Neutral Indian Energy Exchange Ltd For Target Rs. 209 by Motilal Oswal Financial Services Ltd

Strong volume growth partly offset by soft transaction fees

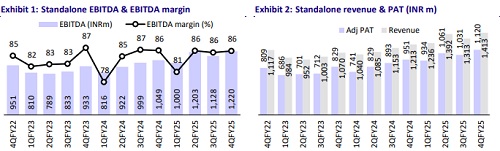

* Indian Energy Exchange (IEX) reported standalone revenue for 4QFY25 at INR1.4b (+16.5% YoY), below our estimate by 7%, due to a lower-thanestimated per-unit transaction fee (-8.6% YoY, -6.8% QoQ). The reported standalone PAT was in line with our est. at INR1.12b (+17.8% YoY), led by an 18% YoY rise in electricity volumes and other income.

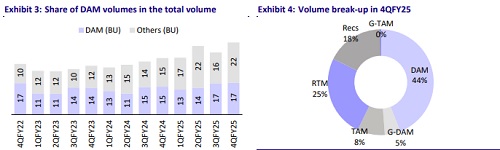

* IEX’s overall volumes rose ~27% YoY in 4QFY25, with electricity volumes increasing 18% YoY and renewable (RE) volumes surging 107.5% YoY.

* IEX holds a dominant market position, with a combined market share of 84% in FY25. Pending approvals for an 11-month contract and the Green RTM market are expected to enhance volume growth opportunities.

* Volumes in the DAM segment moderated to 44% of total volumes in FY25 from 53% in FY23. Further, new categories such as G-DAM were 6% of total volumes compared to 4% in FY23. Strong volume growth in RECs led to a rise in its contribution to 13% of total volumes in FY25 from 6% in FY23, aided by the company’s strategic pricing discounts to drive participation. While concerns around market coupling have subsided somewhat, it remains a risk.

* The stock is currently trading at 37x FY26E P/E, at a notable premium to its LT average 1-yr fwd P/E of 28x. Given IEX’s expected PAT CAGR of 13% over FY25-FY27, we believe the current valuations are not inexpensive anymore. We reiterate our Neutral rating on the stock with a TP of INR209.

PAT in line; transaction fee per unit down 8.6% YoY in 4QFY25

* IEX reported a 4QFY25 standalone revenue of INR1.4b (+16.5% YoY), 7% below our estimate, due to a lower-than-estimated per-unit transaction fee.

* The reported standalone PAT was in line at INR1.12b (+17.8% YoY), driven by an 18% YoY jump in electricity volumes and other income.

Operational performance:

* In 4QFY25, electricity volumes were up 18% YoY to 31.7BUs.

* Within the electricity volume segment, the Day Ahead Market (DAM) was up 13.5% YoY. Volumes of the Term Ahead Market (TAM) dipped 7.6% YoY in 4QFY25.

* Renewable energy certificates (RECs) traded in 4QFY25 stood at 6.7m (+107.5% YoY).

* The green market segment reported a strong performance, with volumes surging 100.5% YoY to reach 1.9BUs.

* In the gas market, the Indian Gas Exchange (IGX) posted a 132% YoY jump in traded volumes in 4QFY25, reaching 20.2m MMBtu. Reported PAT grew 102.9% YoY to INR89m.

* The Board has recommended a final dividend of INR1.50/share for FY25 (Record date: 16th May’25).

Strong volume growth in FY25 drives PAT momentum

* In FY25, traded electricity volumes were up 19% YoY to ~120.7BUs. About 17.8m RECs were traded during FY25, a surge of 136% YoY.

* Consolidated revenue grew 19% YoY to INR6.5b in FY25, while reported PAT rose 22% YoY to INR4.29b vs. INR3.5b in FY24.

* For FY25, India's electricity consumption stood at 1,694BUs, a 4.4% increase YoY.

* Sell liquidity in the DAM segment rose 36% YoY in FY’25, helping keep prices competitive. The market clearing price declined by 14.7% YoY to INR4.47/unit (INR5.24/unit in FY’24).

* IGX recorded gas volumes at 60m MMBtu in FY’25 (+47% YoY), while its PAT rose 34.3% YoY to INR310m.

Highlights of IEX’s 4QFY25 performance

Performance highlights and market developments

* Electricity volumes in 4QFY25 grew 18% YoY to 31.7BUs, while total volumes for FY25 increased 18.7% to 121BUs.

* Standalone profit in 4QFY25 stood at INR1.12b, reflecting a 17.8% YoY growth; revenue rose 16.5% to INR1.4b.

* IGX traded 20.2m MMBTU in 4QFY25, up 132% YoY, mainly since Reliance and ONGC started domestic gas production, and they sold a good part of this in the market. IEX’s reported PAT surged 102.9% YoY to INR89m.

Other highlights:

* IEX holds an 84% market share in the electricity segment and 60% in RECs.

* For FY25, IEX’s market share for the collective segment, i.e., DAM, and RTM, is ~99.8% and for bilateral, it is ~35%.

* IEX is awaiting CERC approval to extend Term-Ahead Market (TAM) contracts from 90 days to 11 months, tapping into a 40BUs addressable trader market.

* New electricity contracting models like battery storage, FDRE, and virtual PPAs are set to deepen market integration.

Valuation and view

* Our TP of INR209 for IEX is based on the following:

* We value the business at FY27E EPS of 5.9 with a P/E multiple of 35x. This compares with the mean one-year forward P/E of 28x.

* We have not assumed any value for IGX's stake in our valuation.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412