Neutral Jyothy Laboratories Ltd for the Target Rs. 350 by Motilal Oswal Financial Services Ltd

Weak performance continues; margins under pressure

* Jyothy Laboratories (JYL) posted flat YoY sales growth in 2QFY26, with volumes rising 3% (est. 4%; 1QFY26 4%). The difference between value and volume growth was primarily due to MRP reductions, higher grammage, and promotional price-offs in select categories. JYL expects a 2%-2.5% value volume gap at the overall level going forward. GT channel continued to remain under pressure, while alternate channels grew double digits.

* Fabric Care grew 6% in value terms, led by liquid detergents, which more than doubled YoY. EBIT margin contracted 300bp YoY to 22%, resulting in a 7% YoY EBIT decline. Dishwash sales declined 4% YoY (volumes +3% YoY), primarily due to MRP reductions and grammage offers on bars. Liquid dishwash outperformed the bars category. EBIT margin contracted 180bp YoY to 17.3%, with EBIT declining 13% YoY.

* The Household Insecticides (HI) business continued to remain weak, marking a 9% YoY decline on a flat base as the category continued to face near-term headwinds. The sales have been on a declining trajectory for four quarters now. EBIT margin stood at -9.7% vs. -9.5% YoY. The Personal Care business sales declined 4%, impacted by GST transition; EBIT margin saw a sharp contraction of 1,090bp YoY to 2.7%, with EBIT declining 81% YoY. JYL expects the segment to return to growth in 2HFY26.

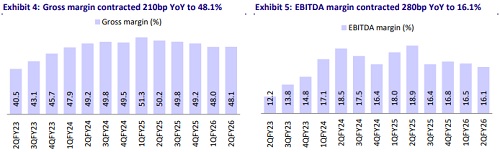

* Gross margin contracted 210bp YoY and flat QoQ to 48.1% (est. 50.3%). Higher employee costs and brand investments led to an EBITDA margin contraction of 280bp YoY, bringing it to 16.1% (below), with EBITDA declining 15% YoY. JYL expects EBITDA margin to be in the range of 16%- 17% in 2HFY26.

* We model a CAGR of 8% in revenue/EBITDA over FY25-28E. We have been cautious on revenue growth and sustaining operating margin previously as well. We cut EPS by 2-3% for FY26/FY27. We reiterate our Neutral rating on the stock with a TP of INR350 (premised on 30x Sep’27E P/E).

Broadly in-line sales; miss on margins

* Volume growth stood at 3%: JYL’s net sales were flat YoY at INR7,361m (est. INR7,567m). Volume growth was 3% (est. 4%) in 2QFY26. In Dishwashing, liquids outperformed bars, while in Fabric Care, the liquid detergent range continued to scale rapidly, with revenue more than doubling YoY.

* Contraction in margins: Gross margin contracted 210bp YoY and remained flat QoQ at 48.1% (est. 50.3%). Employee expenses rose 5%, while Ad spends and other expenses rose 1% each. EBITDA margin contracted 280bp YoY to 16.1%. (est. 17.9%).

* Decline in profitability: EBITDA declined 14.6% YoY to INR1,183m (est. of INR1,351m). PBT declined 12.5% YoY to INR1,187m (est. INR1,328m). Adj. PAT declined 16% YoY to INR878m (est. INR1,009m).

* In 1HFY25, revenue grew 1% YoY, while EBITDA/APAT declined 11%.

Highlights from the management commentary

* The operating environment in 2QFY26 was mixed as the quarter started on a positive note. However, the GST rate revision caused trade disruptions in September, leading to flat growth YoY. The early demand signals for 3QFY26 are encouraging. The company expects demand environment to strengthen in 2HFY26.

* General trade continued to remain under pressure. Modern trade, including e commerce and quick commerce, sustained double-digit growth. Fabric care and dishwash performed well in these channels.

* In 2QFY26, JYL made significant investments in Margo, which, along with price hikes taken in December last year and elevated palm oil prices, weighed on personal care EBIT margins. Over the next couple of quarters, EBIT margins are expected to return to double digits.

* The company expects volume growth in double digits by 4QFY26. It also expects 2%-2.5% value volume gap at the overall level going forward. ? EBITDA margin is expected to be in the range of 16-17% in 2HFY26.

Valuation and view

* We cut our EPS estimates by 2%-3% each for FY26E-28E.

* We believe that while 2HFY26 will be better than 1HFY26 for most FMCG names, elevated competitive intensity could limit JYL’s growth in the near term. Market share gains, the success of new launches, a recovery in personal care, and the turnaround of HI portfolio will be crucial for JYL’s earnings growth. JYL’s margin expansion beyond ~18% is also constrained by its focus on the mass and rural segments. Therefore, we believe its growth potential is adequately priced in at the current valuation. We reiterate our Neutral rating on the stock with a TP of INR350 (premised on 30x Sep’27E P/E).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412