Buy HDFC AMC Ltd For Target Rs. 4,800 by Motilal Oswal Financial Services Ltd

Well poised to sustain outperformance

Robust equity flows despite subdued markets; SIPs continue to scale up

* HDFC AMC is India's third-largest mutual fund house with QAAUM of INR7.9t. It holds an overall market share of 11.5% and a 12.8% share in actively managed equity QAAUM, underpinned by strong brand reputation, consistent fund performance, and an extensive distribution network.

* HDFC AMC operates on a cost-efficient model, driving industry-leading profitability with a PAT-to-AAAUM ratio of 33bp. This lean cost structure supports strong cash generation, enabling a stable RoE of over 30%, significantly outperforming many financial sector peers.

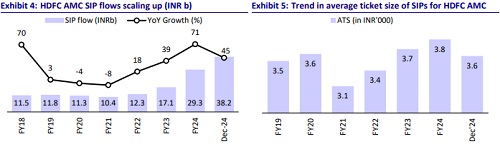

* The company has witnessed robust retail participation, with SIP AUM growing 38% YoY to INR1.8t as of Dec’24, representing 37% of actively managed equity AUM. Furthermore, HDFC AMC commands a 24% share of unique mutual fund investors, reinforcing its leadership in retail investor penetration.

* The company maintains a favorable product mix, with the high-margin equity segment constituting 64.9% of QAAUM as of Dec’24, well above the industry average of 57%. This skew toward equity investments supports superior yield generation and profitability. Notably, its actively managed equity QAAUM expanded by 51% YoY in 3QFY25, reflecting strong investor confidence.

* HDFC AMC’s total AUM accounts for ~27% of HDFC Bank’s total mutual fund AUM, compared to ICICI Prudential MF’s 60% share of ICICI Bank’s AUM and SBI MF’s 98% share of SBI Bank’s AUM. This indicates significant untapped potential for deeper penetration through HDFC Bank’s branch network.

* Looking ahead, we project equity AUM growth of 55%/12%/18% in FY25/FY26/FY27. FY26 is anticipated to start on a weaker note in terms of AUM growth. Despite adjustments in commission structures, we factor in a 1bp decline in overall yields for FY26 and FY27. Consequently, we estimate an earnings CAGR of 14% over FY25-27. We maintain our BUY rating on HDFC AMC, with a one-year TP of INR4,800, based on 32x FY27E EPS.

Industry continues to be on a strong footing

* At the industry level (MAUM basis), the share of equity AUM in total AUM rose to 55% as of Dec’24 from 29% in Mar’15, leading to higher yields and profitability. There is a declining trend in the share of debt AUM, from 44% in Mar’15 to 15% in Dec’24, while the share of passives surged to 18% in Dec’24 from 4% in Mar’15, showing growth in demand for ETFs and index funds.

* The industry spends 2bp of AUM on investor awareness campaigns, like ‘Mutual Fund Sahi Hai’. These investments of ~INR13-14b have further deepened the penetration in the MF industry. A recent regulatory initiative– lowering the SIP ticket size to INR250 per month–will further encourage wider participation in the market.

* SIP has maintained its momentum despite weak market sentiment, with INR260b of inflows in Feb’25 vs. INR264b in Jan’25, reflecting resilient retail participation and a shift toward long-term investing.

* The share of Direct AUM in Equity AUM rose to 29% in Dec’24 from 21% in Dec’20, as tech players such as discount brokers, standalone MF platforms and AMC websites have made MIF investments seamless and efficient.

* Expansion beyond the top 30 cities (19% of overall AUM as on Dec’24) remains a focus, as AMCs leverage digital platforms and expand physical distribution to tap into underserved markets.

HDFC AMC benefits from strong and stable fund performance

* Over the years, HDFC AMC has implemented a multi-pronged strategy to enhance its market share and fund performance.

* The market share of HDFC AMC in the total equity/passives improved to 12.9%/2.1% in Dec’24 from 9.4%/0.6% in Dec’19, owing to the following measures: 1) product diversification by launching new exchange-traded funds (ETFs), index funds, and thematic funds to cater to a broader investor base; 2) strengthened its distribution network by deepening partnerships with banks, financial advisors, and digital platforms; 3) invested in digital transformation, enhancing customer experience and operational efficiency through online platforms.

* The firm also recorded a 13.2% market share as of Dec’24 in individual monthly average AUM, reinforcing its appeal among retail investors.

* Weak fund performance in FY20-21 with few schemes appearing in the top quartile on the one-to-three year return basis during the period led to loss of equity market share to ~11.5% (Dec’21). However, with a consistent increase in the number of schemes appearing in top quartile, its equity market share rose to ~12.9% (MAUM basis in Feb’25).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412