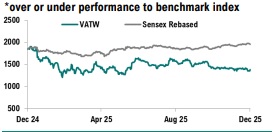

Buy VA Tech Wabag Ltd For Target Rs. 1,877 By Geojit Financial Services Ltd

Strong Executions Drive Topline Growth...

VA Tech Wabag (VATW), is a Chennai-based multinational company specialising in water technology. With its expertise in the turnkey execution and operation of water and wastewater treatment plants, the company primarily serves both municipal and industrial sectors, focusing on providing comprehensive solutions for water-related challenges.

* H1FY26 consolidated revenue increased 18.2%YoY to Rs.1,569cr, driven by strong growth in EPC municipal projects (+45%) and a sharp uptick in O&M industrial activity (+93%), though partially weighed down by softer performance in the EPC industrial segment.

* H1FY26 EBITDA grew 5.7%YoY, although Q2FY26 EBITDA declined 4.6% YoY to Rs.89.3cr, impacted by a higher EPC contribution, which pushed cost of sales up by 23.2% YoY.

* Other income surged 201.4% YoY in Q2FY26, taking H1FY26 other income up 115% YoY, primarily driven by forex gains. Q2FY26 PAT rose 20.6% YoY to Rs.85cr, bringing H1FY26 PAT to Rs.151cr, up 20.4% YoY.

* The company reported a net cash position (ex-HAM) of Rs.675cr, extending its streak to 11 consecutive quarters in positive net cash. Net working capital days came in at 121, highlighting sustained operational discipline and efficiency.

* The order book (ex-framework contracts) rose 10.1% YoY to Rs.14,764cr, ensuring nearly 4x revenue visibility. Management maintained its medium-term guidance of 15–20% revenue CAGR and 13–15% EBITDA margins.

Outlook & Valuation

Wabag reported stronger-than-expected order inflows in H1, supported by healthy execution. We project revenue to grow at a 17% CAGR over FY25–27E, driven by sustained execution of its large order book. However, a higher proportion of construction contracts in the recent mix is likely to weigh on margins, prompting us to reduce our EBITDA margin estimates by 52bps/55bps for FY26E/27E. Even so, EBITDA is expected to grow at a 21% CAGR and PAT at 26% CAGR, improving ROE from 14.9% to 17.4%. We value the stock at 25x FY27E EPS of Rs.75.1, arriving at a target price of Rs.1,877, and maintain our BUY rating.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345