Buy NMDC Ltd for the Target Rs. 83 by Motilal Oswal Financial Services Ltd

In-line revenue; higher other expenses drag earnings

Key result highlights – Consolidated

* Revenue stood in line with our estimate at INR70b, up 8% YoY and 7% QoQ, primarily driven by healthy volumes and NSR growth.

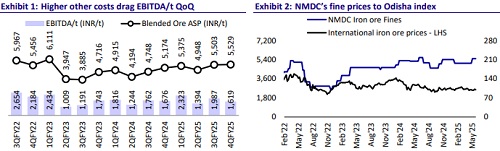

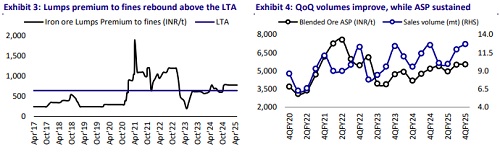

* Iron ore production stood at 13.3mt (flat YoY and QoQ), while sales stood at 12.7mt (+1% YoY and +6% QoQ) in 4QFY25. ASP stood at INR5,530/t (+7% YoY and flat QoQ) as iron ore prices remained firm sequentially.

* EBITDA stood at INR20.5b (-2% YoY and -14% QoQ) against our estimate of INR24.5b, dragged by high other expenses. EBITDA/t stood at INR1,620/t (- 3% YoY and -19% QoQ) during the quarter.

* APAT for the quarter stood at INR14.8b (+3% YoY and -22% QoQ) against our estimate of INR19.8b during the quarter.

* For FY25, the company reported revenue of INR239b (+12% YoY), EBITDA of INR81.5b (+12% YoY), and Adj PAT of INR65b (+13% YoY).

* Iron ore production for FY25 stood at 44mt (-2% YoY) and sales volume at 44.6mt, reporting flat YoY growth. Average blended NSR for FY25 stood at INR5,325/t (+15% YoY). EBITDA/t grew +11% YoY to INR1930/t.

Key highlights from the conference call

* NMDC targets production of 55mt for FY26, with an incremental loading of ~6-7mt from two new lines (line-4 in Bacheli and line-13 in Kirandul).

* Domestic iron ore prices remain stable, supported by safeguard duties on steel despite range-bound international prices (USD99-102/t).

* High RM costs (+80% of sales vs. industry peers at 50-55%) were driven by a higher lump-to-fines ratio (32:68 vs. 20:80) and lower initial utilization.

* NMDC aims to double its production capacity from 50mt to 100mt over the next few years. For FY26, NMDC has guided for a capex of INR40-42b, with a significant ramp-up expected in FY27-28 (potentially exceeding INR100b annually) as projects move into execution.

Valuation and view

* In 4QFY25, volume growth picked up after sluggishness in the early part of the year. NMDC implemented regular price hikes in FY25, which offset the adverse volume impact, translating into a healthy operating profit.

* We expect that going forward, a healthy volume pick-up and stable realization will drive healthy operating growth. Therefore, we largely maintained our estimates for FY26-27. NMDC has planned a capex for various evacuation and capacity enhancement projects, which are expected to improve the product mix and increase its production capacity to ~100mt by FY29-30.

* At CMP, NMDC trades at 4.5x EV/EBITDA on FY27E. We reiterate our BUY rating on NMDC with a TP of INR83 (based on 5.5x FY27E EV/EBITDA).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412