Buy Sobha Ltd for the Target Rs.1,935 by Motilal Oswal Financial Services Ltd

Weak performance; gross margins hint at a turnaround

Strong YoY performance in Gurugram and Tamil Nadu

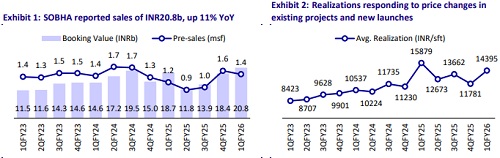

* Total bookings were up 11% YoY/13% QoQ at INR20.8b (31% miss) in 1QFY26. SOBHA’s share of bookings rose 26% YoY/25% QoQ to INR17.2b.

* In 1Q, 57% of sales were led by NCR, as Gurugram sales jumped 2x QoQ to INR3.5b, led by Sobha Aranya and Sobha Altus. The newly launched project, Sobha Aurum, marked the company’s entry into Greater Noida, contributing INR8.3b in sales. About 29% of sales were led by Bangalore, with healthy contributions from Sobha Town Park, Sobha Ayana, and Sobha Neopolis. Kerala sales were up 64% QoQ at INR2.1b, led by the launch of four towers of Marina One, Kochi. Tamil Nadu sales jumped 2x YoY/59% QoQ at INR587m, maintaining steady volumes. Hyderabad and Pune witnessed muted sales due to limited inventory.

* Volumes were up 22% YoY at 1.4msf (48% below our estimate). Average realization was at 14,395psf, down 9% YoY and up 22% QoQ.

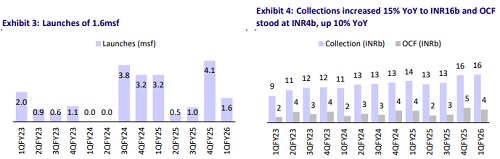

* Completions stood at 594 homes, comprising 1.07msf of saleable area. ? The company's project pipeline is at ~30msf (vs. 31msf in 4QFY25), including 18msf of new projects, with ~8msf located in Bengaluru.

* Real estate collections increased 15% YoY to INR16b. Total cash inflow (incl. contractual business) stood at INR17.8b, up 15% YoY.

* Net operating cash flows (before interest and taxes) rose 22% YoY to INR3.95b.

* In line with its growth strategy, SOBHA increased its land-related investment to ~INR2.8b in 1Q, up 75% YoY. During the quarter, the company generated a cash surplus of INR568m.

* Net cash position stood at INR6.9b vs. INR6.3b in 4QFY25. The cost of borrowings reduced to 8.86% (vs. 9.12% in 4QFY25).

* P&L performance: In 1Q, revenue was up 33% YoY/down 31% QoQ at INR8.5b (18% below estimate). Real estate revenue was up 45% YoY at INR6.9b.

* Gross margin has been improving sequentially for the last two quarters and stood at 36% in 1Q. EBITDA was down 57% YoY/75% QoQ at INR238m (82% below estimate) and margin was down 594bp YoY and 479bp QoQ at 3% (971bp below estimate) due to low revenue recognition and high other expenses.

* Adj. PAT was up 125% YoY/down 67% QoQ at INR136m (83% miss). PAT margin stood at 1.6%, up 65bp YoY/down 170bp QoQ.

Highlights from the management commentary

* In 1QFY26, SOBHA launched Sobha Aurum in Greater Noida (0.7msf; 80% sold, INR8.3b) and the final four towers of Marina One in Kochi (0.9msf).

* FY26 launch pipeline includes 6-8msf (~INR100b GDV), with 3-3.5msf targeted in 1HFY26; 45% of this will be from NCR.

* Key 2QFY26 launches include two Bengaluru projects (~1.1msf) and a commercial development in Gurgaon.

* MMR project (Phase 1 of 0.15msf) is likely to launch in 3QFY26.

* Delay in OCs for five Bengaluru projects led to INR6.5b in revenue deferment, compressing EBITDA margin by 9%.

* Target EBITDA margin stands at 33% for the remaining INR172b in revenue to be recognized.

* Upcoming pipeline includes 17.67msf residential and 0.71msf commercial area across nine cities.

* Land outflow rose 75% YoY to INR2.8b in 1Q; operating cash flow is guided to grow 10% in FY26.

Valuation and view

* SOBHA continues to provide strong growth visibility by unlocking its vast land reserves. Additionally, the recent fundraise and strong cash flows will enable the company to focus on new land acquisitions, which will further enhance its growth pipeline.

* We have incorporated the updated launch pipeline and newly acquired projects during the year. Ongoing and upcoming projects are likely to generate ~INR124b of gross cash flows, which we value at around INR74b.

* We value SOBHA’s land reserve of 154msf at INR86b, assuming 25-75 years of monetization.

* We reiterate our BUY rating on the stock with a revised TP of INR1,935 (earlier 1,778), indicating a 20% upside potential.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412