Buy JK Lakshmi Cement Ltd for the Target Rs. 1,000 by Motilal Oswal Financial Services Ltd

Beats estimates; expansion plans slightly delayed

Guiding for 10% volume growth in FY26 vs. industry growth of 6.0-6.5%

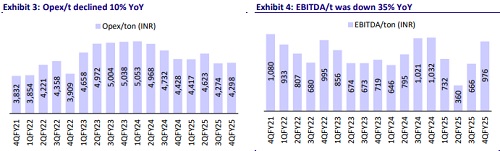

* JKLC’s 4QFY25 EBITDA was above our estimate, led by higher-than-estimated volumes (~3% beat) and realization/t (~5% beat). Consol. EBITDA increased 4% YoY to INR3.5b (~20% beat). EBITDA/t declined 5% YoY to INR976 (est. INR837) and OPM was flat YoY at ~19% (est. ~17%). PAT (adjusting for tax reversals) grew ~23% YoY to INR1.9b (~34% beat).

* Management targets volume growth of ~10% in FY26 vs. expected industry growth of 6.5%-7.0%. Cost efficiency measures are estimated to deliver INR100-120/t in cost savings in the next 12-18 months. On expansions, 1.35mtpa Surat GU will be commissioned in phases during Jun-Dec’25, while the Durg integrated unit is targeted for 3QFY27. The northeast project saw a delay due to political and local issues. However, JKLC is committed to achieving its 30mtpa capacity target by FY30 (vs. 16.4mtpa currently).

* We raised our FY26E/FY27E EBITDA by ~5% each, led by higher realization estimates given the higher exit-FY25 realization. We raised our EPS estimates by ~8%/14% for FY26/FY27, aided by lower depreciation estimates and lower ETR (opting for lower tax rate under new tax regime). The stock is trading at 11.0x/9.0x FY26E/FY27E EV/EBITDA. We value the stock at 10x FY27E EV/EBITDA to arrive at our TP of INR1,000. Maintain BUY.

Sales volume rises ~10% YoY; realization/t dips ~3% YoY (up 7% QoQ)

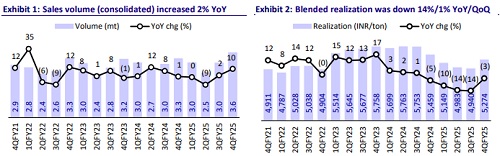

* Consolidated revenue/EBITDA/adj. PAT stood at INR19.0b/INR3.5b/INR1.9b (up 7%/4%/23% YoY and up 7%/20%/34% vs. our estimate). Volume grew ~10% YoY to 3.6mt. Realization declined 3% YoY (up 7% QoQ) to INR5,274/t.

* Opex/t was down 3% YoY (led by reduction in variable cost/t, which declined ~15% YoY) and came in ~2% above our estimates. Employee costs/freight costs/other expenses per ton increased 8%/15%/7% YoY. OPM was flat YoY at ~19% and EBITDA/t declined 5% YoY to INR976 in 4QFY25. Depreciation was up 13% YoY, while other income was down 39% YoY.

* In FY25, revenue/EBITDA/adj. PAT stood at INR61.9b/INR8.6b/INR3.1b (down ~9%/18%/34% YoY). OPM declined 1.5pp YoY to ~14%. Sales volume was up 1% YoY at 12.1mt. OCF stood at INR7.8b vs. INR9.0b in FY24. Capex stood at INR6.5b vs. INR10.0b in FY24. FCF stood at INR1.3b vs. net cash outflow of INR1.1b in FY24.

Highlights from the management commentary

* There has been no notable increase in cement prices since 4QFY25 end in the company’s core markets. It estimates prices to be range-bound in JunJul’25 because of seasonality impact.

* Average fuel cost stood at INR1.53/kcal vs. INR1.57/Kcal in 3QFY25 and is expected to remain stable in 1QFY26. AFR share stood at ~9% in FY25 and is expected to increase to 12%-13% in FY26 at the company level.

* The brand renovation and rejuvenation exercise has been completed, with encouraging market feedback. Premium products are performing well, and the company is committed to further improving premium cement sales.

Valuation and view

* The company’s profitability has improved in 4QFY25, led by strong volume growth and a sharp increase in realization QoQ. So far, the company’s core markets have not seen price hikes and it expects prices to increase after the monsoon as demand improves. The company’s expansion plan in Surat and Durg is witnessing a slight delay of up to three months, part of it due to pending EC. The northeast plant is delayed by 7-8 months.

* We estimate a CAGR of ~11%/26%/32% in revenue/EBITDA/PAT over FY25-27 and OPM at ~16%/18% in FY26/27 vs. ~14% in FY25. However, given the company’s capacity expansion plans, we estimate its net debt to rise to INR25.6b in FY27 from INR13.8b in FY25. The net debt-to-EBITDA ratio is estimated to be at 1.9x in FY27 vs. 1.6x in FY25. The stock trades at 11x/9x FY26E/FY27E EV/EBITDA. We value JKLC at 10x FY27E EV/EBITDA to arrive at our TP of INR1,000. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412