Buy Jindal Steel & Power Ltd for the Target Rs. 1050 by Motilal Oswal Financial Services Ltd

Volume-driven outperformance; margins in line

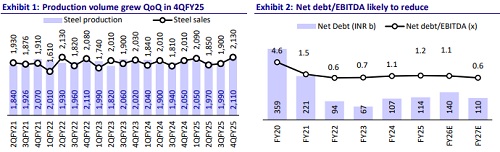

* Jindal Steel & Power (JSP)’s revenue grew 12% QoQ to INR132b (-2% YoY) vs. our estimate of INR121b, fueled by a robust volume growth (9% beat).

* Adj. EBITDA stood at INR24.8b up 14% QoQ and 2% YoY, against our est. of INR22.7b (10% beat). EBITDA/t stood at INR11,650/t in line with our est. of INR11,599/t during the quarter.

* In 4QFY25, JSP’s reported EBITDA included an FX gain of INR200m and oneoffs under other costs of INR2.3b. Further, JSP has reported a provision of INR12.29b as an exceptional item during the quarter, towards diminution in the value of investments in its overseas subsidiaries (Australian mines).

* APAT for the quarter stood at INR11b (+18% YoY and +16% QoQ) against our est. of INR9.6b in 4QFY25.

* Production and sales stood at 2.11MT (+3% YoY) and 2.13MT (+6% YoY), respectively, in 4QFY25. The share of exports was 3% in 4QFY25 vs. 7% in 3Q. ASP came in-line at INR61,890/t (-8% YoY and flat QoQ) in 4QFY25.

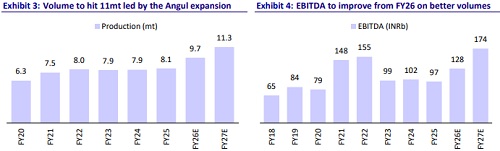

* For FY25, revenue stood at INR498b (flat YoY), while EBITDA declined 5% YoY to INR97b, and APAT declined 28% YoY to INR43b.

* In FY25, JSP’s production grew 2% YoY to 8.12MT and sales rose 4% YoY to 7.97MT. The share of exports was 6% in FY25 vs. 9% in FY24.

Highlights from the management commentary

* The company expects 9-10mt of crude steel production for FY26, with incremental steel production of 0.2-0.3mt coming from existing plants and 0.7-1.6mt from new expansion.

* JSP expects finished steel sales of 8.5-9mt for FY26; the lag between production and sales will be due to the ongoing ramp-up.

* Coking coal costs declined by USD11/t in 4QFY25, and management expects a further moderation of USD10-12/t in 1QFY26. Earnings are expected to be better in 1QFY26, driven by healthy volumes, better NSR, and lower costs

Valuation and view

* JSP reported a decent 4Q performance that was above our estimates, led by robust volumes. Earnings should improve going ahead, aided by volume ramp-up, NSR recovery, and muted costs.

* With the completion of its ongoing Angul expansion, JSP’s crude steel capacity will rise 65% to 15.9mtpa and finished steel capacity will increase 90% to 13.8mtpa, providing significant headroom for earning growth.

* The company has reduced its debt significantly, with a net debt-to-EBITDA ratio of 1.26x as of end-4Q. JSP aims to keep the debt level in check ahead.

* We trim our EBITDA estimates by 5% each for FY26 and FY27, factoring in the gradual ramping of new capacities and market volatility over global trade tension. We reiterate our BUY rating with a revised TP of INR1,050, based on 6.5x FY27E EV/EBITDA.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412