Buy MAS Financial Services Ltd for the Target Rs. 380 by Motilal Oswal Financial Services Ltd

Resilient through cycles; positioned for steady compounding

Multi-product NBFC with risk-calibrated growth and improving operating leverage

* MAS Financial (MAS) navigated 1HFY26 with prudence amid macro moderation and sectoral stress. It maintained a strong focus on both portfolio quality and profitability. With improving economic conditions, better borrower cash flows driven by festive demand, and lower rejection rates, the business momentum and AUM growth are likely to rebound in 2H.

* The company’s diversified, multi-product model targets the credit needs of underserved low- and middle-income segments, providing a long runway for scalable growth. MAS is also building a ‘mini-NBFCs within NBFC’ structure, appointing dedicated heads and teams for each segment to enhance agility, accountability, and execution focus.

* MAS plans to maintain its MSME exposure at ~55–60%, while scaling up the Wheels business (a key focus area) and piloting new segments such as used-car financing and embedded finance. Management targets to scale up the AUM to ~INR250–300b over the next 3–4 years.

* Enhancing operational efficiency remains a key priority for MAS, with a strong emphasis on leveraging technology, optimizing talent deployment, and strengthening distribution. The company is expanding its in-house tech team and is targeting a direct retail distribution share of ~70–75%.

* MAS’s asset quality remains resilient, supported by stronger borrower profiles, lower rejection rates, and over-collateralized fintech exposures, resulting in benign credit costs and sustaining healthy RoA and RoE.

* MAS has consistently demonstrated well-calibrated operational resilience, supported by disciplined execution across business cycles. Its diversified portfolio mix, prudent risk management, and focused growth strategy continue to reinforce stability and profitability. The company also benefits from strong business fundamentals and robust corporate governance, underpinned by a stable management team and a significantly high promoter holding. With steady margins, a clearly defined growth trajectory, and sustained asset quality, MAS is well-positioned to remain a reliable long-term compounder. We estimate ~21% PAT CAGR over FY25-28, with an RoA/RoE of ~2.9%/15.5% in FY28. We reiterate our BUY rating on the stock with a TP of INR380 (based on 2x Sep’27E BV).

Focused expansion and distribution depth powering the next phase

* MAS continues to operate in a stabilizing macro environment with a riskcalibrated growth approach that prioritizes portfolio quality and profitability. While AUM growth was modest in 1HFY26 due to eligibility constraints and sectoral stress, improving borrower cash flows, festive demand, and lower rejection rates are likely to accelerate momentum in 2H.

* MAS’s multi-product, diversified model is centered on serving the credit needs of underserved low- and middle-income segments. To strengthen focus and agility, the company is establishing a ‘Micro-NBFCs within NBFC’ structure, with dedicated segment heads and teams to drive experimentation and scalable growth in each vertical.

* Management intends to maintain an MSME mix of 55–60% while scaling up the Wheels business and piloting the used-car and embedded finance segments. MAS is targeting an AUM of ~INR250–300b over the next 3–4 years, implying a ~20–25% CAGR.

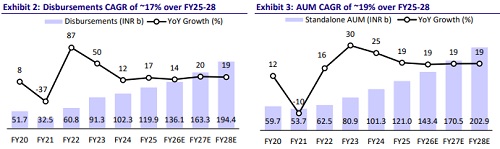

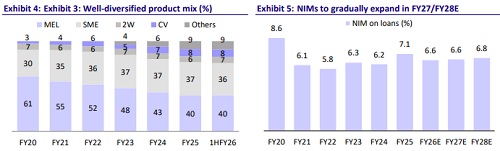

* MAS’s network of 208 branches and 15.5k customer touchpoints – supported by intermediaries and senior regional hires to strengthen presence in the North and South – continues to enhance market reach and support long-term growth. Management has articulated a long-term AUM aspiration of ~INR1t over the next decade. We model an AUM CAGR of ~19% over FY25–28E.

Strengthening the funding engine for steady and risk-calibrated growth

* MAS has maintained stable margins despite a softening rate environment owing to rising direct distribution share, growing wheels portfolio, and collateralbacked SME lending.

* The CoF is likely to improve further due to MCLR-linked borrowings and upgradation in ratings from CARE. MAS also plans to diversify its borrowing mix further by increasing the share of NCDs to ~25% and ECBs to 10%.

* A strong liquidity buffer, well-managed ALM across a 2-5 year tenure, and an optimal leverage strategy underscore MAS’ disciplined approach to risk-adjusted and long-term growth.

Tech-led efficiency and segment-focused execution boosting operating leverage

* MAS is strengthening overall efficiency through a combined focus on technology, talent, and distribution. It aims to increase direct retail distribution from ~65% to ~70–75%, supported by investments in infrastructure and staffing to deepen penetration in existing markets.

* To enhance technological capabilities, MAS is expanding its in-house tech team (currently ~100–120 employees), reducing dependence on external service providers. Management noted that full-scale deployment will follow thorough in-system validation.

* The company is also building dedicated teams for each product segment, operating as separate verticals for sharper focus and execution. MAS has guided for an opex-to-assets ratio of ~2.5%–3% and a cost-to-income ratio of ~35-38%.

Resilient asset quality; prudent risk management amid sectoral stress

* MAS continues to maintain stable asset quality, supported by disciplined underwriting and a conservative growth approach. Stress in the CV and MSME segments was primarily due to customer over-leveraging and aggressive lending by lending institutions. The company also managed its credit costs well by rationing incremental lending to segments that are vulnerable to the US tariffs.

* The loan portfolio is showing early signs of stabilization, with improved borrower quality and lower rejection rates. Fintech-sourced loans are further secured through corporate guarantees and over-collateralization, helping to contain credit costs.

Subsidiaries

MAS Rural Housing and Mortgage Finance Company (MRHMFL)

* MRHMFL continues to strengthen its presence in the rural and semi-urban regions, offering various loan products in the affordable housing segment with a strong presence across Maharashtra, Gujarat, Rajasthan, and MP.

* The housing subsidiary exhibited resilient performance with AUM growth of ~24% YoY, despite stress in the affordable housing space.

* The management will plan to list its housing finance subsidiary once the AUM in this business scales up to ~INR40-50b.

MAS Fin Insurance Broking Private Limited

* MAS Fin Insurance, a subsidiary of MAS Financial Services Limited, received IRDAI registration to operate as a Direct Insurance Broker (Life & General).

* MAS invested INR3.5m in the subsidiary, and the shareholding of the company in MAS Fin Insurance Broking stands at ~69.5%.

Valuation and view

* MAS has consistently demonstrated well-calibrated operational resilience, supported by disciplined execution across business cycles. Its diversified portfolio mix, prudent risk management, and focused growth strategy continue to underpin stability and profitability. The company effectively leverages its strengths on both the business and governance fronts, backed by a stable management team and a significantly high promoter holding. With steady margins, a clearly defined growth trajectory, and sustained asset quality, MAS is well-positioned to remain a steady long-term compounder.

* We model a FY25–28E CAGR of 19% in standalone AUM and 21% in PAT, with RoA/RoE expected at 2.9%/15.5% by FY28E. Earnings quality remains strong, supported by risk-calibrated AUM growth despite stress in the MSME ecosystem. We reiterate our BUY rating on the stock with a TP of INR380 (based on 2x Sep’27E BV). Key risk: a macroeconomic slowdown that could weaken loan growth and asset quality.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412