Voltas Retains Market Leadership Despite Weak Summer and Voltas Beko Continues to Gain Market Share in Refrigerators and Washing Machines

The Board of Directors of Voltas Limited, India’s No. 1 Air Conditioning brand from the house of Tata’s, announced the consolidated financial results (including the consolidated segment report) of the Company for the quarter ended 30th June 2025.

The quarter was marked by unseasonal and unpredictable weather conditions. The onset of summer was delayed, temperatures remained relatively mild, and the season concluded abruptly due to early monsoon. This resulted in a sharp decline in demand for cooling products, particularly in case of Air Conditioners. The impact was further accentuated by an exceptionally high base in the corresponding quarter of the previous year, which had benefited from a harsh and prolonged summer that drove record sales. Despite these temporary challenges, Voltas demonstrated resilience by retaining its market leadership and maintaining stable performance across its core business segments.

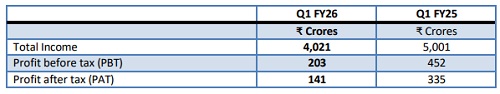

Consolidated Results for the quarter ended 30th June, 2025: For the quarter ended 30th June 2025, the Company reported a Consolidated Total Income of Rs.4,021 crores, against Rs.5,001 croresin the same period last year. Profit Before Tax stood at Rs.203 crores compared to Rs.452 crores previously. Net Profit (after tax) was Rs.141 crores, compared to Rs.335 crores in the corresponding period last year.

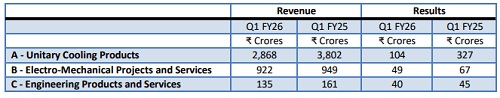

Segment Revenue and Results for the quarter ended 30th June, 2025:

Consolidated Segment Results for the quarter ended 30th June 2025:

(A)Unitary Cooling Products (UCP): The Unitary Cooling Products segment faced a subdued quarter, shaped by the delayed onset of summer, relatively mild temperatures, and the early arrival of the monsoon, all of which shortened the peak selling season. Trade partners had built up inventory in anticipation of strong demand, but softer secondary sales led to slower off-take and elevated stock levels, prompting a temporary adjustment in factory operations. To sustain market momentum, Voltasintensified its effortsto drive secondary sales through focused promotional activities, which placed some pressure on margins.

Despite these challenges, the Company retained itsleadership position in both fixed speed and inverter Air Conditioners, reflecting the strength of its brand, product portfolio, and wide distribution network. The long-term fundamentals of the business remain strong, with a volume compound annual growth rate of more than 20 percent from FY 2023 to FY 2026. With inventory levels expected to normalize and demand likely to improve, aided by upcoming regulatory changessuch asrevised energy efficiency norms, the segment is well positioned for recovery in the quarters ahead.

For the quarter ended June 2025, the UCP segment registered a revenue of Rs.2,868 crores, as compared to a significantly higher performing previous quarter of Rs.3,802 crores in Q1FY25. The Segment reported an EBIT of Rs.104 crores in Q1FY26 as compared to Rs.327 crores in Q1FY25.

Voltas Beko:

Voltas Beko delivered a strong performance in the first quarter of FY 2026, recording close to one million units in volume sales and achieving year-on-year growth of 33 percent. The Washing Machine category led this momentum, supported by successful product launches and a sharper product mix. Gains in the Refrigerator category were equally encouraging, with direct cool models driving a marked improvement in market share.

This growth was underpinned by agile manufacturing, timely availability of fast-moving products, and a steady pipeline of product innovations and new launches tailored to evolving consumer needs. Improved traction across general trade, modern retail, and e-commerce channels was complemented by enhanced retail visibility, focused marketing campaigns, and operational efficiency -- driving both volume expansion and margin improvement. Voltas Beko’s growing scale, expanding product portfolio, and increasing consumer acceptance continue to strengthen Voltas’ overall appliance business while reducing its reliance on seasonal product categories.

(B) Electro-Mechanical Projects and Services:

The Electro-Mechanical Projects and Services segment delivered a steady performance during the quarter, supported by disciplined execution, robust project oversight, and focused receivables management. Execution across domestic and international geographies remained on track and timely certifications and periodic project evaluations helped ensure margin stability, while consistent cost controls reinforced operational efficiency. In the domestic business, the company remains focused on execution efficiency and financial discipline, supported by a healthy and well-diversified order book.

For the quarter ended June 2025, segment revenue was Rs.922 crores, compared to Rs.949 crores in the same period last year. The segment result was Rs.49 crores, as compared to Rs.67 crores last year.

(C) Engineering Products and Services:

The Engineering Products and Servicessegment delivered a balanced performance during the quarter, with stable execution in core areas and selective improvement in margins. In the Mining and Construction Equipment business, while overall sales volumes were lower, a shift in the product mix contributed positively to profitability. Operations and maintenance contracts continued to offer a steady revenue stream and supported baseline performance.

In the Textile Machinery Division, subdued capital expenditure and cautious customer sentiment led to softer demand in the agency business. Voltas remains focused on strengthening its presence in spinning and post-spinning segments, while enhancing service delivery and customer engagement to build long-term competitiveness.

For the quarter, segment revenue was Rs.135 crores, compared to Rs.161 crores in the same quarter last year. The Segment Result for the quarter was Rs.40 crores, as against Rs.45 crores in the corresponding quarter last year.

Commenting on the performance, Mr. poBakshi, MD & CEO, Voltas Limited, said, “The first quarter of FY26 presented certain challenges, particularly due to unseasonal weather and shifting consumer sentiment. While these factors impacted our seasonal product categories, our core strengths—market leadership, operational resilience, and strategic agility—remain intact. We view this as a one-offsituation and are confident that our ongoing investmentsin innovation, channel expansion, and customer-centricity will enable us to overcome short-term headwinds and continue delivering sustainable growth in the quarters ahead”.

Above views are of the author and not of the website kindly read disclaimer