Copper may rise on better risk mood, Codelco El Teniente supply worry - ICICI Direct

Bullion Outlook

* Spot Gold is likely to move lower towards $3300 on easing geopolitical tensions. Hopes of ceasefire in Ukraine and end to the Russia-Ukraine war has increased after the talks between US and Russian Presidents last week. Today, US President will meet Ukrainian President and European leaders to strike quick peace deal. Any positive outcome would ease safe haven demand and bring correction in price. Additionally, investors will eye on this week’s key FOMC meeting minutes to get more clarity on interest rate cut prospects. Last week’s higher PPI numbers has lowered the chances of 50 bps rate cut in September.

* Spot Gold is expected to slip towards $3300, as long as it trades under $3375. MCX Gold October is expected to weaken towards Rs.98,800 as long as it remains below Rs.100,450 level.

* MCX Silver Sep is expected to hold support at Rs.112,800 and rebound towards Rs.115,400 level. Only below Rs.112,800, it would turn weaker.

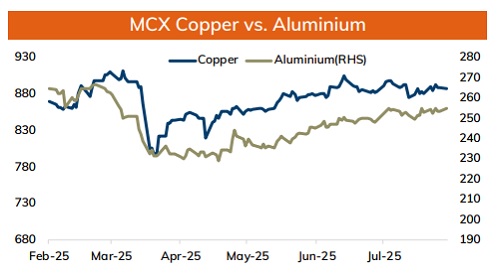

Base Metal Outlook

* Copper prices are expected to hold its ground and move higher on improved risk sentiments and supply concerns from Codelco’s EI Teniete operation. Meanwhile, weaker than expected economic numbers from China would restrict its upside. Further, additional tariffs on steel and aluminium products might weigh on metal prices. Additionally, rising LME inventory levels would also limit its gains.

* MCX Copper August is expected to consolidate in the band of Rs.883 and Rs.895 level. Only a move below the 50-day EMA support at Rs.883 it would turn weaker towards Rs.878.

* MCX Aluminum August is expected to consolidate in between Rs.252 and Rs.256 level. Only above Rs.256, it would turn bullish towards Rs.259. MCX Zinc August is likely to move north towards Rs.272 level as long as it stays above Rs.268 level. Move below Rs.268 it would turn weaker towards Rs.264.

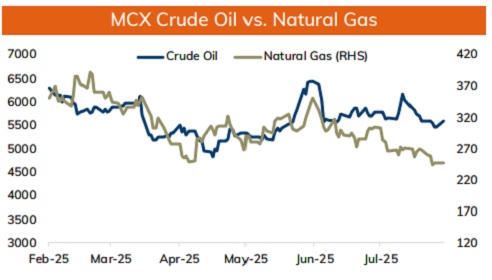

Energy Outlook

* Crude oil is likely to trade lower on easing geopolitical risk. Focus will shift towards the meeting between US President Donald Trump and Ukrainian President Volodymyr Zelenskiy aimed at advancing a peace deal with Russia. The talks will also include French President, NATO secretary and European commission. Any positive outcome from the meeting to end the war would improve oil supplies from Russia. Meanwhile, forecast of higher output in the coming year by OPEC and the EIA likely to weigh on oil prices.

* On the data front, 60 put strike has higher OI concentration which would act as key support. On the upside 65 call strike, has higher OI concentration, likely to act as immediate hurdle. MCX Crude oil September is likely to slide towards Rs.5200 as long as it trades under Rs.5550 level. A move below Rs.5200 would turn weaker.

* MCX Natural gas August future is expected to remain under pressure and move towards Rs.240, as long as it trades under Rs.255.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631