INR4,500 (60x Sep’27 P/E).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)