Buy Delhivery Ltd for the Target Rs.480 by Motilal Oswal Financial Services Ltd

Built to scale, wired for speed!

Well-positioned to capitalize on the ‘Express’ opportunity

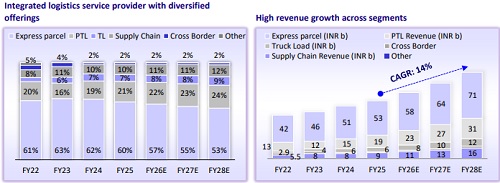

* Delhivery is India’s leading 3PL logistics player, catering to a wide network of ~19,000 pincodes. Its service offerings include express parcels, part truck load (PTL), supply chain services, and others. Delhivery, which commenced operations in 2011 as an express logistics player, has rapidly increased its presence in the PTL segment after the acquisition of Spoton Logistics in 2021. The company is India’s premier logistics operator at present, with a market share of >20% in the express logistics space. With robust industry tailwinds and Delhivery’s strong infrastructure in place, it is well placed to capitalize on the opportunity

* During FY19-25, Delhivery reported a 32% revenue CAGR, driven by the express parcel and PTL segments. During this period, the company turned EBITDA positive, reporting EBITDA of INR3.7b in FY25 (vs. an operating loss of INR16b in FY19). The turnaround was driven by economies of scale in the express parcel business and stabilization of the PTL business post-acquisition of Spoton. We expect Delhivery to strengthen its market dominance and achieve a 14% revenue CAGR, driven by 18% revenue CAGR in PTL and 10% CAGR in the express parcel business. Strong revenue growth, coupled with improved cost structure, is expected to drive an EBITDA/APAT CAGR of 36/52% over FY25-28. With improved earnings, we expect RoE to improve to 5.6% in FY28 from 1.8% in FY25. With a strong B/S and negligible debt, Delhivery would comfortably be able to fund its capex requirements over the next few years.

* We initiate coverage on Delhivery with a BUY rating. We value the company using DCF, arriving at a TP of INR480 based on a WACC of 12% and terminal growth rate of 5% (implied EV/EBITDA of 36x on FY28). We believe Delhivery’s focus on strategic acquisitions and providing integrated solutions will further strengthen its growth prospects.

Strong track record in the express business; focus on asset-light operations

* Since 2011, Delhivery has garnered a sizeable share of the express logistics market and has grown exponentially. The company initially focused on the express parcel business – the fastest-growing segment in the logistics industry – to capture growth. Now it is aiming to grow materially in the high-margin PTL express market, which will lead to a strong balance of growth and profitability

* Additionally, Delhivery focuses on an asset-light business model, as it owns a negligible vehicle fleet, and the infrastructure spaces (delivery & sorting centers/warehousing space) are mainly leased. Overtime Company has built an enviable network catering to a massive ~19,000 pin codes across India.

Key beneficiary of the fast-growing express logistics market

* With the increasing penetration of express services in Tier 2 and 3 cities, the express logistics market is expected to clock a 14% CAGR during FY23-28.

* Delhivery is expected to be a key beneficiary driven by 1) a growing user base, 2) the launching of new categories, and 3) the scaling up of new e-commerce opportunities (D2C, social commerce, and omnichannel). The company’s market share in the e-commerce express segment doubled to ~25% in FY24 (excluding captive, the share was at ~40%) from ~12% in FY19.

Established 3PL player with an enviable network and infrastructure setup

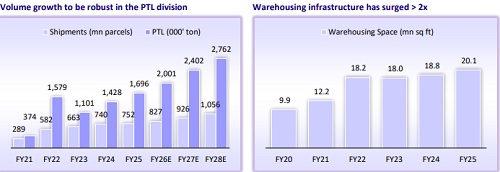

* Delhivery has gradually evolved to become a premier 3PL service provider, which has allowed it to gain market share and consistently outgrow its peers. In addition, the company has built massive physical infrastructure, which is very difficult to replicate. Delhivery today caters to ~19,000 pin codes, serving 44,000 customers. It has 111 gateways, 45 automated sort centers, and 20m sq ft of infrastructure space, which allows it to seamlessly handle a large volume of parcels and deliver on time.

* Delhivery plans to continue investing in expanding and enhancing its infrastructure network, which would help in fostering higher throughput.

Expect 14% revenue CAGR over FY25–28; express and PTL to drive growth

* Delhivery has been on a robust growth path with 32% revenue CAGR over FY19- 25, driven by the express parcel business and robust growth in PTL. Going forward, we expect revenue to clock a 14% CAGR over FY25-28, fueled by 1) healthy growth in the PTL industry (18% revenue and volume CAGR over FY25- 28), 2) operating scale and effects of a larger network with the integration of Delhivery-Spoton, and 3) scaling up of integrated solutions as ~60% of revenue is from customers using two or more services.

* We also believe the e-commerce market in India will continue to grow steadily with rising penetration in tier 2 and 3 cities. Moreover, the growing demand for express logistics will lead some businesses from the traditional transport segment to transition towards express. While express parcel services are likely to generate a majority of the revenue, we anticipate steady traction in the PTL business. Delhivery recently acquired Ecom Express to strengthen its presence in the express logistics segment.

EBITDA margin set to expand with higher volumes across segments

* In the express parcel business, Delhivery would benefit further from economies of scale, and the cost per unit is expected to reduce with enhanced volumes, leading to better margins in the coming years. Further, Delhivery is targeting strong growth in its PTL business share post-acquisition of Spoton.

* The PTL business is a high-margin segment with a sticky customer base, and as business stabilizes and volumes ramp up, we expect margins to improve further. We estimate Delhivery to achieve a 7% EBITDA margin by FY28 from 4.2% in FY25.

Well-primed to capitalize on the growth opportunity; Initiate with a BUY

* Delhivery clocked a 32% revenue CAGR during FY19-25, primarily fueled by the express parcel business. During this period, Delhivery turned EBITDA positive, reporting EBITDA of INR3.7b in FY25 (EBITDA loss of INR16b in FY29). Going forward, we estimate the company to post a 14% revenue CAGR over FY25-28. Increasing contribution from the PTL express segment to support growth. We anticipate EBITDA margins to improve from 4.2% in FY25 to 7% in FY28, supported by a better cost structure in express and improved margins in the PTL business. We expect EBITDA/APAT CAGR of 36/52% over FY25-28.

* With improved earnings, we expect its RoE to improve to 5.6% in FY28 from 1.8% in FY25. Considering the strong focus on volume growth, cost reduction, enhanced service offerings, and tight B/S control, we believe Delhivery is very well placed to capitalize on the growth opportunity unfolding in the express logistics sector. We initiate coverage on Delhivery with a BUY recommendation.We value the company using DCF, arriving at our TP of INR480, based on a WACC of 12% and a terminal growth rate of 5% (implied EV/EBITDA of 36x on FY28).

*Key risks: Slower growth in the e-commerce segment and slower-thanexpected penetration in the B2B express market.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)