Buy Emami Ltd For Target Rs. 750 By Emkay Global Financial Services Ltd

Weak season ahead, though outlook firm on better execution

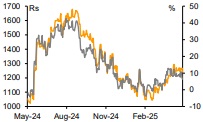

We maintain BUY with Mar-26E TP of Rs750, on 35x P/E. The company has taken corrective action in 20% of the portfolio, which has been a drag on growth. With enhanced professional capability, we see the company delivering double-digit growth, though the past dullness makes us conservative on the business, which we see delivering only a high single-digit growth. Given the elevated seasonal concentration in revenue, the weak summer is likely to have a bearing on Q1FY26; we see only 4% revenue growth, though the outlook for the rest of the year is robust, on enhanced execution. The Man Company under new Chief Operating Officer Zairus Master is aiming for high double-digit growth. On margin, we do not expect any major headwinds and see a moderate increase ahead which is likely to aid 9% earnings CAGR over FY25-28E.

Emami’s Q4FY25 results in-line

Consol revenue grew 8%, with 9% growth in the domestic business (volume growth at 5%). Adjusted for digital brands, domestic business growth was 11% with 7% volume growth. Given the early onset of summers, the Navratna and Dermicool range saw 16% growth, likely to moderate in Q1FY26 amid a weak season in South India and a high sales base. Boroplus saw a healthy 27% revenue growth, with the momentum sustaining in Q1FY26-TD. Healthcare growth was maintained at 13%, given i) 50% growth in the D2C portfolio (aided by NPD and marketing initiatives), ii) double-digit growth seen in OTC offerings like Nityam and cough syrup, and iii) better growth in the medico business. Pain management saw 1% growth, affected by the muted show by Zandu balm, while Ultra power and Mentho plus did well. International revenue (20% of consol revenue), grew 5%, with improved momentum across countries except select territories in Africa.

Actions in place for addressing issues

20% of Emami’s domestic business is concentrated in Kesh King, Smart and Handsome, and digital brands, where it is seeing pressure related to category and execution. In Q4, this portfolio saw flat YoY sales, with 7% growth in Smart and Handsome. In Q4FY25, the company relaunched product offerings under the Smart and Handsome brand. Under this new brand identity, the company is looking to enter segments beyond face cream or face wash. For Kesh King, the company has plans to immediately implement consultant BCG’s recommendations. Amid digital brands, the company has roped in Zairus Master as COO of The Man Company (TMC). For both, TMC and Brillare, the company expects strong double-digit growth in FY26. Going ahead, if Emami is successful in pulling the portfolio on to the growth path, it will see acceleration in revenue growth, in our view.

Capability build-up heartening, should enhance execution; maintain BUY

Emami continually enhances execution, supported by addition of professionals in its team. With demand rebound in rural, its enhanced thrust on the urban-relevant portfolio, and supportive seasonality, the company is poised for better growth ahead.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354