Buy Dixon Technology Ltd for the Target Rs.22,100 by Motilal Oswal Financial Services Ltd

Spreading wings

Dixon’s 1QFY26 revenue/EBITDA/PAT came in ahead of our estimates, with the mobile segment registering a strong growth of 125% YoY. Ismartu integration, improved volumes from existing clients and higher exports led to a YoY jump in mobile volumes during the quarter. The company is following a two-pronged strategy for growth: 1) deepening relationships with existing clients via JVs for enhanced volumes for the long term, and 2) focusing on tie-ups and partnerships with players across components for backward integration. This strategy will provide revenue visibility and improve margin in the coming years. A display facility with HKC, a camera module with Qtech and precision components with Chongqing Yuhai Precision Manufacturing will help Dixon address a larger portion of BoM of smartphone, which should improve margins and customer stickiness for Dixon in the long run. Along with this, a JV with Longcheer and Vivo will add incremental volumes on a sustainable basis for the company. We raise our FY27 estimates by 10% to factor in higher mobile volumes and maintain BUY with a revised PT of INR22,100, based on DCF.

Beat across all parameters

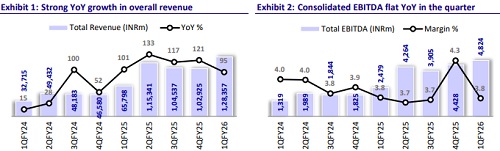

Consolidated revenue grew 95% YoY to INR128.4b (7% beat). Absolute EBITDA rose 95% YoY to INR4.8b (8% beat), while margins were flat YoY at 3.8% (vs. our estimate of 3.7%). Adj. PAT increased 68% YoY to INR2.3b, broadly in line (+4%) with our estimate of INR2.2b. The benefit of lower-than-expected interest cost was more than offset by higher depreciation and lower other income. Among the segments, the mobile and EMS segment registered 125% YoY growth. The consumer electronics segment’s performance was driven by a sharp ramp-up in refrigerators, while LED TV remained weak. Lighting products revenue declined 17% YoY, while home appliances revenue inched up only 3% YoY.

Recent tie-ups reinforce the strategy of backward integration

Since the beginning of FY26, Dixon has announced several JVs and partnerships to enhance the scope of backward integration. These include 1) JV with Taiwanbased Inventec named Dixon IT Devices Pvt Ltd to be owned 60% by Dixon and 40% by Inventec for the manufacturing of notebook PC products, servers, desktops and PC components in India, along with access to Inventec’s global list of customers; 2) JV agreement with Signify to form a JV company for OEM business of lighting products and corresponding transfer of lighting business of Dixon to the JV company; 3) Agreement with Eureka Forbes for assembly, manufacturing and supply of robotic vacuum cleaners; 4) a binding term sheet with Qtech India and its shareholders for acquiring a 51% stake in Qtech India for a collaboration in manufacturing and distribution of camera and fingerprint modules, IoT and automotive applications; and 5)a binding term sheet with Chongqing Yuhai Precision Manufacturing Co. Ltd. to form a prospective 74:26 JV in India to carry on the business of manufacturing and supply of precision components for laptop, mobile phones, IoT, automotive and any other products, subject to government approvals. With these transactions, Dixon will be able to address a larger BoM across components.

Mobile segment continues to outperform

Mobile volumes for Dixon stood at 9.7m units during 1QFY26 and are expected to grow to 10m-11m in 2QFY26. The company is witnessing improved volume traction from existing clients and is targeting volumes of 42-43m smartphones during the year. During the quarter, Dixon also entered into a contract manufacturing agreement with NxtCell India to manufacture smartphones for the French tech brand Alcatel in the Indian market. Dixon has a capacity of 60m smartphones and has an addressable market of 100m smartphones (excluding Apple, Samsung and inhouse volumes of One plus, Oppo and Vivo). Once the approval for Vivo also comes in, the company would scale up its capacity to 80m smartphones. As a result, the scale-up in mobile volumes is expected to be around 60m in FY27. Additional upside to volumes will come from Longcheer JV, which is currently being explored. Longcheer has a large customer base with 25m smartphones in India, and Dixon can potentially benefit from those volumes in a post-PLI scenario. Hence, it is present with almost all the mobile OEMs, except Apple. We expect Dixon to continuously work toward increasing its wallet share with existing clients and improve customer stickiness with backward integration for sustainable volume growth in future too even when mobile PLI gets over.

