Buy Emami Ltd For Target Rs.750 by Motilal Oswal Financial Services Ltd

In-line performance; winter portfolio performs well

* Emami reported consolidated sales growth of 5% YoY in 3QFY25 (est. 6%). The core domestic business (excl. D2C portfolio) grew 9% YoY, led by volume growth of 6%. While overall domestic value/volume growth was 7%/4%. Demand was healthy in rural markets (~55% revenue), while demand softness continued in urban markets.

* Winter portfolio saw healthy demand despite delayed and mild winters. Boroplus delivered 20% YoY growth, led by strong demand for its core portfolio, led by rural markets and enhanced trade schemes. Healthcare segment maintained double-digit revenue growth of 13% YoY, led by new launches and strong traction on the digital platform. Navratna, Dermicool and pain management each reported 3% growth. Kesh King and male grooming dipped 10% and 4% YoY, respectively. D2C portfolio declined 13% owing to a sharp increase in competitive pressure due to discounting.

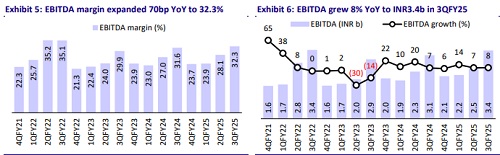

* GM trajectory remained healthy, with 150bp YoY expansion to 70.3% (est. 69.5), driven by a price hike (1.5-2.5%) and cost-control initiatives. EBITDA margin expanded by 70bp YoY to 32.3% (12-quarter high). The organized channel grew 13% YoY in 3Q with revenue contribution of 28.6% (+160bp), while general trade saw a slowdown.

* With improving rural recovery and Emami’s own initiatives related to distribution, new launches, and marketing spends, it is expected to sustain revenue growth. We reiterate our BUY rating on the stock with a TP of INR750 (premised on 35x Dec’26E EPS).

In-line performance; sustaining margin expansion

* Healthy growth in core business: Consolidated net sales grew by 5% YoY to INR10,495m (est. INR10,530m). Core domestic business (excl. D2C portfolio) grew by 9% YoY, with volume growth of 6%. Overall domestic business delivered value/volume growth of 7%/4%. (est. 5%, 1.7% in 2Q). International business revenue declined 3% YoY (-2% in cc terms).

* GM expansion continues: Gross margin expanded by 150bp YoY to 70.3%. (est. 69.5%). Absolute ad spends increased by 6% YoY to INR1,757m. As a % of sales, ad spends rose 10bp YoY to 17%, employee expenses increased by 50bp YoY to 11%, and other expenses grew 30bp YoY to 11% in 3Q. EBITDA margin expanded by 70bp YoY to 32.3% (est. 31.9%), 12-quarter high.

* High-single-digit growth in profitability: EBITDA grew 8% YoY to INR3,387m (est. INR3,357m). PBT grew 10% YoY to INR3,059m (est. INR3,019m). APAT rose 6% YoY to INR3,006m (est. INR3,046m).

* In 9MFY25, net sales/EBITDA/APAT increased by 6%/9%/13%.

Highlights from the management commentary

* Urban demand is facing headwinds, primarily due to rising food inflation and liquidity constraints in retail and wholesale trade channels. Rural demand exhibited resilience, driven by favorable monsoon conditions and a strong harvest.

* Emami focuses on small packs catering to middle-income consumers (~20% revenue contribution). Rural salience in the domestic business stands at 53- 54%, with organized channels contributing 28-29% and urban GT contributing 16-18%.

* In The Man Company portfolio, Emami is strategically calibrating discounts to ensure sustainable long-term growth, despite a temporary impact on revenue. It also plans to invest judiciously in branding initiatives to achieve sustainable and profitable growth over the next two quarters.

* The international business witnessed a decline, primarily due to lower growth in Russia and Ukraine. However, performance was stable in Bangladesh and other markets.

Valuation and view

* We broadly maintain our FY25/FY26 EPS estimates.

* Emami’s core categories are niche, and they have been witnessing slow user addition over the last five years. Although it commands a high market share in core categories, the share gain is no longer a catalyst for volume growth.

* The management has initiated several steps (e.g., team additions, new launches, hiring consultants, marketing spending, etc.) over the last two to three years to revive volume growth.

* Emami is currently trading at 33x FY26E and 30x FY27E EPS. We reiterate our BUY rating with a TP of INR750, based on 35x Dec’26E EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412