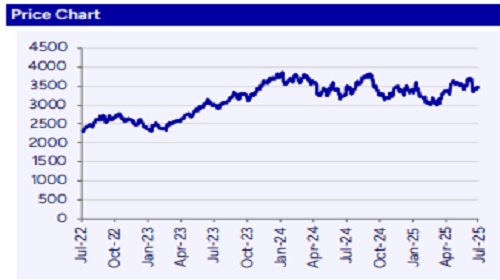

Hold Titan Company Ltd For Target Rs.3,830 by Prabhudas Liladhar Capital Ltd

DAMAS acquisition – EPS accretive by CY28 only

The acquisition of Damas will enable TTAN to consolidate its presence in USD15bn GCC jewellery market with brands like Damas, Tanishq and Gaia. TTAN will be paying an EV of AED 1038mn, which will be funded through a debt of Rs12bn and small funding from reserves. Damas has debt of ~700mn AED and working capital is funded by gold metal loan.

TTAN plans to close stores catering to Se Asian population with gold jewellery and convert many of these into Tanishq stores. 3 Graff stores (20% of sales) are not a part of this transaction while 110 signature stores will be scaled up.

2025 will be the year of re-structuring and the transaction will be EPS dilutive in CY26. It will be EPS neutral in CY27 and will be EPS accretive only in CY28. This acquisition provides Titan plans to leverage its expertise in sourcing, inventory management, and customer acquisition to drive backend and technological efficiencies which along with superior gross margin, and improved product mix will drive margins higher.

At current sales of Rs26.3bn (ex of Graff), DAMAS EV/Sales multiple stands at 0.95x, which is in-line with most global retailers. We believe, Damas acquisition will add value over next 3-4 years and does not add any upside in the near to medium term. TTAN will continue to drive strong growth in domestic market given benign base and benefits of strong brand and distribution. We reiterate Buy on Titan with TP of Rs3830.

Key highlights: Titan Diversifying beyond Indian diaspora

* Damas Overview - Damas Jewellery. founded in 1907. headquartered in Dubai, UAE, stands as Middle East’s premier jewellery retailer. weaving a rich legacy of over a century. Damas operates 146 stores across the UAE, Saudi Arabia, Qatar, Bahrain, Kuwait, and other GCC countries. Damas today houses a rich and curated portfolio of in-house collections alongside prestigious international labels. Over the last decade, Damas has continued to solidify its position as a trusted design-led jewellery house, empowering and celebrating modern consumers.

* Titan through its wholly owned subsidiary Titan Holdings International FZCO has entered into an Agreement for the Sale and Purchase of Shares, to acquire 67% stake in Damas LLC (UAE), current holding company for Damas jewellery business in GCC countries (Damas Business) from Mannai Corporation

* On completion of the acquisition, Titan Holdings would hold 67% of the equity share capital and voting rights in Damas LLC and a path to acquire the balance 33% stake from Mannai after 3QFY30, subject to conditions agreed upon in the definitive document.

* The consideration for the Proposed Transaction arrived based on the EV value of AED 1,038 million (~Rs24.38bn). We understand that Damas has a debt of AED 300mn in its books and has gold metal loan for working capital. TTAN will pay Rs12-13bn for 67% stake in the company. Damas will continue to have gold metal loans and debt of AED250-300mn in its books. The acquisition will be funded through some equity but mainly through a debt of Rs12bn which would be getting an interest of 6%.

* Damas has 3 Graff stores which account for 20% of total sales, these stores are not a part of this transaction.

* Damas drives 50% of sales from gold jewellery and 50% from signature jewellery, it will be closing some of the stores which are focusing on gold jewellery, and some will be converted into Tanishq stores. Around 110 stores out of a total of 146 stores are signature stores and will continue to operate like current operations.

* CY25 will be the year of restructuring and closures of stores focused on SE Asia consumers and gold jewellery. Overall, Damas will be EPS dilutive in CY26 and EPS neutral in CY27. It will only be EPS accretive from CY28.

* UAE has 60% organized share and Saudi Arabia, with 30-40% organized leaves ample opportunity for TTAN to capture the market share by bringing operational synergies with DAMAS

* Damas Revenue grew at~12% CAGR over CY20-CY24 while PAT grew from losses of Rs1.93bn to profit of Rs184mn in CY24 led by better mix with EBIDTA margins improving from 0.9% in CY20 to 10.5% in CY24.

* TTAN plans to bring in operational efficiencies into DAMAS and we anticipate healthy double-digit sales CAGR with gradual recovery in margins as it restructures operations and reduces proportion of gold jewellery. merchandise)

Above views are of the author and not of the website kindly read disclaimer