Neutral Mahindra Logistics Ltd For Target Rs. 300 by Motilal Oswal Financial Services Ltd

In-line operational performance; express business continues to struggle

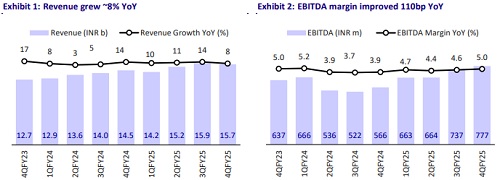

* Mahindra Logistics (MLL)’s revenue grew ~8% YoY to INR15.7b in 4QFY25, in line with our estimate.

* EBITDA margin came in at 5% (+110bp YoY and +30bp QoQ) vs. our estimate of 4.7%. EBITDA rose ~37% YoY to INR777m (in line).

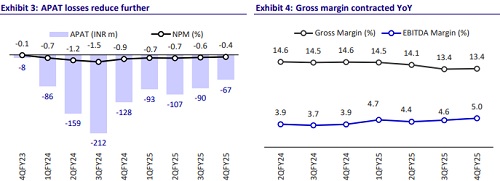

* Adjusted net loss narrowed to INR68m in 4QFY25 from INR128m in 4QFY24 (our estimate of INR29m profit).

* During FY25, revenue stood at INR61b (+11% YoY), EBITDA stood at INR2.8b (+24% YoY), EBITDA margin came in at 4.7%, and adj. loss stood at INR359m (vs. loss of INR586m in FY24).

* Supply Chain management recorded revenue of INR14.9b (+8.6% YoY) and EBIT loss of INR4m. Enterprise Mobility Services (EMS) reported revenue of INR800m (+2% YoY) and EBIT of INR13.3m.

* Mr. Rampraveen Swaminathan, MD and CEO, has resigned. The company has appointed Mr. Hemant Sikka as MD & CEO (Designate) from 22nd Apr’25 to 4th May’25 (both days inclusive).

* MLL saw modest revenue growth in 4QFY25 as strong performance in 3PL and outbound logistics was partially offset by challenges in express logistics. While B2B express and mobility segments are facing challenges, the company remains focused on cost control, retail volume growth, and new service offerings. The company expects express business losses to reduce in the coming quarters as volumes pick up. We largely retain our EBITDA estimates for FY26 and FY27, in line with modest operating performance. We estimate a CAGR of 24%/37% in revenue/EBITDA over FY25-27. Reiterate Neutral with a revised TP of INR300 (premised on 11x FY27 EPS).

Order intake remains strong; volumes pick up in B2B express business, though challenges persist

* MLL reported a stable performance in 4QFY25, with 8% YoY revenue growth, led by its contract logistics segment and improving momentum in express logistics volumes.

* While challenges persist in segments like B2B express and mobility services due to pricing pressure and client churn, MLL’s ongoing efforts in account expansion, warehousing footprint growth, and operational efficiency are aimed at long-term value creation.

* MLL continues to benefit from sectoral tailwinds in automotive, rural demand, and consumer durables, alongside encouraging signs of recovery in B2B and real estate-linked logistics.

* MLL is targeting revenue growth in mid-to-high teens and RoE of 18% by FY26.

Highlights from the management commentary

* MLL reported 8% YoY revenue growth in 4Q and 11% in FY25, driven by robust performance in 3PL contract logistics, new service offerings, and strategic account additions.

* Contract logistics grew 9% YoY, cross-border logistics rose 20% YoY, and lastmile delivery saw a 10% YoY rise. While B2B express revenue fell 4% YoY, volumes recovered QoQ. Warehousing grew 15% YoY with major expansions underway.

* Automotive demand, especially in EVs and tractors, remained strong. Consumer and B2B sectors showed early signs of recovery despite price hikes. Service levels stayed consistently above 90%.

Valuation and view

* The Express business continues to struggle due to lower volumes across the industry and high competition. MLL is targeting to add customers and volumes, which should help to reduce loses. Considering the current demand scenario, we believe the journey toward profitability would be gradual in the express business. The performance of this business would remain a key monitorable going forward.

* We largely retain our EBITDA estimates for FY26 and FY27. We estimate a CAGR of 24% in revenue and 37% in EBITDA over FY25-27. We reiterate our Neutral rating with a revised TP of INR300 (premised on 11x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Buy Zen Technologies Ltd For Target Rs.1,600 by Motilal Oswal Financial Services Ltd

.jpg)