Buy TBO Tek Ltd For Target Rs. 1,750 By JM Financial Services

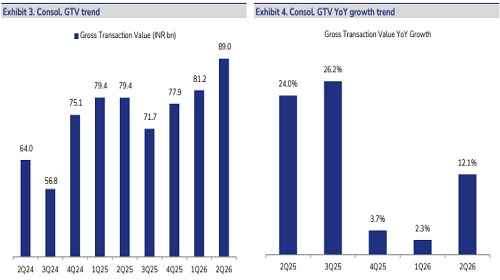

TBO Tek’s (TBO) consol. GTV growth in 2Q accelerated to 12% YoY from just 2% YoY in 1Q, inline JMFe. Acceleration was driven by both H&P growth improving to 20%+ from 12%/17% in 1QFY26/4QFY25 and air trends turning flattish YoY vs. low-teens decline in the prior 2 quarters. We expect organic GTV growth trends in both these segments to be stable in the near term in the absence of any macro challenges. While reported EBITDA of INR 881mn was c.2% ahead of JMFe, adjusted for one-off M&A expense (related to Classic Vacations acquisiton) of INR 132mn, the beat was 17%. Importantly, the management noted that SG&A expense growth is likely to decelerate henceforth on account of upfronting of most sales headcount expansion related costs. This, in turn, should enable the much-awaited operating leverage to play out (on an organic basis) latest by 4QFY26, in our opinion. Valuations too appear attractive as the stock has given up most of the early gains post Classic Vacations M&A announcement. We, therefore, upgrade TBO to BUY with a Sep’26 TP of INR 1,750 (unchanged multiple of 40x EPS).

* H&P growth recovery driven by key international markets: TBO’s consol. GTV grew 12.1% YoY (+9.6% QoQ) to INR 89bn in 2QFY26, in line with JMFe. Segment-wise, H&P GTV grew 20.4% YoY from 12.5%/17.4% in 1QFY26/2QFY25, respectively, whereas Air ticketing GTV was flattish YoY vs. low-teens decline in the prior 2 quarters. H&P segment in turn saw broad-based improvement in trends across key international markets, particularly Europe (+20% YoY), MEA (+27% YoY) and APAC (+41% YoY). Other markets, the US, LATAM and India grew 16%, 10% and 4%, respectively. Consol. revenue grew 25.9% YoY to INR 5.67bn, a beat on JMFe/ Cons. By 2.8%/ 4.9% respectively, aided by the H&P (+34.3% YoY) segment that reported better-than expected take-rate on account higher share of commission income. While gross take-rates in the H&P segment stood at 8.46% vs. 8.36%/7.59% in 1QFY26/2QFY25, air segment take-rate was 2.41% vs. 2.56%/2.60% in 1QFY26/2QFY25, respectively.

* Strong EBITDA beat excluding one-off, cost discipline to aid expansion ahead: Consol. gross margin was down 390bps YoY (-116bps QoQ) to 64.0%, a miss on our estimate of 65.8% due to sharp decline in H&P as well as the air segment margin. While reported EBITDA margin was down 288bps YoY (+28bps QoQ) to 15.5%, adjusted for one-off M&A expense of INR 132mn, the margin was down only c.55bps YoY to 17.8%. Excluding the one-off, EBITDA grew 22% YoY to INR 1,013mn (reported grew 6% to INR 881mn), a beat on JMFe by c.17% (~2% beat on reported). The management indicated that incremental hiring and frontline expansion are largely behind and hence SG&A growth (in the organic business) relative to gross profit growth will continue to moderate over the next few quarters. This, in turn should help TBO’s organic business EBITDA margin expand from 4QFY26 (seasonality may weigh on 3Q).

* Upgrade to ‘BUY’ with revised TP of INR 1,750: We marginally raise consol. GTV estimates by ~1% over FY26-28. Consol. Revenue has been raised by c.2% during this period, assuming higher take-rates in the H&P segment basis 2Q results. However, we cut EBITDA margin forecasts by 44 for FY26 due to one-off M&A expense impact but raise the same by 10-11bps over FY27-28. Overall, our EPS forecasts are raised by c.1-5%. Due to improved earnings growth visibility and attractive valuations (post recent correction in the stock), we upgrade TBO to BUY rating with a Sep’26 TP of INR 1,750 derived basis 40x NTM PER.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361