Buy Voltas Ltd for the Target Rs. 1,600 by Motilal Oswal Financial Services Ltd

UCP margin higher; near-term growth outlook challenging

Late-season demand likely to bridge the earlier gaps

* Voltas (VOLT)’s 4QFY25 performance was in line with our estimates. Total revenue grew ~13% YoY to INR47.7b, aided by ~17% YoY growth in the UCP segment. EBITDA surged ~75% YoY to INR3.3b and OPM jumped 2.5pp YoY to 7.0%. PAT grew 2.3x YoY to INR2.4b.

* Management indicated that margin improvement in the UCP segment was led by better product mix and higher demand for large-capacity/energy-efficient products, which enjoy slightly better margins. The unseasonal rains in a few parts of the country hit secondary sales in the initial few days (30-40 days) of the summer season. An extended summer season is anticipated, which should help make up for the volume lost in the last few days. In FY25, VOLT’s UCP volume grew ~37% YoY. It projects double-digit growth in FY26.

* We broadly retain our EPS for FY26E/FY27E. However, we cut our valuation multiple for the UCP segment to 45x FY27E EPS (from 50x), reflecting uncertainty surrounding the summer season. Reiterate BUY with a revised SoTP-based TP of INR1,600 (earlier INR1,710).

UCP’s EBIT margin beat estimates; RAC market share at ~19% YTD

* VOLT’s consol. revenue/EBITDA/PAT stood at INR47.7b/INR3.3b/ INR2.4b (up 13%/75%/2.3x YoY and in line) in 4QFY25. Depreciation/interest costs grew 19%/12% YoY, whereas ‘other income’ rose 46% YoY.

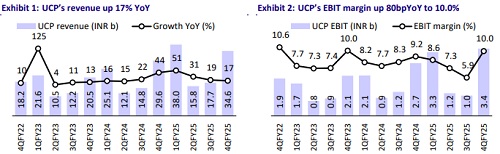

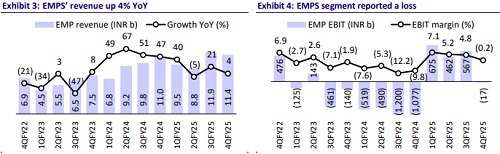

* Segmental highlights: a) UCP – revenue grew 17% YoY to INR34.6b, and EBIT increased 27% YoY to INR3.4b. EBIT margin was up 80bp YoY to 10.0%; b) EMPS – revenue rose 4% YoY to INR11.4b. It reported a loss of INR17m vs. a loss of INR1.1b in 4QFY24; c) PES – revenue declined 16% YoY to INR1.3b, and EBIT was down 29% YoY to INR341m. EBIT margin dipped 4.8pp YoY to ~26%.

* In FY25, revenue/EBITDA/Adj. PAT stood at INR154.1b/11.2b/8.4b (up 23%/ 135%/252% YoY. The UCP/EMPS segments’ revenue grew 30%/13% YoY to INR106.1b/INR41.6b, whereas the PES segment’s revenue declined ~3% YoY to INR5.7b. UCP’s EBIT grew 29% YoY to INR8.9b, while EBIT margin was flat YoY at 8.4%. Operating cash outflow stood at INR2.24b vs. OCF of 7.6b in FY24, led by a surge in working capital. Capex stood at INR2.1b vs. INR2.9b in FY24. Net cash outflow was INR4.3b vs. net cash inflow of INR4.7b in FY24.

Highlights from the management commentary

* Sales volume of RAC was 2.5m+ units in FY25. During FY25, the primary volume growth for UCP was ~36% YoY, and it maintained a YTD market share of ~19%.

* It recorded the highest-ever sales of air coolers in FY25, with volume rising 70%+ YoY to 0.5m+ units. VOLT achieved 8.5% market share in this category.

* Management is not planning for any price hikesin the RAC category immediately. However, it will take appropriate action as the situation demands

Valuation and view

* VOLT reported a strong performance in FY25 with strong growth in the UCP segment and healthy margins. The company retains leadership in RAC with ~19% market share and benefits from the ramp-up of its Chennai facility. However, increased competition and seasonality concerns warrant caution. The demand tailwind from the anticipated extended summer should be closely monitored for stock performance.

* We expect VOLT’s revenue/EBITDA/adj. PAT to report a CAGR of 12%/22%/24% over FY25-27. We estimate OPM to be at 8.0%/8.5% in FY26/FY27 vs. 7.2% in FY25. We estimate UCP’s margin at 8.8%/9.0% for FY26E/27E vs. 8.4% in FY25. We have revised the valuation multiple for the UCP segment downward to 45x FY27E EPS (from 50x), reflecting uncertainty surrounding the summer season. Reiterate BUY with a revised SoTP-based TP of INR1,600 (earlier INR1,710).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412