Buy Inox Wind Ltd for the Target Rs. 190 by Motilal Oswal Financial Services Ltd

Moderate performance; stable outlook ahead

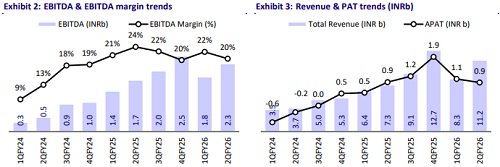

* INOX Wind’s (IWL) 2QFY26 deliveries at 202MW were in line with our estimate, whereas revenue came in below our estimate by 8% at INR11.2b (+53% YoY, +35% QoQ). EBITDA stood at INR2.3b (+32% YoY, +24% QoQ), exceeding our estimate by 4%. EBITDA margin was 20% (our est. 18%). APAT at INR0.9b missed our est. by 14%.

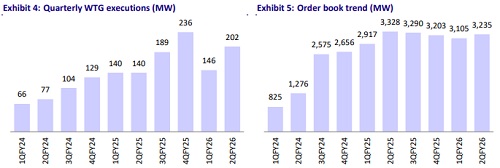

* Execution outlook and order book strength: In 1HFY26, IWL reported deliveries of 350MW and received new orders of 400MW. For FY26, we build in 1.3GW of deliveries and 1GW of total new orders. With EBITDA margin of 21% in 1HFY26, we see scope for an upgrade in our FY26/FY27 margin estimates of 18%/17%, should the company sustain this performance. The current order book stands at 3.2GW, and IWL remains a key contender for the upcoming 1.6GW NTPC tender.

* IGL’s expansion and EBITDA upside: Inox Green’s (IGL) O&M portfolio has expanded to 12.5 GW, including 6.5GW of recently acquired wind assets, which management expects to be consolidated in FY27. After consolidation, we estimate IGL to deliver EBITDA of ~INR4b assuming a realization of INR0.9m/MW for wind O&M portfolio with a 50% EBITDA margin, and 0.2m/MW for the solar O&M portfolio with a 15% EBITDA margin (FY25 EBITDA: INR0.5b).

* Valuation: We maintain a BUY rating and arrive at a TP of INR190 by applying a target P/E of 24x to FY28E EPS, which represents a 20% discount to our target multiple for SUEL.

EBITDA beats estimates; revenue misses

Financial Performance:

* Consolidated revenue grew 53% YoY/35% QoQ to INR11.2b (8% miss).

* EBITDA rose 32% YoY/24% QoQ to INR2.3b (4% beat), with EBITDA margin of 20% vs. our estimate of 18%.

* APAT was flat YoY and down 13% QoQ at INR0.9b (14% below our estimate).

Operational Performance:

* Execution stood at 202MW, in line with our estimate of 200MW.

* The WTG order book stood at 3,235MW (56% Turnkey; 44% WTG).

* IGL’s O&M portfolio expanded to ~12.5GW (10GW wind, 2.5GW solar).

Highlights of 2QFY26 performance

* IWL executed 202MW in 2Q and ~350 MW in 1H, and management remains confident of achieving the 1,200MW execution target for FY26.

* New orders of 380MW were secured in 1H from new and existing customers.

* FY26 capex guidance is ~INR2b.

* IWL is expanding its manufacturing footprint in South India through a new blade and tower facility on 70 acres allotted by KIADB with an investment of ~INR4b. The facility is expected to become operational in 2026.

* IGL’s O&M portfolio has scaled to 12.5GW (10GW wind; 2.5GW solar), including the recently acquired 6.5GW of operational wind O&M assets. After statutory approvals, these acquisitions will be consolidated into IGL’s financials in FY27

Valuation and view

* We maintain a BUY rating with a TP of INR190. We arrive at our TP of INR190 by applying a target P/E of 24x to FY28E EPS, which is at a 20% discount to our target multiple for SUEL.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412