Neutral Bank of Baroda Ltd for the Target Rs. 290 by Motilal Oswal Financial Services Ltd

Steady quarter; int on IT refund drives earnings beat

Asset quality ratio improves further

* Bank of Baroda (BOB) reported 2QFY26 PAT of INR48.1b (up 5.9% QoQ, down 8% YoY, 12% beat), aided by NII growth (owing to IT refund of INR7.5b), lower provisions and contained opex growth.

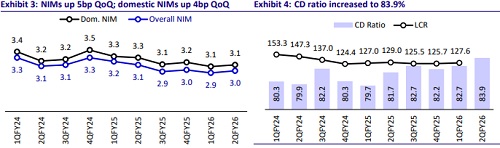

* NII grew by 2.9% YoY/ 4.5% QoQ to INR119.5b (9% beat) amid interest on IT refund. Reported NIMs improved by 5bp QoQ to 2.96%, while adjusted NIMs would have been lower by 3-5bp QoQ.

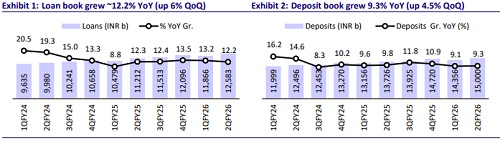

* Business grew by a healthy 12.2% YoY/6% QoQ, fueled by growth in retail and pickup in corporate advances. Deposits grew by 9.3% YoY/4.5% QoQ. CD ratio increased to 83.9% (up 124bp QoQ), within the guided range.

* The bank made floating provisions of INR4b for ECL (O/S pool at INR10b) and guided to increase them further. Slippages declined to INR30.6b from INR36.9b in 1QFY26. GNPA/NNPA ratios declined 12bp/3bp QoQ to 2.16%/0.57%. PCR stood at ~74.1% vs. 74% in 1QFY26.

* We raise our FY26 earnings estimate by 5% while maintaining FY27 forecasts, projecting FY27E RoA/RoE at 1.03%/14.7%. We reiterate our Neutral rating with a TP of INR290 (1.0x FY27E ABV).

Business growth robust; credit cost declined to 29bp

* BOB reported 2Q PAT of INR48.1b (up 5.9% YoY, 12% beat). NII grew 2.9% YoY/4.5% QoQ to INR119.5b (9% beat). Reported NIMs improved by 5bp QoQ to 2.96%, while adjusted NIMs on calculated basis would have been lower by 3-5bp QoQ. It expects margin to remain at ~2.85-3% in FY26.

* Other income declined by 32% YoY/25% QoQ to INR35.2b (16% miss) amid lower treasury income and lower recovery from TWO. Total income thus declined by 8% YoY/4% QoQ to INR155b (largely in line).

* Opex was up 8% YoY/flat QoQ (largely in line). PPoP thus declined by 20% YoY/8% QoQ to INR75.8b (6% beat). Provisions declined by 47% YoY/37% QoQ to INR12.3b (12% lower than MOFSLe).

* Advances grew by a robust 12.2% YoY/6% QoQ. Among segments, retail book grew 17.6% YoY/4.5% QoQ. In retail, home loan grew by 3.9% QoQ, Auto grew by 4.5% QoQ, and mortgage by 5.5% QoQ. Corporate book too grew by 3% YoY/8% QoQ. While corporate growth has been lower, the bank aspires growth to recover to 9-10% YoY.

* Deposits grew by 9.3% YoY/4.5% QoQ, while domestic CASA grew by 6.6% YoY/3.2% QoQ. As a result, domestic CASA ratio declined to 38.4% from 39.3% in 1QFY26.

* On the asset quality side, slippages declined to INR30.6b from INR36.9b in 1QFY26, led by a decline in fresh slippages. GNPA/NNPA ratios declined by 12bp/3bp QoQ to 2.16%/0.57%. PCR stood at ~74.1% vs. 74% in 1QFY26.

* SMA 1&2 stood at 0.39% vs. 0.4% in 1QFY26.

ighlights from the management commentary

* NIMs improved and are expected to remain stable or slightly rise in the coming quarters. The full-year NIM guidance stands at 2.85-3% (including IT refund).

* ECL and Risk Weights – The overall impact on CRAR is estimated at around 1.25%. However, the reduction in credit RWAs is expected to provide a benefit of about 60bp. Overall, the maximum impact is likely to be around 75bp, spread over a five-year period. The implementation of ECL could increase credit costs by a maximum of 20-25bp.

* Slippage ratio is guided at 1-1.15% and credit cost at 0.75bp, although they will be fairly lower than the stated guidance.

Valuation and view: Reiterate Neutral with a TP of INR290

BOB reported an earnings beat, driven by stronger NII growth, controlled operating expenses, and lower provisions. Reported NIMs improved 5bp QoQ to 2.96%, though on a calculated basis, NIMs moderated by 3-4bp QoQ. The bank expects NIMs to remain within the 2.85-3% range. Growth momentum picked up in 2Q after a muted 1Q, with the CD ratio rising 124bp QoQ to 83.9%. Corporate loan growth is expected to accelerate, with management guiding for 9-10% YoY growth (vs. 3% YoY in 2Q). Asset quality improved, reflected in a lower slippage ratio and contained credit costs. The bank created INR4b of floating provisions and plans to strengthen this buffer further. The ECL transition is expected to have a 1.25% impact on CRAR. We raise our FY26 earnings estimate by 5% while maintaining FY27 forecasts, projecting FY27E RoA/RoE at 1.03%/14.7%. We reiterate our Neutral rating with a TP of INR290 (1.0x FY27E ABV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412