Buy Bharti Airtel Ltd for the Target Rs. 2,365 by Motilal Oswal Financial Services Ltd

Strong margins across key segments; 2Q FCF robust

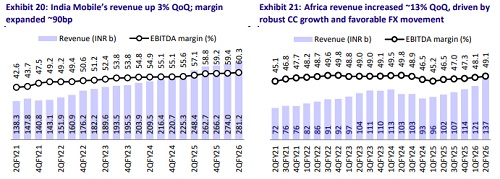

* Bharti Airtel (Bharti) posted a strong 2QFY26, with consolidated EBITDA rising 6% QoQ (3% above), fueled by better performance in Airtel Africa (AAF, 7% beat) and India wireless (2% ahead, driven by a better-thanexpected ARPU uptick and a 94% incremental EBITDA margin).

* Consolidated capex surged to INR114b (+37% QoQ), though 1HFY26 India capex (ex-Indus) is still 3% lower YoY. Management reiterated that FY26 India capex (ex-Indus) should further moderate from the FY25 levels(~INR300b).

* Consolidated FCF remained robust at INR146b (vs. ~INR143b in 1Q), despite a moderation in FCF generation from Indus Towers (Indus) in 2Q, reflecting the diversified and profitable nature of Bharti’s portfolio.

* Bharti’s consolidated net debt (ex-leases) inched up ~INR12b QoQ to INR1.27t, due to dividend payouts and the INR depreciation hit on FX debt.

* We continue to like Bharti’s superior execution on the premiumization agenda. Further, with moderation in capex intensity and a potential tariff hike, Bharti is likely to generate significant FCF (~INR1t over FY26-27E).

* We raise our FY26-28E EBITDA by 2-3%, driven by higher growth in AAF and slightly higher India wireless ARPU. We model a CAGR of 15%/18% in Bharti’s consolidated revenue/EBITDA over FY25-28E, driven by 1) benefits of the ~15% tariff hike in India wireless from Dec’25, 2) continued acceleration in Home broadband net adds, and 3) strong double-digit growth in Africa.

* We reiterate our BUY rating with an SoTP-based revised TP of INR2,365. We value the India wireless and homes business on DCF (implies ~13x Dec’27E EV/EBITDA), DTH/Enterprise at 5x/10x Dec’27 EBITDA, and Bharti’s stake in Indus Towers and Airtel Africa at a 25% discount to our TP/CMP.

* Bharti continues to outperform the broader market (up 33% YTD vs. 8% for Nifty-50), but we believe there are further re-rating triggers such as impending tariff hike, JPL IPO, and potential waiver on AGR dues. Further, we believe long-term risk-reward is favorable (bull case: INR2,970; bear case: INR1,770).

FCF generation robust at INR146b; net debt marginally higher QoQ

* Bharti’s consolidated revenue grew 5% QoQ (+26% YoY) to INR521b, led by robust growth in AAF (+13% QoQ) and the Homes business (+8.5% QoQ).

* Consolidated EBITDA rose 6% QoQ to INR296b (up 35% YoY, 3% above), driven by robust performance in Airtel Africa (+15.5% QoQ, 7% beat), Home Broadband (+9% QoQ), and India Wireless (+4% QoQ, 2% above).

* India wireless revenue and EBITDA grew 2.6% and 4.2% QoQ, respectively (vs. 3.2%/3.5% QoQ for RJio), driven by ~2.2% QoQ ARPU uptick to INR256 (our est. of INR253) and 94% incremental margins.

* Homes continue to benefit from acceleration in subscriber additions (record high 0.95m net adds). Enterprise (B2B) revenue grew 4% QoQ (as the impact of rationalization of lower-margin business fades), while EBITDA margin was resilient at 41.6% (though it dipped 100bp QoQ). Revenue and EBITDA growth accelerated in Africa, driven by the flowthrough of tariff hikes in Nigeria and favorable FX movements.

* After lower capex in 1QFY26, consolidated capex at INR114b picked up pace, with India capex (ex-Indus) rising ~33% QoQ to INR71b (16% YoY).

* Consolidated net debt (ex-leases) inched up ~INR12b QoQ to INR1.267t, with the India net debt-to-EBITDAaL dipping to 1.19x (vs. 1.35x QoQ).

* Consolidated FCF (after leases and interest payments) was broadly stable QoQ at INR146b (vs. ~INR143b QoQ), driven by better operational performance (OCF pre-WC changes rose 6% QoQ) and lower interest outgo (-22% QoQ), despite weaker FCF generation by Indus.

Key highlights from the management commentary

* AGR issue: Bharti welcomed the SC’s recent stance on AGR dues and would push their case to be included in a broader sector-wide relief with the GoI.

* Home broadband (HBB): The company’s home passes accelerated to ~2.5m (vs. ~1.6m in 1QFY26). While the company’s net adds remain lower than RJio’s, and the company intends to step up net adds further, management noted that its share on large OTT platforms is tracking well.

* Indus stake purchase: Bharti has taken an enabling resolution to raise its stake in Indus Towers by 5% in one or more tranches (vs. 51% currently). Management indicated that it views Indus as a vital asset for Bharti’s network, one which is comparatively undervalued (vs. global towercos). However, management reiterated that there are no plans to fold Nxtra datacenter into Indus, as there are no synergies in the two businesses as such.

* 5G: Bharti has deployed dual-mode 5G (combining SA and NSA) for FWA in 13 circles and will completely transition to SA for wireless over the next few years.

* Capex: The capex to switch from NSA to SA 5G is not very material, and the acceleration in HBB capex is already built into management’s guidance of FY26 India (ex-Indus) capex to be lower than FY25 levels (~INR300b). However, the company is looking to raise its investments in data centers (through Nxtra as well as a recent tie-up with Google for an AI data center) over a period.

Valuation and view

* We continue to like Bharti’s superior execution on the premiumization agenda. Further, with moderation in capex intensity and a potential tariff hike, Bharti is likely to generate significant FCF (~INR1t over FY26-27E).

* We raise our FY26-28E EBITDA by 2-3%, driven by higher growth in AAF and slightly higher India wireless ARPU. We model a CAGR of 15%/18% in Bharti’s consolidated revenue/EBITDA over FY25-28E, driven by 1) benefits of the ~15% tariff hike in India wireless from Dec’25, 2) continued acceleration in Home broadband net adds, and 3) strong double-digit growth in Africa.

* We reiterate our BUY rating with an SoTP-based revised TP of INR2,365. We value the India wireless and homes business on DCF (implies ~13x Dec’27E EV/EBITDA), DTH/Enterprise at 5x/10x Dec’27 EBITDA, and Bharti’s stake in Indus Towers and Airtel Africa at a 25% discount to our TP/CMP.

* Bharti continues to outperform the broader market (up 33% YTD vs. 8% for Nifty50), but we believe there are further re-rating triggers like the impending tariff hike, JPL IPO, and potential waiver on AGR dues. Further, we believe long-term riskreward is favorable (bull case: INR2,970; bear case: INR1,770).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412