Buy Happy Forgings Ltd For Target Rs. 980 by Motilal Oswal Financial Services Ltd

Multiple growth drivers in place

Diversification has helped offset demand weakness in core segments

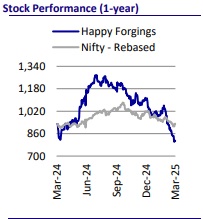

Happy Forgings’ (HFL) stock has corrected 34% from its peak over the past six months, driven by slower-than-expected revenues (9MFY25 growth was just 4% YoY), largely due to the ongoing slowdown in its core segments. However, we believe there are multiple growth drivers for HFL moving forward that will help offset the underlying demand weakness, including: 1) new order wins in the Industrials segment, which will increase its contribution to 18-20% over the next 2-3 years from the current 14%, and further to 30% post-peak revenues from the new INR6.5b capex; 2) new order wins in the PV segment, which will help increase the segment’s contribution to 8-10% of revenues over the next three years; 3) a gradual revival in both domestic and European CVs; and 4) recovery in domestic tractors, while exports are expected to stabilize at lower levels. While we have maintained our FY25 estimates, we have lowered our FY26 EPS estimates by 5% to factor in the adverse global macro. Backed by its new order wins and an improving mix, we expect HFL to post a 19% PAT CAGR over FY25-27. Following the correction, valuations at 24.2x FY26E and 20.7x FY27E appear attractive. We reiterate BUY with a TP of INR980, valued at a 26x Dec’26E EPS

Industrials segment to continue as a key growth driver

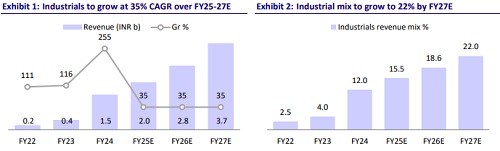

* While HFL has historically focused on auto segments like CV and farm equipment, it has strategically expanded into the non-auto space over the past few years as part of its de-risking efforts. It is now experiencing strong order wins in segments like wind energy (with this business expected to grow 20-25% in the coming years) and portable gensets.

* To further strengthen its presence in this segment, HFL has now announced an INR6.5b capex to establish advanced forging facilities for heavyweight components (>250kg and up to 3MT in weight), targeting industries such as power generation, marine, mining, oil & gas, wind energy, and aerospace & defense.

* Given the strong order visibility in this segment, HFL expects its revenue contribution to increase to 18-20% over the next 2-3 years, up from the current 14%, and further exceed 30%+ once the INR6.5b capex is fully utilized over the next 4-5 years. Thus, the Industrials segment is expected to remain a key growth driver, helping to offset the near-term slowdown in its core auto and farm segments, both globally and in India.

PV segment contribution to inch up to 8-10% over the next three years

* In Feb’24, HFL announced its foray into the PV segment after receiving an order worth INR4b from a leading Indian OEM. As a result, HFL’s contribution from PVs has already increased to 4% of revenues as of YTDFY25 from 0.9% in FY24.

* Following this, HFL secured three more orders, two of which were from US OEMs, including one for e-axle components, marking its entry into the US EV market. These order wins provide revenue visibility of around INR2b pa in PVs (domestic + exports) by FY27, once volumes are fully ramped up. Based on this growth trajectory and the strong order visibility, the company is confident that the PV segment’s contribution will increase to 8-10% over the next three years.

CV and domestic tractors likely to revive; HFL to outperform core segments

* A notable slowdown in HFL’s core segments, such as CVs and tractors, has led to only a 4% YoY growth in its 9MFY25 revenue, despite its strong order book.

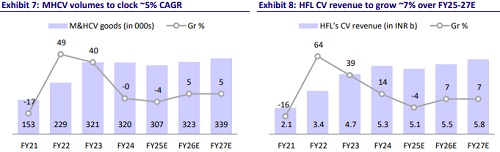

* While domestic MHCV demand is likely to remain weak in Q4 (low single-digit growth expected), we expect the MHCV goods segment to post ~5% CAGR over FY25-27, led by favorable demand indicators. Moreover, following a sharp decline in CY24 and the subsequent inventory correction, experts expect CV demand in Europe to revive from May-June 2025 onwards.

* In tractors, while the domestic industry is experiencing a healthy revival in demand from Q3FY25 onwards, driven by positive farm sentiments, the export market (mainly in the US and Europe) has stabilized at lower levels after a sharp decline in CY24 and a corresponding inventory correction.

* Thus, the outlook for both CVs and tractors is now on an improving trend, with a revival expected from FY26 onwards. HFL is expected to outperform the underlying segments, benefitting from its new order wins.

Resilient performance amid weak macros

* While HFL has corrected by almost 34% from its peak due to global demand headwinds, we anticipate multiple growth drivers for the company in the coming years, including: 1) significant new order wins in the Industrials segment, which will help increase its contribution to 18-20% over the next 2-3 years, up from the current 14%, and further to 30% post-peak revenues from the new INR6.5b capex; 2) new order wins in PVs, with peak annual revenues of INR2b, which will help increase the segment’s revenue contribution to 8-10% by FY27; 3) a gradual revival in both domestic and European CVs, with HFL positioned to outperform the industry; 4) a recovery in domestic tractors, with exports expected to stabilize at lower levels and the company likely to outperform due to new order wins.

* While we have maintained our FY25 estimates, we have lowered our FY26 EPS estimates by 5% to factor in the adverse global macro. Backed by its new order wins, we expect HFL to post a 13% revenue CAGR over FY25-27. This is likely to drive a healthy PAT CAGR of ~19%. We, hence, believe the recent stock correction presents a strong buy opportunity for HFL at reasonable valuations of 24.2x FY26E and 20.7x FY27E. We reiterate BUY with a TP of INR980, valued at 26x Dec’26E EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)