Buy Persistent Systems Ltd for the Target Rs.6,800 by Motilal Oswal Financial Services Ltd

Steady steps toward USD2b ambition

Although keeps one eye on margins

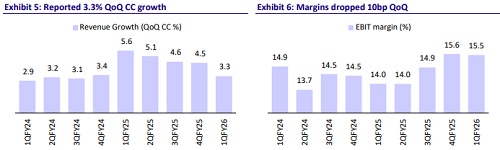

* Persistent Systems (PSYS) reported 1QFY26 revenue of USD390m (vs. est. USD392m), up 3.9% QoQ in USD terms and 3.3% in CC (est. +4.0%). EBIT margin stood at 15.5% (est. 15.8%).

* EBIT grew 3.3% QoQ/31.1% YoY to INR5.1b. Adj. PAT came in at INR4.2b (est. INR4.2b), up 7.4% QoQ/38.7% YoY. For 1QFY26, revenue/EBIT/PAT grew 21.8%/34.8%/38.7% YoY in INR terms.

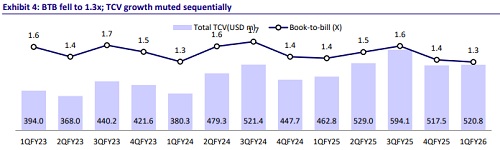

* We expect PSYS’s revenue/EBIT/PAT to grow 20.8%/35.3%/36.9% YoY in 2QFY26. TTM TCV was USD520.8m, up 1% QoQ and up 12% YoY (1.3x book-to-bill). We value PSYS at 48x FY27E EPS. Given its consistent execution and visibility on growth, we value PSYS at 48x FY27E EPS. Reiterate BUY with a TP of INR 6,800.

Our view: BFSI and Hi-Tech to sustain momentum in FY26

* Growth moderates, but FY27 target holds steady: PSYS reported 3.3% QoQ CC growth in 1QFY26, moderating from its ~4.5% recent run-rate due to client-specific delays and macro caution. That said, growth was broad-based with BFSI and Hi-Tech continuing to lead. The company reaffirmed its USD2b revenue goal by FY27, implying an 18-19% cc CAGR over FY25-27.

* BFSI & Hi-Tech continue to drive momentum: BFSI/Hi-Tech registered healthy growth of 9.0%/3.6% QoQ in USD terms. BFSI stood out this quarter with healthy traction across sub-segments and strong deal wins. PSYS expects BFSI to continue driving growth in FY26. Further, deal activity in Hi-Tech is gradually improving, with early traction in modernization and AI-led programs. We expect momentum in both to sustain through FY26.

* Pipeline remains healthy, but conversion remains key: TTM TCV stood at USD520.8m (+12% YoY) with a 1.3x book-to-bill, slightly below historical levels. While deal conversions may remain uneven in the near term, PSYS continues to pursue large deals and is sharpening its TCV-toACV conversion focus.

* Margins, however, are a risk: Headline EBIT margin contracted just 10bp QoQ to 15.5%. This included a 230bp benefit from lower ESOP costs. Adjusting for this, core margins stood at ~13.2%.

* With wage hikes deferred and ESOP costs expected to remain stable in the near term, some room exists for margin expansion through SG&A leverage. We factor in margin expansion of 80bp over FY26E (another 60bp by FY27E) despite the management reiterating its target of 200- 300bp margin expansion over the medium term.

Valuation and revisions to our estimates

* We project an 18% USD revenue CAGR over FY25-27 for PSYS, which, combined with margin expansion, could result in a ~25% EPS CAGR. This places the company in a league of its own as a diversified product engineering and IT services player.

* We largely maintain our estimates for FY26E/FY27E. Owing to its superior earnings growth trajectory, on a PEG basis, we believe the valuation still has room for upside. We value PSYS at 48x FY27E EPS. Reiterate BUY with a TP of INR6,800.

In-line revenues and miss on margins; BFSI & Hi-Tech led growth

* 1QFY26 revenue stood at USD390m (vs. est. USD392m), up 3.9% QoQ in USD terms. It reported CC growth of 3.3% QoQ vs our estimate of 4.0% QoQ CC growth.

* Growth was led by BFSI (up 9.0% QoQ) and Hi-Tech (up 3.6% QoQ) in USD terms.

* EBIT margin at 15.5% was down 10bp QoQ and below our estimate of 15.8%.

* TTM TCV stood at USD520.8m, up 1% QoQ and up 12% YoY (1.3x book-to-bill).

* Net new TCV was up 2.4% QoQ at USD337m. ACV stood at USD385.3m.

* Net headcount improved 3% QoQ. Utilization was up 60bp QoQ at 88.7%. TTM attrition was up 100bp QoQ at 13.9%.

* EBITDA grew 4.6% QoQ/34.4% YoY to INR6.1b and EBITDA margin came in at 18.3%, in line with our estimate of 18.3%.

* Adj. PAT stood at INR4.2b (up 7.4% QoQ/38.7% YoY), in line with our estimate of INR4.2b.

Key highlights from the management commentary

* The environment remains cautious, with delays in client decision-making cycles.

* The company's strategy for the next couple of years is to deepen its presence in existing verticals before expanding into new ones such as Auto—potentially through inorganic acquisitions.

* There was a secular increase in revenues across all top 100 clients. The company remains committed to achieving USD2b in revenue by FY27.

* The focus will be on delivering profitable growth without compromising margins. There may be tuck-in acquisitions (especially in Europe, which is targeted to contribute 15% of total revenues) that will be capability-led over scale.

* The deal pipeline remains healthy, and the company remains confident about the large deals in progress.

* The focus remains on improving TCV to ACV conversion.

* Wage hikes have been deferred by a quarter; historically, they occur in 2Q.

* Management expects 200-300bp margin expansion by FY27.

* HLS declined QoQ, primarily due to a planned transition of work from onsite to offshore and some client-specific issues.

* No further decline is expected in this vertical; growth is expected to resume in the remainder of the year.

Valuation and view

* We project an 18% USD revenue CAGR over FY25-27 for PSYS, which, combined with margin expansion, could result in a ~25% EPS CAGR. This places the company in a league of its own as a diversified product engineering and IT services player.

* We largely maintain our estimates for FY26E/FY27E. Owing to its superior earnings growth trajectory, on a PEG basis, we believe the valuation still has room for upside. We value PSYS at 48x FY27E EPS. Reiterate BUY with a TP of INR6,800.

.

.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412