Buy Jubilant FoodWorks Ltd for the Target Rs. 700 By Prabhudas Liladhar Capital Ltd

Demand outlook strong

Quick Pointers:

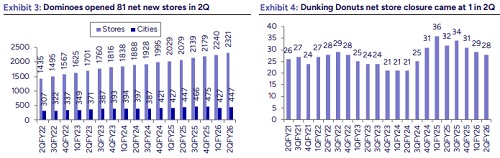

* Management guided for 15-16% sales CAGR and 200bps margin improvement by FY28 on the base of FY24 and plan to open 900 stores over next 3 years

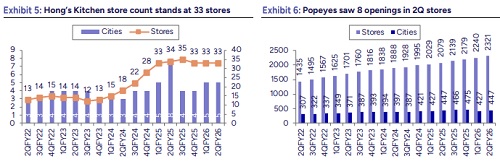

* Popeye is seeing healthy double-digit growth with expansion plan on track

We are upgrading JFL from Hold to BUY given 1) strong sales momentum in Octoebr and positive outlook 2) focus on premiumisation led by new innovations and launches across brands 3) guidance of 200bps margin expansion by FY28 (on FY24 base) with 100bps coming from reduction in losses in new businesses.

2Q26 results were inline with 9.1% LFL growth led by robust menu innovation and focus on providing value to consumers. Popeyes is witnessing good traction and with improving economics and healthy double digit growth. Dp eurasia continues to remain impacted by inflation which has now stabalized in Turkey. We expect ~220bps expansion over FY26-FY28 led by 1) increase in average ticket size 2) supply chain benefits and 3) gains from tech investments and a healthy LTL outlook.

We estimate 57.9% standalone EPS CAGR over FY26-28 on a low base. We have assigned 33x FY27 EV/EBIDTA to standalone nos and arrive at value of Rs634/share and 22x PAT to dp eurraisa (Rs 66/share) on its CY26 earnings. We assign an SOTP based target price of Rs700 (670 earlier). JUBI seems best placed in QSR space to gain from expected improvement in consumer demand coupled with healthy commentary. Upgrade to BUY.

Standalone Revenues up 15.8%, LFL growth at 9.1%: Revenues grew by 15.8% YoY to Rs17bn (PLe: Rs16.98bn). SSG growth at 9.1%. Gross margins contracted by 169bps YoY to 74.4% (Ple: 76.5%). EBITDA grew by 15.9% YoY to Rs3.3bn (PLe: Rs3.31bn); Margins expanded by 2bps YoY to 19.4% (PLe:19.5%). Adj PAT grew by 22.8% YoY to Rs0.63bn (PLe: Rs0.63bn).

DP Eurasia (Turkey, Azerbaijan and Georgia) Turkey, system sales came in at Rs9,957mn. The revenue came in at Rs5,927mn, up 28.7% yoy with PAT margin delivery of 10.4%.

* Domino’s Sri Lanka revenue of Rs317mn was up by 86.1%. Domino’s Bangladesh revenue came in at Rs194mn up by 54.1%

* A total of 5 net stores were added across all brands in the international markets, ending the period with 1,030 stores.

Concall Takeaways: 1) Overall demand in Q2 remained strong, driven by menu innovation. 2) October seeing similar demand scenario with growth beating internal estimates. 3) JUBI has accelerated the pace of new product innovation by introducing Sourdough Pizza, 7 new variants of flavor burst burgers launched in Dunkin donuts. 4) JUBI is likely to focus on changing its mix from value to premium portfolio to drive margins and increase average ticket size 5) JUBI is seeing good traction for its premium portfolio in tier-2 and tier-3 cities. 6) JUBI is materially ahead of competition in terms of store expansion with 65-70% market share in pizza category 7) Gross margin came in at 74.4%, lower by ~169bps YoY, however company remains confident on improving its margin in coming quarters led by internal initiatives 8) Take away business declined by 19% led by 20-min delivery and free delivery 9) Company took calibrated price increase in some of its pizza portfolio eg. cheese volcano along with packaging charges 10) Pre-Ind AS 116 EBITDA margin expanded 37bps YoY on account of sequential improvement in gross margin, store productivity and operating leverage 11) Popeyes is seeing strong double digit growth with 8 new popeye stores opened in Q2 out of which 4 were in Mumbai 12) The company targets India business growth of ~15% yearon-year, with 5-7% from like-for-like growth (including 1-2% from pricing/mix) and 7-10% from store expansion. 13) Management committed to minimum 200bps EBITDA margin improvement by FY28 from FY24 base levels, driven by 100bps reduction from losses in new businesses (currently 200bps) and rest from Operating leverage from 5-7% LTL growth. 14) Mumbai commissary is expected to be commissioned by end of current quarter or early next quarter. 15) In Turkey, the company is operating in a hyperinflationary environment which impacts accounting and inventory management

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271