Buy Jindal Stainless Ltd for the Target Rs.870 by Motilal Oswal Financial Services Ltd

In-line performance; strong volume and healthy NSR support earnings

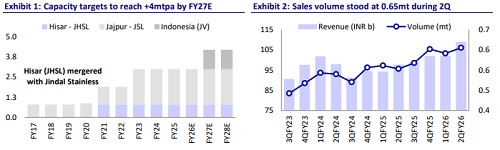

* Jindal Stainless’ (JDSL) revenue for 2QFY26 came in line with our estimates at INR109b, up 11% YoY and 7% QoQ. The growth was primarily led by healthy sales volume of 648KT, which recorded 15% YoY and 4% QoQ growth in 2QFY26.

* The exports share remained steady at 9% in 2QFY26 compared to 1QFY26 (vs. 10% in 2QFY25). ASP stood at INR168,000/t (-3% YoY and +3% QoQ), led by SS price recovery during the quarter.

* Adj. EBITDA stood at INR13.9b (in line with our estimate of INR13b), up 17% YoY and 6% QoQ. This led to an EBITDA/t of INR21,416, which improved 2% YoY and QoQ, supported by favorable pricing during the quarter.

* APAT for the quarter stood at INR7.9b (+29% YoY and +11% QoQ) and was in line with our estimate of INR7.4b.

* During 1HFY26, revenue/EBITDA/APAT grew 10%/12%/19%, respectively, supported by strong volume and NSR recovery.

Highlights from the management commentary

* Management reiterated volume growth guidance of 9-10% YoY for FY26, with capacity utilization of 80-85%.

* The company expects short-term export volumes to remain subdued until uncertainties surrounding CBAM are resolved. In the long term, management indicated that the company is largely compliant with CBAM requirements (rising RE share), which should facilitate easier access to EU markets once the regime stabilizes.

* JDSL increased its renewable energy share to 42% in 2QFY26 from 26% in 2QFY25 and targets to increase it further with the commissioning of a green hydrogen plant at its Jajpur facility by mid-next year.

* The SS series mix for 2QFY26 stood at 34% for the 200 series, 49% for the 300 series, and 17% for the 400 series.

Valuation and view

* JDSL reported a decent performance in 2QFY26, supported by healthy volumes and SS price recovery. Industry-level SS demand is set for strong growth, reaching 7.3mt by FY31, driven by domestic SS consumption. We believe JSL is well-placed to capitalize on this robust demand outlook, with higher VAP supporting margins.

* JSL has expanded into rebar, wire rods, and others, unlocking significant infrastructure opportunities. Additionally, the focus on value-added CR SS has strengthened its position in both domestic and export markets.

* We maintain our FY26/27E earnings estimates, projecting revenue CAGR of ~13% with steady EBITDA of INR22,000/t, leading to ~15% EBITDA CAGR over FY25-28E. Moreover, the healthy CFO and steady capex outflow will ensure a resilient B/S (consol. net debt/equity of 0.2x as of 2QFY26). We reiterate our BUY rating with a TP of INR870 (premised on 11x EV/EBITDA on Sep’27 estimate).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)