Neutral Shree Cement Ltd for the Target Rs.33,000 by Motilal Oswal Financial Services Ltd

EBITDA in line; premiumization and value focus intact

Reiterates capacity target of 80mtpa by FY28 from 62.8mtpa currently

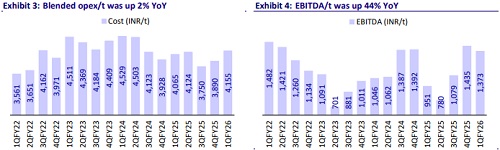

* Shree Cement’s (SRCM) 1QFY26 operating performance was in line with our estimates. EBITDA increased ~34% YoY to INR12.3b and EBITDA/t rose ~44% YoY to INR1,373 (est. INR1,325). OPM surged 5.9pp YoY to ~25%. PAT grew ~95% YoY to INR6.2b (~39% beat), mainly led by lower depreciation and higher other income than our estimates.

* Management noted that industry demand is expected to grow by 6-7% YoY in FY26, aided by strong government capex, rising rural housing demand on a good monsoon, increasing urbanization and industrial activities. In Apr’25, SRCM commissioned capacities at Baloda Bazar, Chhattisgarh (3.4mtpa), and Etah, Uttar Pradesh (3.0mtpa), taking total grinding capacity to 62.8mtpa. It has also reiterated its capacity target of 80mtpa by FY28.

* We largely maintain our earnings estimates. Despite lower depreciation vs. our estimate in 1Q, we maintain our depreciation estimates given the previous guidance. We also introduce FY28 estimates. SRCM trades fairly at 21x/18x FY26E/FY27E EV/EBITDA. We maintain our Neutral rating with a TP of INR33,000 (based on 18x Jun’27E EV/EBITDA).

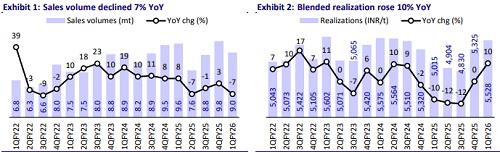

Volumes decline ~7% YoY; blended realization up ~10% YoY/4% QoQ

* Standalone revenue/EBITDA/PAT stood at INR49.5b/INR12.3b/INR6.2b (up 2%/34%/95% YoY and in-line/-5%/+39% vs. estimates) in 1QFY26. Volumes declined ~7% YoY to 9.0mt (4% below estimates). Blended realization grew ~10% YoY (up ~4% QoQ) to INR5,528/t.

* Opex/t increased ~2% YoY/7% QoQ in 1QFY26 (+5% vs. estimate). Variable cost/t declined ~4% YoY. However, other expenses/staff cost/freight costs per ton grew ~13%/12%/5% YoY. OPM surged 5.9pp YoY to ~25%, and EBITDA/t increased ~44% YoY to INR1,373.

* Depreciation/interest costs declined 14%/22% YoY. Other income grew 49% YoY. ETR was at 25.8% vs. 9.4% in 1QFY25.

Highlights from the management commentary

* SRCM’s UAE subsidiary, Union Cement Co. (UCC), delivered a robust performance as revenue/EBITDA surged ~19%/397% YoY in 1QFY26. Given the improved performance and healthy demand outlook, SRCM announced a capacity expansion plan of 3.0mtpa for UCC at an investment of AED110m (INR2.6b).

* Share of premium products in trade sales rose to 17.7% vs. 15.6% in 4QFY25, reflecting continued improvement. SRCM’s share of green power stood at ~66% vs. ~60% in 4QFY25 of total power consumption, among the highest in the industry. Green power capacity increased to 586 MW in 1Q.

* The company’s ongoing integrated cement capacity expansions at Jaitaran, Rajasthan (3.0mtpa), and Kodla, Karnataka (3.0mtpa), are progressing as per schedule. After the commissioning of these plants, SRCM’s domestic grinding capacity will increase to 68.8mtpa.

Valuation and view

* SRCM’s operating performance was in line with our estimates as lower volume and higher opex/t vs. our estimates were offset by higher-than-estimated realization. The company remains focused on pricing and its premiumization strategy; hence, despite higher capacity additions, it reported a volume decline. We estimate that a lower capacity utilization (~60-62% over FY26-28) will lead to lower return ratios (ROE/ROCE at ~9%/10%, post tax, vs. in mid-teens over FY16- 24). Further, we are watchful about the company’s next leg of capacity expansion (to reach at 80mtpa by FY28).

* We estimate a CAGR of 9%/18%/24% in revenue/EBITDA/PAT over FY25-28. We estimate a volume CAGR of ~7% over FY25-28 and EBITDA/t of INR1,344/ INR1,416/INR1,480 in FY26/FY27/FY28 vs. INR1,086 in FY25E. The stock trades fairly at 21x/18x FY26E/FY27E EV/EBITDA. We maintain our Neutral with a TP of INR33,000 (valuing it at 18x Jun’27E EV/EBITDA).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412