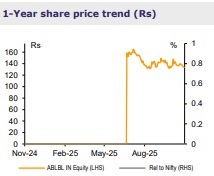

Buy Aditya Birla Lifestyle Brands Ltd for the Target Rs.170 By Emkay Global Financial Services Ltd

GST change partially postpones primary billings to H2

We have a BUY on ABLBL, with a TP of Rs170 (25x Sep-27E EBITDA). ABLBL’s Q2 EBITDA was in line with expectations, albeit the performance was muted with 4% topline growth. However, we expect ABLBL’s growth to improve as the slow growth was on account of a mismatch between primary and secondary sales due to GST revision during Q2. The same was reflected by muted trends in B2B channels (wholesale/e-commerce), while LTL growth for the retail channel continued to be robust at 10-20% for Lifestyle, Reebok, and VH Innerwear. Gross store additions have been healthy, with 125 gross additions in H1 for ABLBL. ABLBL is a relatively mature business (vs ABFRL), with a lowdouble-digit growth profile and margin turnaround in emerging segments; FCF growth and debt reduction are key triggers for the business.

Strong 10-20% LTL growth in retail; GST change impacts B2B channel growth

Consolidated sales at Rs20.4bn were up 4% YoY, led by 7% growth in Lifestyle Brands, though partly offset by a 10% decline in the Emerging Business portfolio (partially impacted by the Forever 21 exit). Lifestyle Brands registered double-digit LTL growth (~12%) and Q2 was the fifth consecutive quarter of strong positive LTL growth, driven by strong momentum across small towns and steady retail execution. Among emerging segments, Reebok/American Eagle saw near double-digit LTL growth, while the innerwear business grew faster at +20% LTL growth across its 100+ exclusive stores. Consolidated EBITDA grew ~12% YoY to Rs3.4bn, with margins improving ~130bps YoY to 16.6%, aided by gross margin gains and cost efficiencies. Lifestyle Brands saw an ~80bps margin expansion, while Emerging Business improved by ~130bps.

Small towns seeing faster growth in Lifestyle Brands

Lifestyle Brands grew by 7%, although registered double-digit LTL growth (~12%). Q2 was the fifth consecutive quarter of strong positive LTL growth, driven by strong momentum across small towns and steady retail execution. The department store channel moderated due to lower primary sales; the E-com business is stabilizing and is poised for profitable acceleration ahead. In terms of margins, the segment saw ~80bps margin expansion. ABLBL opened 20+ stores across Lifestyle Brands in H1FY25. For Allen Solly and Louis Philippe, it is focusing on larger stores and deeper retail presence.

Innerwear segment to continue to see increased investments

The Emerging Business Portfolio, which now spans 350+ stores, was impacted by the closure of Forever 21. The management noted that overall growth would have been higher by around 1%, excluding the Forever 21 impact. There was some network rationalization impact in the AE business. LTL sales growth across emerging brands was in double digits, with a weighted average of ~11%, although around half of Sep was affected by GST transition challenges and temporary inventory reductions in some stores. The company plans to continue to invest in its innerwear business, which delivered the highest LTL sales across the portfolio during the quarter. The company has ~110 exclusive innerwear stores, which, on average, delivered +20% LTL growth.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354