Buy Sobha Ltd for the Target Rs. 1,778 by Motilal Oswal Financial Services Ltd

Miss on financials; strong launch pipeline shows visibility

Strong YoY performance from Gurugram, Tamil Nadu, and Gift City

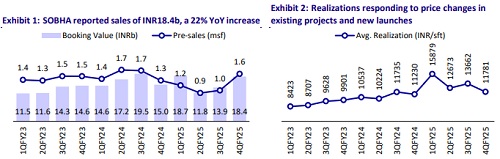

* SOBHA reported bookings of INR18.4b (8% above estimate), up 22%/32% YoY/QoQ. Its share of sales stood at INR13.7b, up 8%/10% YoY/QoQ. Additionally, SOBHA’s share accounted for 75% of total bookings. In FY25, the company reported bookings of INR63b, down 6% YoY (in line with estimates), while its share of sales stood at INR50b, down 8% YoY.

* In 4QFY25, ~76% of sales were led by Bengaluru, contributing INR14b across 1.24msf, supported by two new launches—SOBHA Madison Heights and SOBHA Hamptons—with a total saleable area of 3.7msf. Hyderabad and Tamil Nadu sales were up ~2x/54% YoY to INR418m/INR371m. Gurgaon recorded 25% QoQ growth in sales, whereas Kerala remained steady.

* Total sales volume for the quarter stood at ~1.6msf, up 16%/+53% YoY/QoQ. However, realization was up 5% YoY to INR11,781. In FY25, total sales volume stood at ~4.7msf, down 23% YoY. Realization was up 23% YoY to INR13,399, driven by an increase in the prices of ongoing projects and higher realization from new launches.

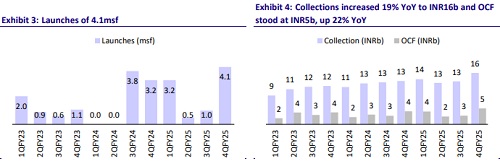

* The company's project pipeline increased to ~31msf (vs 24msf in 4QFY24), including 19msf of new projects, with ~8msf located in Bengaluru.

* Collections increased 99%/101% YoY/QoQ to INR26.5b. Total cash inflow (incl. contractual business) stood at INR17.9b, up 19% YoY.

* Operating cash flows (before interest and taxes) increased 29% YoY to INR4.6b.

* Aligned with its growth-focused strategy, SOBHA increased its land-related investment for the quarter to ~INR3.1b, up 49% YoY. During the quarter, the company generated a cash surplus of INR10.9b.

* Net cash position stood at INR6.3b or 0.14x of equity (vs net debt of INR4.59b or 0.13x in 3QFY25). Cost of borrowings reduced to 9.12% (vs 9.44% in 3QFY25). ? SOBHA delivered 4.54msf in FY25, translating into 3,008 apartments, while it delivered 1.11msf for the quarter.

* P&L performance: In 4QFY25, revenue increased 63%/flat YoY/QoQ to INR12.4b (11% below estimate). Real estate revenue was up 74%/flat YoY/QoQ to INR34b.

* EBITDA was up 52%/40% YoY/QoQ to INR0.9b (in line with estimate), while margin stood at 7.6%, down 56bp YoY and up 209bp QoQ. Margin for the Real Estate business stood at 8%.

* Adj. PAT stood at INR409m, 6x/88% YoY/QoQ (36% below estimate). PAT margin stood at 3.3%, up 237bp/152bp YoY/QoQ.

* In FY25, revenue increased 30% YoY to INR40b, in line with estimates. Real Estate revenue was up 40% YoY to INR34b.

* EBITDA was up 6% YoY to INR2.9b (in line with the estimate), while margin stood at 7.3%, up 29bp YoY. Margin for the Real Estate business stood at 10%.

* For FY25, adj. PAT stood at INR947m, up 93% YoY. PAT margin stood at 2.3%, up 76bp YoY.

Highlights from the management commentary

* Bengaluru accounted for 76% of 4QFY25 sales, contributing INR14b across 1.24msf. New launches included SOBHA Madison Heights and Hamptons.

* The FY26 pipeline includes 10msf of planned launches, with 45% coming from NCR and a key project in Mumbai scheduled for 3QFY26.

* The EBITDA margin on current sales stood at 40%, with project-level margins targeted at 33% for EBITDA and 28% for PBT.

* Revenue of INR159b is yet to be recognized, with an upcoming pipeline of 18.56msf residential and 0.71 msf of commercial developments across nine cities.

* Land investments rose to INR9.5b in FY25 (vs INR3.8b in FY24), supporting growth plans and future project approvals across 24msf and 1,765 acres.

Valuation and view

* SOBHA continues to provide strong growth visibility by unlocking its vast land reserves. Additionally, the recent fundraise and strong cash flows will enable the company to focus on new land acquisitions, which will further enhance its growth pipeline.

* We have incorporated the updated launch pipeline and newly acquired projects during the year. Ongoing and upcoming projects are likely to generate ~INR124b of gross cash flows, which we value at around INR74b.

* We value SOBHA’s land reserve of 154msf at INR86b (previously INR87b), assuming 25-75 years of monetization.

* We reiterate our BUY rating on the stock with a revised TP of INR1,778 (earlier 1,803), indicating a 24% upside potential.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412