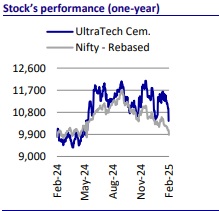

Buy UltraTech Cement Ltd For Target Rs.13,700 by Motilal Oswal Financial Services Ltd

Exploring growth in the construction chain…

…cables and wires offer immediate adjacencies

While UTCEM is venturing into a new business segment—Cables and Wires (C&W)— its core business remains grey cement. The company aims to expand its consumer reach and has identified C&W as a strategic fit, given its immediate adjacencies to the existing core construction value chain. At the same time, the company continues to strengthen its leadership position in cement through both organic and inorganic expansions beyond FY27. We reiterate our BUY rating on the stock.

Highlights from the management commentary

Cement, RMC, and white cement businesses remain in focus

* Grey cement is the core business and will remain in its high-growth phase. Cement demand continues to be strong, backed by infrastructure development and the real estate segment. India’s per capita cement consumption stood at 295kg in FY24, while cement consumption in Western countries peaked at 600-700kg/capita before settling at ~500kg.

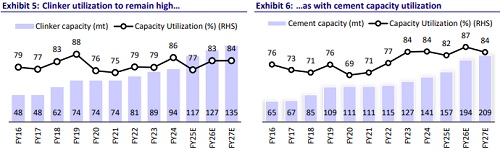

* UTCEM’s domestic grey cement capacity is expected to reach 182.8mtpa by FY25-end, accounting for ~28% of the industry’s capacity. The capacity will further grow to ~209mtpa by end-FY27. UTCEM is growing ahead of the industry and will continue to grow through a mix of organic and inorganic expansions.

* Cement consumption through RMC is less than 5% of the total consumption, but this is expected to grow rapidly. UTCEM is the largest player in the RMC segment, with 348 operational RMC plants. The company is also an established player in the white cement segment.

Why C&W?

* UTCEM aims to capture a higher wallet share from consumers. The Building Product Division (BPD) has five stages: design, construct, enable, decorate, and service. In the construction materials segment, the company already offers 90 SKUs. UTCEM has evaluated multiple business categories, such as sanitary fittings, lighting, fans, and pipes, but determined that most of them were not the right fit and dropped those product categories.

* C&W emerged as a strategic fit, complementing the company’s/group’s existing product offerings. It believes that ~85% of the wire consumption comes from the residential segment, while ~65% of cement demand also originates from this segment. In the residential market, ~35% of cement demand is driven by the rural market, which UTCEM can leverage through its extensive relationships with individual house builders and contractors. It already sells many products through UltraTech Building Solutions (UBS). Urban housing contributes to ~30% of cement demand, where the builders’ community decides which products will be used.

* UTCEM believes it will be easy to make inroads into this market. Cable demand is infrastructure-driven, and with UTCEM already present in many projects, it sees a strong opportunity for growth in this segment. The C&W plant will be commissioned on or before Dec’26. UTCEM’s strong connections with large EPC contractors were a key reason for incorporating this brand into the company.

Capex, working capital, and other opportunities

* The company is investing INR18.0b toward setting up its C&W capacity. The plant is expected to have a capacity of 3.5m-4.0m km and is expected to be commissioned by Dec’26. Key product categories will include wires, while in cables, the major product categories will be Low Tension, Control, Instrumentation, Flexible, Rubber, etc. As of now, the company is not exploring the HT, MVT, and EHV segments in cables.

* The capital employed in the cement division will reach INR1.0t by FY27, with capex in C&W being relatively small in comparison. The company expects initial operating profitability to be lower due to the gradual ramp-up, higher marketing and promotional spending, brand-building efforts, etc. However, it targets an RoCE of ~25% by FY31-32.

* Copper will be available near the plant (within a 100km range) and UTCEM will be able to manage working capital well. It believes that it will be able to operate this business with negative working capital, similar to its cement operations.

* EBITDA margin will be similar to what the industry is achieving at a full ramp-up phase (expected by FY30-31). Brand recognition, UBS network, B2B relationship, and access to end-users and influencers will provide an opportunity for a ‘Right to Win’.

* It believes that the industry has the potential to absorb future capex plans of companies and can accommodate one more player. The revenue contribution is expected to be 60% from wires and ~40% from cables. Specialists who understand the business and technology of C&W will be hired.

* It highlighted that the UBS channel partners are excited to have UTCEM products on their shelves.

Valuation and view

* There are signs of recovery in cement demand after the festive season, and we anticipate industry volume to grow ~4% YoY in FY25, implying ~7-8% YoY growth in 4QFY25. This growth is expected to be driven by pent-up demand, a rebound in government spending, and robust demand in the real estate and housing sectors. Strong volume growth and improvements in clinker utilization (estimated to peak in 4QFY25) are expected to support price hikes across the industry. Being the largest player in the industry with a pan-India presence, we expect UTCEM to benefit from the cement demand recovery and price hikes.

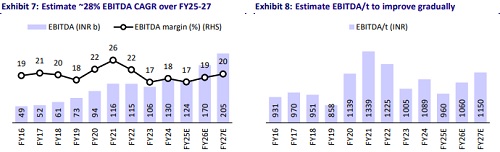

* We estimate UTCEM’s consol. revenue/EBITDA/PAT CAGR at ~17%/28%/32% over FY25-27. We estimate a consolidated volume CAGR of ~16%, aided by inorganic growth. We estimate its EBITDA/t at INR1,060/INR1,150 in FY26/FY27 vs. INR960 in FY25E (average of INR1,160 over FY20-24). We estimate the company’s net debt to peak in FY26 at INR204b (vs. ~INR153b as of Dec’24). The net debt-to-EBITDA ratio is estimated at 1.2x/0.8x in FY26/FY27 (vs. 1.3x as of Dec’24 TTM). We reiterate our BUY rating with a TP of INR13,700, valuing at 20x FY27E EV/EBITDA.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412