Buy Vedanta Ltd For Target Rs.625 By Emkay Global Financial Services Ltd

We visited Hindustan Zinc (HZ)’s Rampura Agucha (RA) mine and interacted with the management. HZ contributes 40% to VEDL’s consolidated EBITDA. The management reiterated its strong medium-term visibility on earnings, supported by a secure mine life, high structural entry barriers, and renewablesled cost tailwind. FY27 management guidance for zinc output is ≥1,080kt and for silver production ~700t—positioned in the first quartile on the global zinc cost curve; minimal hedging for FY27 reflects the management’s firm belief about structural silver tightness and supports a price-led earnings upside. At spot prices, we estimate EBITDA of Rs258bn vs consensus’ Rs220bn, a ~17% upgrade potential. Each USD1/oz move in silver price changes HZ’s EBITDA by 1%. We believe that silver exposure is underpriced and the recent runup in the HZ and VEDL stock price reflects earnings upgrade potential.

Mgmt confident of retaining mines in the CY30 reauction with operational moat Management commentary was constructive, reinforcing confidence on medium-term volume growth, cost discipline, earnings visibility. Mine-life is well secured, with Sindesar Khurd (SK) valid through to CY49 and RA till CY30; notably for RA mines due for reauction in CY30, HZ retains right of first refusal. The management highlighted high structural entry barriers, particularly around reserve development and integrated smelting, supporting a high probability of mine retention, albeit at moderately higher royalty. The energy mix transition emerges as a key structural cost lever, with renewables penetration targeted to increase from 7% in FY25 to 55% in FY27 and to 70% by FY28. Each 2% increase in the renewables share yields USD1/t in cost savings, helping offset mining cost inflation as operations go deeper. Guidance for FY27 zinc output is a minimum 1,080kt and for silver production at ~700tonne. The cost base remains globally competitive, with mining cost of USD580–590/t at RA and of USD400–500/t at SK, along with smelting cost of USD350–360/t and company-level unit cost at ~USD1,000/t.

Minimal hedge in the FY27 support price-led earnings upgrades Silver hedging is limited to 123tonne (34% of H2FY26) at USD37/oz, while FY27 hedging remains minimal, showing management conviction of a healthier supply-demand balance, supporting medium-term price realization. We believe HZ provides the cleanest exposure to play silver price strength in India (refer to HZ — In its element). Each USD1/oz move in silver price changes EBITDA by 1%, while a USD100/t movement in zinc price drives a 2.5% EBITDA sensitivity.

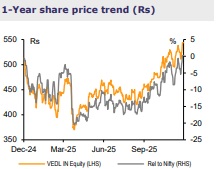

Mark-to-market spot earnings indicate consensus’ upgrade potential At spot zinc (USD3,025/t) and silver (USD65/oz) prices, we estimate EBITDA of Rs258bn, implying ~17% upgrade potential vs consensus’ at Rs220bn for FY27. We still believe silver exposure is underpriced and the recent runup in HZ and VEDL stock price is a reflection of the earnings upgrade potential (refer to Silver exposure underpriced).

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

.jpg)

.jpg)