Buy Blue Jet Healthcare Ltd for the Target Rs.1,100 by Motilal Oswal Financial Services Ltd

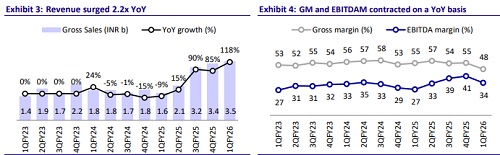

Gross margin under pressure in 1Q, but recovery imminent EBITDA lower than the estimate

* Blue Jet Healthcare (BLUEJET) reported an EBITDA of INR1.2b up 2.7x YoY (vs. our est. of INR1.5b), with a gross margin of 48.8% (vs. 54.9% in 1QFY25). EBITDA margin contracted to 34.1% from 41.1% in 1QFY25 (est. 41.6%). EBITDA missed our estimate due to a shift in product mix and reduced inventory levels, resulting in lower overhead absorption.

* The pharma intermediates & API segment sustained its robust momentum, with the cardiovascular intermediate continuing to scale under long-term contracts. We expect this trend to persist owing to the strong customer demand visibility and expected additional launches in the near term.

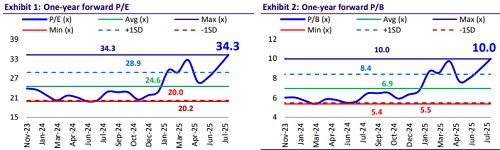

* Factoring in the 1QFY26 performance, we cut our FY26/FY27 earnings estimates by 6% each and value the stock at 35x FY27E EPS to arrive at our TP of INR1,100. Reiterate BUY.

Pharma intermediaries drive revenue growth

* The company reported a revenue of INR3.5b, up 2.2x YoY and 4% QoQ (in line). The revenue growth was fueled by growth in the 1) contrast media intermediaries, which rose 51% YoY to INR972m, and 2) pharma intermediaries, which surged 3.5x YoY to INR2.1b, while revenue from highintensity sweeteners remained flat at INR349m.

* Gross margin stood at 48.4%, which contracted 620bp YoY/650bp QoQ primarily due to a shift in product mix and reduced inventory levels resulting in lower overhead absorption.

* EBITDA surged 2.7x YoY, while it declined 14% QoQ to INR1.2b (est. INR1.5b). EBITDA margin expanded 690bp YoY but contracted 700bp QoQ to 34.1% (est. 41.6%).

* Adj. PAT stood at INR912m (up 2.4x YoY, down 17% QoQ) in 1QFY26, below our estimate of INR1.2b.

Highlights from the management commentary

* Gross margin: The dip in gross margin to 48.4% in 1Q from 54.7% in 4QFY25 was mainly due to a shift in product mix and reduced inventory levels. This led to lower overhead absorption for the quarter. Going forward, management guides that the gross margin will be normalized in the range of 53%.

* Capacity addition: BLUEJET is focusing on amino acid derivatives and latestage intermediates and additionally plans to add 1,000 KL of capacity over the next 2–3 years through a newly acquired land parcel, which will be developed in three phases. This expansion will support a range of products, including APIs, with one of the key targets being the API for Bempedoic Acid.

* R&D: The company has committed to a capex of INR400m towards R&D capabilities and maintains a strong pipeline of 20 opportunities with high client interest, with ~30% (six opportunities) in the late phase 3 or commercial phase.

Valuation and view

* We anticipate the pharma intermediates and APIs to continue their robust growth momentum in FY26, supported by strong customer demand visibility and additional product launches.

* Further, contrast media molecules are likely to see growth driven by ramp-up in client offtake, while high-intensity sweeteners are expected to sustain the steady volume performance.

* We expect a revenue/EBITDA/ PAT CAGR of 35%/ 38%/ 35% during FY25-27, led by the structural tailwinds because of the de-risking of supply chains by global innovators and the increasing adoption of complex APIs and NCE intermediates.

* Factoring in the 1QFY26 performance, we cut our FY26/FY27 earnings estimates by 6% each and value the stock at 35x FY27E EPS to arrive at our TP of INR1,100. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)