Buy Emami Ltd for the Target Rs. 750 by Motilal Oswal Financial Services Ltd

Steady performance; forays into brightening cream

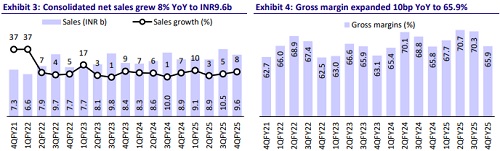

* Emami reported consolidated sales growth of 8% YoY in 4QFY25 (est. 7%). The core domestic business (ex-D2C portfolio) grew 11% YoY, led by volume growth of 7% YoY. The overall domestic value/volume growth was 9%/5%. Demand trends continued to mirror 3QFY25, and rural markets continued to outperform urban demand. The organized channel rose 13% YoY in FY25, with a revenue contribution of 27.6% (+140bp).

* Boroplus delivered 27% YoY growth, backed by strong demand for its core portfolio given extended winters. The Navratna & Dermicool range grew 16% YoY. The healthcare segment maintained double-digit revenue growth at 13% YoY, led by new launches and strong traction on the digital platform. Male grooming rose 7% YoY, while Pain management reported 1% YoY growth. Kesh King dipped 1% YoY. The D2C portfolio remained impacted by management transition and change in leadership.

* In 4QFY25, Emami forayed into the INR40b brightening cream category with the launch of ‘Emami Pure Glow’. It is currently available in select markets across South, West, and North India and will be scaled up gradually.

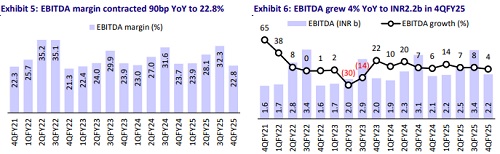

* GM trajectory remained healthy, with a 10bp YoY expansion to 65.9%. (est. 66.5%). EBITDA margin, however, contracted 90bp YoY to 22.8%. The company expects a 2-3% price hike in FY26.

* With a gradual recovery in demand and Emami's efforts to expand distribution reach, continued new product launches, and marketing initiatives, the company is likely to sustain revenue growth. Given benign RM costs and operational efficiencies, we expect its margins to remain at current levels. We reiterate our BUY rating on the stock with a TP of INR750 (premised on 30x FY27E EPS).

In-line performance; volume growth at 5% YoY

* Healthy growth in core business: Consolidated net sales grew 8% YoY to INR9,631m (est. INR9,529m). The overall domestic business rose 9% YoY with a volume growth of 5% YoY (est. 4% YoY, 4% in 3QFY25), and the core domestic business increased 11% YoY with a volume growth of 7%. International business revenue grew 6% YoY (+5% in cc terms).

* GM stable: Gross margin expanded by 10bp YoY to 65.9%. (est. 66.5%). Absolute ad spending increased 5% YoY to INR1,889m. As a % of sales, ad spending was down 60bp YoY to 19.6%, employee expenses increased 130bp YoY to 11.5%, and other expenses rose 30bp YoY to 12% in 4QFY25. EBITDA margin contracted 90bp YoY to 22.8% (est. 23.5%).

* High-single-digit growth in profitability: EBITDA grew 4% YoY to INR2,194m (est. INR2,236m). PBT grew 14% YoY to INR1,943m (est. INR1,880m). APAT grew by 9% YoY to INR1,812m (est. INR1,757m).

* In FY25, Emami’s net sales/EBITDA/APAT increased 7%/8%/12% YoY.

Highlights from the management commentary

* While rural markets continued to perform well, mass urban demand remained subdued. Emami expects a gradual pick-up in consumption.

* For 1QFY26, summer has been slightly impacted by the sudden rainfalls; the southern and eastern regions are more impacted for Emami. Particularly, the talc powder offtake was hit in Apr’25.

* Kesh King's grammage was increased from 5.5ml to 6ml, to be at par with the competition.

* The Man Company’s sales stood at INR1,500m, while Brillare’s sales came in at INR500m in FY25. Management expects strong double-digit sales growth from these businesses in FY26. Recently, Mr. Zairus Master joined as the COO of The Man Company.

* Management expects 2-3% price hikes in FY26.

* NPDs contributed ~3-4% to sales in the last 2-3 years, and Emami expects it to be in the similar range going forward.

Valuation and view

* We broadly maintain our FY25/FY26 EPS estimates.

* Emami’s core categories are niche, and they have been witnessing slow user addition over the last five years. Although it commands a high market share in core categories, the share gain is no longer a catalyst for volume growth.

* The management has initiated several steps (e.g., team additions, new launches, hiring consultants, marketing spending, etc.) over the last two to three years to revive volume growth.

* Emami is currently trading at 29x FY26E and 27x FY27E EPS. We reiterate our BUY rating with a TP of INR750, based on 30x FY27E EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412