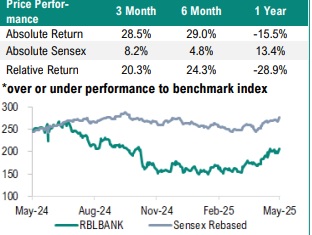

Accumulate RBL Bank Ltd for Target Rs. 240 by Geojit Financial Services Ltd

Weak revenue, stable operating metrics

RBL Bank Ltd. is a private sector bank, with 561 branches and 1.6cr+ customers as of Q4FY25. It provides corporate, institutional, commercial, retail and agricultural development banking, as well as financial market access.

• In Q4FY25, interest income increased 4.1% YoY to Rs. 3,476cr, driven by robust growth in secured retail (+43% YoY) and wholesale loan (+6% YoY) segments.

• Interest expense rose 10.0% YoY to Rs. 1,913cr in Q4FY25, led by higher cost of deposits (6.5%) and cost of funds (6.6%). Consequently, net interest income declined 2.3% YoY to Rs. 1,563cr and net interest margin (NIM) moderated to 4.89% compared to 4.90% in Q3FY25 and 5.45% in Q4FY24.

• Other income increased 14.2% YoY to Rs. 1,000cr in Q4FY25, driven by strong growth across core fee categories such as FX, processing fees, general banking, distribution, payment-related services, trade and others.

• The pre-provision operating profit decreased 2.9% YoY to Rs. 861cr, due to increase in operating expenses by 7.2%

• PAT declined 80.5% YoY to Rs. 69cr, due to full provisioning on JLG (Joint Liability Group), higher credit cost, lower NII and increased operating expenses.

Outlook & Valuation

The bank delivered resilient performance in the quarter, sustaining momentum across key business segments while maintaining its branch network and strengthening customer engagement. Continued focus on improving deposit granularity, expanding retail assets and optimising operational efficiency is expected to support balanced growth. While business fundamentals are improving, near-term margin pressures and a cautious approach in unsecured segments may limit the upside. However, strategic investments in digital initiatives and risk management are expected to enhance long-term competitiveness. Therefore, we upgraded our rating from SELL to ACCUMULATE on the stock, based on 0.8x FY27E book value per share, with a revised target price of Rs. 240

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345