Targeting increased export volumes

The company recorded export volumes of 1.5m phones for Motorola during FY25 and expects to scale up this number to 8-9m smartphones in FY26. It expects export revenue of nearly INR70b in FY26.

Display facility to become operational in 4QFY26

Dixon’s display facility with HKC is expected to commence trial production from 1QFY27. Gradually, the company will target increased volumes for in-house customers from this facility on account of duty arbitrage on components as well as component PLI. With improved acceptance of customers, we expect the display facility to more than offset the decline in mobile segment margins after PLI incentives end. From the display facility capacity, the company expects healthy double-digit margin. Along with this, Q-tech India already supplies camera modules to large mobile players and hence can subsequently add to overall margins once the transaction is completed. In future, precision components will also drive margin improvement.

Other non-mobile segments performance

In 1QFY26, Consumer Electronics revenue declined 21% YoY to INR6.7b, primarily due to a drop in LED TV volumes, although this was partially offset by strong performance in the refrigerator business, which more than doubled to INR3.3b (+129% YoY). Despite the revenue drop, the segment's EBITDA grew 38% YoY to INR400m, aided by an improved product mix, a higher share of refrigerator, and a higher contribution from ODM sales, leading to a 260bp margin expansion to 6.0%. Home Appliances maintained stable performance with a 3% YoY revenue increase to INR3.13b, driven by steady washing machine demand and new product launches. EBITDA rose 13% YoY to INR360m, with margins improved 90bp to 11.5%, supported by operating leverage. On the other hand, the Lighting segment saw a 17% YoY decline in revenue to INR1.9b, as pricing pressures and commoditization impacted demand. This resulted in a 27% YoY fall in EBITDA to INR110m and 80bp contraction in margins to 6.0%.

Planned capex focusing on organic and inorganic growth

Dixon is executing a focused capex strategy of INR11.5b-12b in FY26 to support expansion across key segments. Around INR7.5b-8.0b is allocated to component manufacturing, including the Q Tech JV for camera modules and the HKC JV for display modules, and the balance INR3b-4b would be for capacity expansion, among other things. A 1m sq. ft. mobile plant in Noida is under construction for anchor clients like Vivo, while the display facility will produce 2m mobile and 2m laptop displays monthly, with future expansion planned. In IT hardware, production for HP, Asus, and Lenovo is underway, and the Inventec JV, starting in 4QFY26, is expected to generate INR20b in revenue over two years. With capex funded through internal cash flows and government schemes, Dixon is well-positioned to scale up operations and deepen integration across its value chain.

Financial outlook

We revise our estimates to factor in higher mobile volumes and increased capex, and expect a CAGR of 33%/36%/45% in revenue/EBITDA/PAT over FY25-FY28. Revenue growth would be mainly driven by mobile segment, while consumer electronics will remain under pressure for some more time. We expect an EBITDA margin of 3.8%/4.0%/4.2% for FY26/FY27/FY28, led by increased focus on backward integration post PLI. This will result in a PAT CAGR of 45% over FY25- FY28E.

Valuation and view

The stock is currently trading at 60.8x/44.8x P/E on FY27/28E earnings. We maintain our BUY rating on the stock with a revised DCF-based TP of INR22,100 (earlier INR20,500). Reiterate BUY.

Key risks and concerns

The key risks to our estimates and recommendation would come from the lowerthan-expected growth in the market opportunity, loss of relationships with key clients, increased competition, and limited bargaining power with clients.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412