Buy Tech Mahindra Ltd for the Target Rs. 1,620 by Axis Securities Ltd

Mix-bag Performance; Growth Trajectory Continues

Est. Vs. Actual for Q2FY26: Revenue – INLINE ; EBIT Margin – BEAT; PAT – MISS

Change in Estimates YoY post Q2FY26:

FY26E/FY27E: Revenue: 1%/1%; EBIT: 2%/1%, PAT: -2%/1%

Recommendation Rationale

* Demand across Selective Pockets: The overall demand environment continues to remain challenging; however, the Telecom vertical has stabilised, while Manufacturing, BFSI, and Logistics registered significant growth during the quarter. The management remains confident that deal wins will continue across key focus areas, provided the macro and business environment stays stable.

* Deal Wins/Pipeline: Total Contract Value (TCV) for the quarter stood at $816 Mn, reflecting a robust 57% growth on an LTM basis and a 35% YoY increase. The company aims to further scale its quarterly deal win rate, targeting to reach closer to the $1 Bn mark in the coming quarters.

* Growth Aspiration Intact: Despite the challenging environment, the EBIT margin commitments of 15% for FY27 remain intact, led by productivity and cost efficiency programs.

Sector Outlook: Cautiously optimistic

Company Outlook & Guidance: Tech Mahindra focuses on GenAI, which includes autonomous networks and network optimisation for telcos, and Comviva, leveraging AI to reduce churn and increase ARPU.

Current Valuation: 24x FY27E P/E (Earlier Valuation: 26x FY27E P/E)

Current TP: 1,620/share (Earlier TP: 1,775/share)

Recommendation: With a strong deal pipeline across business verticals, AI implementation is expected to deliver better performance and a favourable environment ahead. We believe Tech Mahindra will continue its growth trajectory. Hence, we maintain a BUY rating on the stock.

Financial performance

In Q2FY26, Tech Mahindra reported revenue of Rs 13,995 Cr vs Rs 13,351 Cr, up 5.1% YoY and 4.8% QoQ. EBIT stood at Rs 1,699 Cr vs Rs 1,280 Cr, registering a growth of 33% YoY and 15.1% QoQ, driven by ongoing cost optimisation initiatives under Project Fortius, improved fixedprice project productivity, volume growth, SG&A efficiency, and currency tailwinds. EBIT margin stood at 12.1%. Net Income came in at Rs 1,205 Cr vs Rs 1,257 Cr, down 4.2% YoY but up 6.8% QoQ. LTM attrition stood at 12.8% vs 12.6% QoQ, marginally higher by 20 bps.

Valuation & Recommendation

The management remains optimistic about the improvement and scalability of business operations. Moreover, the overall deal pipeline remains strong, with a continued focus on scaling the digital business. We remain constructive on the long-term outlook and expect sequential growth to sustain in the coming quarters. We value the company at 24x P/E on FY27E earnings to arrive at a TP of Rs 1,620/share, implying an upside of 10% from the CMP, and maintain our BUY rating.

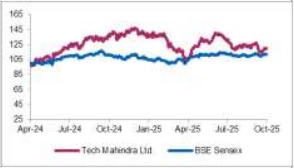

Relative Performance

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633