Buy Ashok Leyland Ltd for the Target Rs. 275 by Motilal Oswal Financial Services Ltd

Margin beat aided by improved mix

Net cash position to help invest in future growth avenues

* Ashok Leyland’s 4Q PAT at INR12.5b came in ahead of our estimate of INR10.8b, aided by better-than-expected operational performance (EBITDA margin at 15% ahead of our estimate of 14.2%) and higher other income.

* Over the years, AL has done well to reduce its business cyclicality by focusing on non-MHCV segments. Further, a net cash position would help AL invest in growth avenues in the coming years. Its focus on improving margins should bode well for returns in the long run. We reiterate our BUY rating with a TP of INR275 (based on 11x FY27E EV/EBITDA + ~INR19/sh for the NBFC).

Earnings beat driven by improved mix and higher other income

* 4Q PAT at INR12.5b came in ahead of our estimate of INR10.8b, aided by better-than-expected operational performance and higher other income.

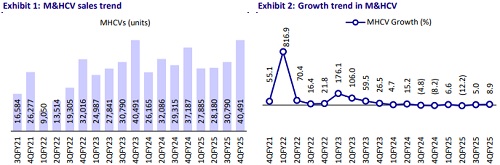

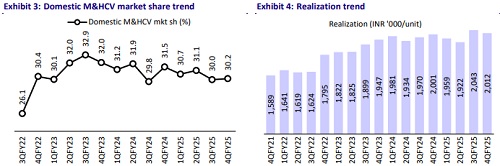

* Revenue grew 6% YoY to INR119b and was in line with our estimate. Revenue growth was driven by 5% YoY growth in volumes and 0.6% growth in blended ASP.

* Non-CV business continues to do well. In 4Q, engine volumes grew 9% YoY and spare part revenue rose 15% YoY.

* EBITDA margin improved 90bp YoY to 15%, ahead of our estimate of 14.2%. Margin surprise was led by improved gross margin which was in turn a function of better mix.

* Other income was much higher at INR1.1b – ahead of our estimate of INR367m.

* Adjusted for one-offs, PAT grew 32% YoY to INR12.5b.

* For FY25, revenue grew 1% YoY to INR387b, largely led by ASP growth.

* For FY25, engine volumes rose 2% YoY over a high base of last year (which was led by pre-buy) and spare part revenue grew 14% YoY. Defense revenue remained flat YoY in FY25.

* EBITDA margin improved 70bp YoY to 12.7%.

* Adjusted for one-offs, PAT grew 20% YoY to INR32.2b.

* The board has declared a dividend of INR6.25 per share in FY25, up from INR5 per share in FY24. This translates into a dividend payout ratio of 57%.

* FY25 FCF stood at INR69b post capex of INR9.2b, led by improved operational performance and sharp reduction in working capital.

Highlights from the management commentary

* Management expects each of the CV segments to post growth in FY26, led by favorable indicators. Among segments, management expects bus, tractor, trailer and tipper to drive industry growth in FY26E.

* Management has indicated that they have reduced dependence on MHCVs over the last few years. The non-MHCV business now contributes to about 50% of AL’s revenues with much better profitability; hence, cyclicality in business revenue and on profitability has reduced over the years.

* It expects defense revenue (currently at around INR10b) to double over the next 2-3 years, based on the healthy order backlog.

* Management has indicated that it expects steel prices to inch up from 1Q onward (by INR3-5 per kg) and further in 2Q due to the safeguard duty imposed on steel. Steel cost pressure is likely to normalize from 2H onward. Further, truck prices are likely to increase by about 0.5-2% due to the AC cabin norms to be implemented from Jun’25 onward. AL would take a measured approach to pass on the impact of rising costs, based on a competitive environment.

* Management maintains its medium-term targets, which include achieving a 35% market share in MHCVs and mid-teens margins among others.

* Management indicated that it is in a substantially strong position relative to past CV cycles today. It now has a net cash of INR9.5b vs. net debt of INR2b in FY24. Hence, its ability to invest in growth opportunities is much higher. It targets to invest around INR10b in capex in FY6 and another INR5-7.5b in its subsidiaries.

Valuation and view

* We expect CV demand to recover in FY26, driven by favorable factors highlighted above. Over the years, AL has done well to reduce its business cyclicality by focusing on non-MHCV segments. Further, a net cash position would help AL invest in growth avenues in the coming years. Its focus on improving margins should bode well for returns in the long run. We reiterate our BUY rating with a TP of INR275 (based on 11x FY27E EV/EBITDA + ~INR19/sh for the NBFC).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)