Buy Sapphire Foods India Ltd For Target Rs. 360 By JM Financial Services

Sapphire’s revenue growth was tepid at 8% YoY (6% miss) led by 11%/19% growth (4%/10% miss) in KFC/Sri Lanka businesses, while Pizza Hut (PH) business registered decline of 6% YoY (10% miss). SSSG for KFC was flat YoY with low single digit positive SSTG after several quarters led by higher value offerings. SSSG for PH declined by 8% during the quarter despite a weak base of -7% in 1QFY25. Contribution margin disappointed; operating deleverage, lower gross margin and higher delivery mix impacted KFC’s margin while higher marketing cost and operating deleverage impacted PH’s margin. Lower gross margin was a factor of higher value offerings. SSSG for the Sri Lanka business remained resilient though contribution margin contracted ~50bps YoY due to upward revision in minimum wages. We believe the management’s efforts towards driving revival in SSTG and SSSG by increasing its value offerings and stepping up innovations are steps in the right direction; however, this may have an adverse impact on margins in the near term. Baking in this impact, we therefore cut our Pre-Ind AS EBITDA estimates by 7%-17% over FY26-28E and revise our target price to INR 360 (earlier INR 365) based on 26x EV/EBITDA Pre Ind AS Jun’27; there is no major change in our TP despite these cuts as we roll-over the multiple to Jun’27. Demand recovery holds the key for the management’s initiatives to bear fruit; we believe we are now near the bottom of the earning cuts cycle and could witness a sharp uptick in margin and profitability once the demand environment improves. We maintain BUY.

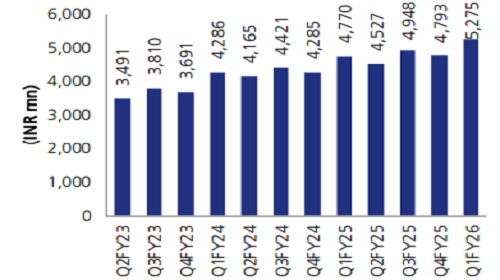

* Miss on revenue, margins disappoint: Consolidated revenue grew 8% YoY to INR 7.8bn (6% miss vs. estimate). EBITDA fell 9% YoY to INR 1.1bn (12% below estimate) as EBITDA margin shrank ~280bps YoY to 14.5% (JMFe: 15.5%) led by gross margin contraction of ~120bps YoY to 67.4% (JMfe: 68%) and increase of 160bps YoY in other expenses on account of negative leverage. PAT loss was INR 18mn vs. profit of INR 118mn in 1QFY25 (JMFe: profit of INR 12mn) largely led by 8%/2% YoY rise in interest/depreciation partially offset by 29% YoY higher interest income. Pre-Ind AS EBITDA fell 22% YoY to INR 548mn as margin shrank ~280bps YoY to 7.1%. Consol. brand EBITDA fell 13% YoY to INR 944mn (margin -12.2%; down ~290bps YoY).

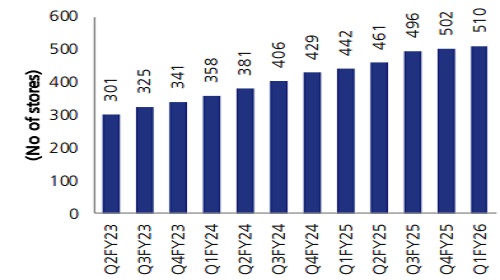

* PH and Sri Lanka drag overall performance: KFC’s revenue grew 11% YoY to INR 5.3bn (4% miss). It added 8 stores QoQ (510 stores). EBITDA declined 8% YoY to INR 828mn as brand EBITDA margin contracted ~310bps YoY to 15.7% (JMFe: 15.7%) led by ~110bps YoY gross margin (GM) contraction to 67.1% and negative leverage. Pizza Hut’s (PH) revenue declined 6% YoY (10% miss) to INR 1.3bn despite addition of 2 stores (336 stores). EBITDA margin contracted ~710bps YoY to -2.5% (JMFe: -3%) led by GM contraction by ~150bps YoY to 74.6%. Sri Lanka (SL) revenue grew 19% YoY to INR 1.2bn (10% miss). It added one store QoQ (128 stores). EBITDA grew 15% YoY to INR 148mn as margin contracted ~50bps YoY to 12.7% (JMFe: 14.5%) despite GM expanding by ~30bps YoY to 60.9%. KFC/PH/SL’s SSSGs were at -0/-8/+12%. ADS of KFC/PH declined by 5%/8% YoY while that of SL increased by 16%YoY.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

.jpg)

.jpg)